Borrowing Resolution Form

What is the Borrowing Resolution

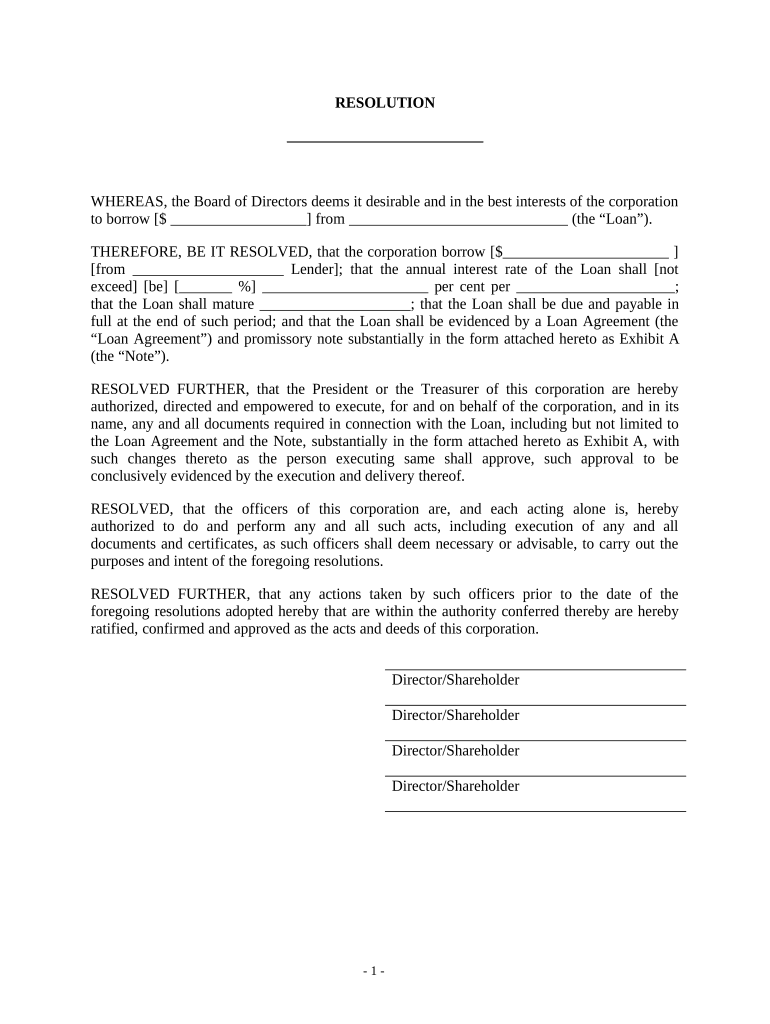

A borrowing resolution is a formal document that authorizes a business or organization to borrow money from a financial institution. This resolution outlines the specific terms of the borrowing, including the amount, purpose, and repayment conditions. It serves as a record of the decision made by the governing body of the organization, such as the board of directors, and is essential for ensuring compliance with legal and financial regulations.

How to Use the Borrowing Resolution

To effectively use a borrowing resolution, organizations should follow a structured approach. First, identify the need for borrowing and the amount required. Next, draft the resolution, ensuring it includes key details such as the purpose of the loan and the proposed repayment plan. Once drafted, present the resolution to the governing body for approval. After obtaining the necessary signatures, submit the resolution to the lender as part of the loan application process.

Key Elements of the Borrowing Resolution

A well-crafted borrowing resolution should include several critical elements to ensure its effectiveness and legality. These elements typically consist of:

- The name of the organization borrowing the funds

- The specific amount of money being borrowed

- The purpose of the loan

- The terms of repayment, including interest rates and payment schedules

- The names and signatures of the authorized individuals who approve the resolution

Including these details helps to clarify the intent and scope of the borrowing, making it easier for both the organization and the lender to understand their obligations.

Steps to Complete the Borrowing Resolution

Completing a borrowing resolution involves several important steps. Begin by gathering all necessary information about the loan, including the amount and purpose. Next, draft the resolution, ensuring it meets all legal requirements. Once the draft is complete, present it to the governing body for discussion and approval. After receiving approval, obtain the necessary signatures from authorized individuals. Finally, submit the signed resolution to the lender as part of the loan application process.

Legal Use of the Borrowing Resolution

For a borrowing resolution to be legally binding, it must comply with specific legal requirements. This includes ensuring that the resolution is properly documented and signed by authorized individuals within the organization. Additionally, the resolution should adhere to any relevant state and federal regulations governing borrowing practices. By following these legal guidelines, organizations can protect themselves and ensure the enforceability of the resolution.

Examples of Using the Borrowing Resolution

Organizations can utilize borrowing resolutions in various scenarios. For instance, a small business may need a borrowing resolution to secure a loan for purchasing new equipment. Similarly, a nonprofit organization might use a borrowing resolution to fund a community project. In both cases, the resolution serves as a formal record of the borrowing decision and outlines the terms of repayment, ensuring clarity and accountability.

Quick guide on how to complete borrowing resolution

Complete Borrowing Resolution effortlessly on any gadget

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Borrowing Resolution on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Borrowing Resolution effortlessly

- Locate Borrowing Resolution and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign Borrowing Resolution to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a borrow form and how can it be used?

A borrow form is a digital document used for requesting a loan or borrowing money. With airSlate SignNow, you can easily create, customize, and send a borrow form to streamline the lending process, ensuring a smooth experience for both lenders and borrowers.

-

How do I create a borrow form using airSlate SignNow?

Creating a borrow form with airSlate SignNow is simple. You can start from a template or build one from scratch using our user-friendly drag-and-drop editor, which allows you to add fields, set requirements, and customize the design to suit your needs.

-

Is there a cost associated with using the borrow form feature?

Yes, there are different pricing plans for airSlate SignNow that include access to the borrow form feature. Our plans are designed to be cost-effective, allowing businesses of all sizes to utilize digital processing and eSigning of borrow forms without breaking the bank.

-

What are the benefits of using a digital borrow form?

Using a digital borrow form offers numerous benefits, including faster processing times, reduced paperwork, and increased accuracy. With airSlate SignNow, you can track the status of your borrow forms in real-time and receive instant notifications when they are signed.

-

Can I integrate the borrow form with other applications?

Absolutely! airSlate SignNow provides seamless integrations with various applications such as CRM systems, project management tools, and cloud storage services. This allows you to incorporate your borrow form into your existing workflows effortlessly.

-

Is it secure to send a borrow form through airSlate SignNow?

Yes, sending a borrow form through airSlate SignNow is highly secure. We use advanced encryption protocols and adhere to stringent security standards to protect your sensitive information, ensuring that your borrow forms are safe and confidential.

-

Can I track the status of my borrow form after sending it?

Yes, airSlate SignNow allows you to track the status of your borrow form in real-time. You’ll receive notifications when the form is opened, completed, and signed, giving you complete visibility and control over the borrowing process.

Get more for Borrowing Resolution

Find out other Borrowing Resolution

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online