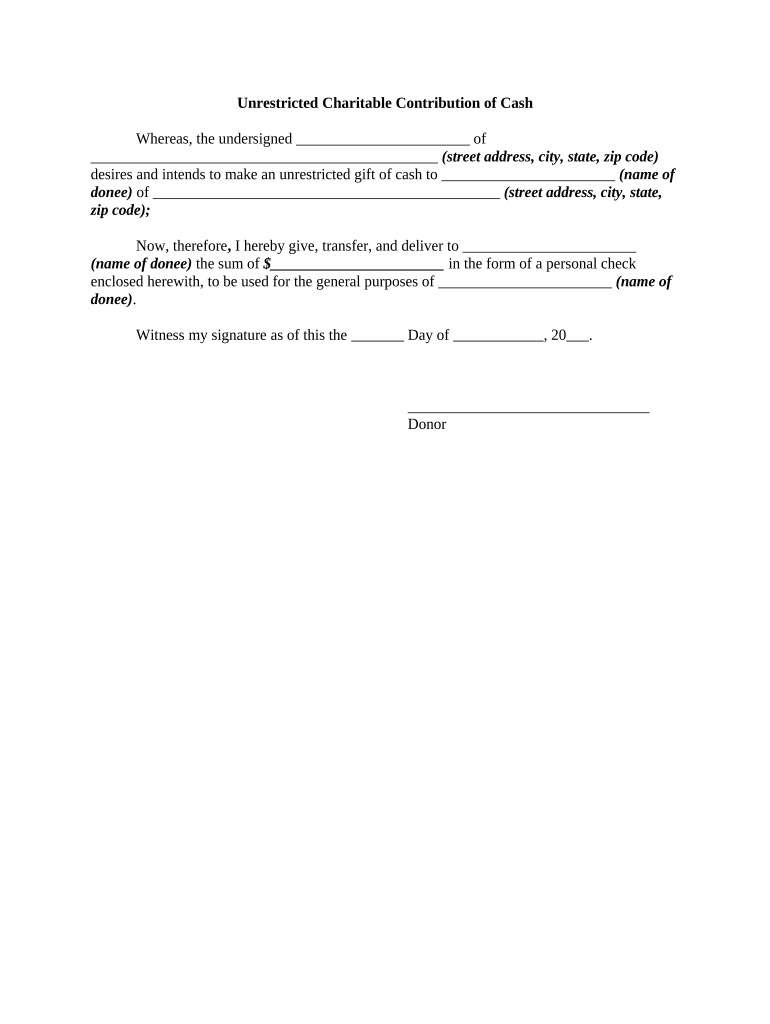

Unrestricted Charitable Contribution of Cash Form

Understanding the unrestricted charitable contribution of cash

The unrestricted charitable contribution of cash refers to donations made to charitable organizations without any specific restrictions on how the funds should be used. This type of contribution allows the receiving organization to allocate the funds where they are most needed, whether for operational costs, program development, or other initiatives. It is important for donors to understand that these contributions can have significant tax implications, potentially providing deductions on their federal income tax returns.

Steps to complete the unrestricted charitable contribution of cash

Completing the unrestricted charitable contribution of cash form involves several key steps to ensure proper documentation and compliance with tax regulations. Start by gathering necessary information, including the name and address of the charitable organization, the amount of the contribution, and the date of the donation. Next, fill out the form accurately, ensuring all details are correct. After completing the form, review it for accuracy before submitting it to the organization or retaining it for your records. Keeping a copy of the form is essential for tax purposes.

Legal considerations for the unrestricted charitable contribution of cash

When making an unrestricted charitable contribution of cash, it is crucial to adhere to legal guidelines set forth by the Internal Revenue Service (IRS). The IRS requires that contributions be made to qualified organizations to be eligible for tax deductions. Donors should verify the organization's tax-exempt status and ensure they receive a written acknowledgment of the donation, particularly for contributions exceeding two hundred fifty dollars. This acknowledgment should include the amount donated and a statement indicating whether any goods or services were received in exchange for the contribution.

IRS guidelines for cash contributions

The IRS has specific guidelines regarding cash contributions to charitable organizations. Donors can generally deduct contributions made to qualified organizations on their federal income tax returns. However, it is essential to keep detailed records, including receipts and bank statements, to substantiate the contributions. The IRS also emphasizes the importance of ensuring that contributions are made to eligible charities listed in the IRS database. Understanding these guidelines helps donors maximize their tax benefits while supporting charitable causes.

Examples of unrestricted charitable contributions of cash

Examples of unrestricted charitable contributions of cash include donations made to nonprofit organizations, religious institutions, and educational foundations. For instance, a donor may contribute five hundred dollars to a local food bank without specifying how the funds should be used. Similarly, a donor might give one thousand dollars to a university's general fund, allowing the institution to allocate the funds towards scholarships or campus improvements. These contributions play a vital role in supporting various initiatives and programs within the community.

Filing deadlines and important dates

Filing deadlines for reporting unrestricted charitable contributions of cash typically align with the annual tax filing deadline for individuals in the United States. Generally, taxpayers must file their federal income tax returns by April fifteenth of each year. It is advisable for donors to keep track of their contributions throughout the year to ensure they meet reporting requirements and deadlines. Being aware of these dates helps donors stay organized and compliant with tax regulations.

Quick guide on how to complete unrestricted charitable contribution of cash

Complete Unrestricted Charitable Contribution Of Cash effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Unrestricted Charitable Contribution Of Cash on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Unrestricted Charitable Contribution Of Cash with ease

- Obtain Unrestricted Charitable Contribution Of Cash and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

No more worries about missing or lost documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Unrestricted Charitable Contribution Of Cash and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Unrestricted Charitable Contribution Of Cash?

An Unrestricted Charitable Contribution Of Cash refers to a donation made to a charity without any specific limitations on how the funds should be used. This type of contribution allows organizations the flexibility to allocate resources to their most pressing needs. By focusing on unrestricted contributions, charities can better manage budgetary needs and impact areas effectively.

-

How does airSlate SignNow facilitate Unrestricted Charitable Contribution Of Cash processes?

airSlate SignNow simplifies the process of handling Unrestricted Charitable Contribution Of Cash by enabling organizations to send, sign, and manage donation agreements electronically. Our user-friendly platform ensures that all necessary documents are securely signed and archived, streamlining the operational workflow for nonprofits. This efficiency allows charities to focus on what truly matters—making a positive impact.

-

What are the benefits of using airSlate SignNow for managing charitable contributions?

Using airSlate SignNow for Unrestricted Charitable Contribution Of Cash management provides numerous benefits, including reduced administrative burden and increased processing speed. Organizations can track contributions easily and maintain compliance through automated workflows. By minimizing paperwork, charities can allocate more time and resources to their core missions.

-

Are there any associated costs with using airSlate SignNow for charitable contributions?

Yes, there are costs associated with using airSlate SignNow, but they are designed to be budget-friendly for organizations handling Unrestricted Charitable Contribution Of Cash. Our subscription plans provide various pricing tiers based on features, allowing you to choose one that matches your organization's needs. The investment often pays off through enhanced efficiency and reduced operational costs.

-

What integration options does airSlate SignNow offer for managing charitable contributions?

airSlate SignNow offers seamless integrations with various platforms such as CRM systems and financial software, enhancing your ability to manage Unrestricted Charitable Contribution Of Cash. These integrations ensure that donation data is easily accessible and organized, promoting better tracking and reporting. Furthermore, this interoperability reduces the chances of errors in data handling.

-

How secure is airSlate SignNow for handling charitable contributions?

Security is a top priority at airSlate SignNow, especially when it comes to handling Unrestricted Charitable Contribution Of Cash. We employ advanced encryption and compliance measures to ensure that all documents and data are protected. Our platform also allows you to set permissions, ensuring that only authorized personnel can access sensitive information.

-

Can airSlate SignNow help improve donor relations for cash contributions?

Absolutely! AirSlate SignNow can enhance donor relations related to Unrestricted Charitable Contribution Of Cash by providing a streamlined communication process. Automated reminders and personalized acknowledgment letters can be easily integrated to keep donors informed and appreciated. This proactive approach strengthens relationships and encourages future contributions.

Get more for Unrestricted Charitable Contribution Of Cash

- Motion to contest impending judgment 244 clerk of the court form

- Child support credit affidavit clay county clerk of the circuit court form

- Motion for mediation florida form

- Subpoena for deposition in pinellas county fl form

- Form declaration domicile

- Georgia bar association complaint form

- Divorce papers georgia online fillable 1999 form

- Fulton county 30 day joint compliance worksheet form

Find out other Unrestricted Charitable Contribution Of Cash

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now