Balloon Promissory Form

What is the Balloon Promissory?

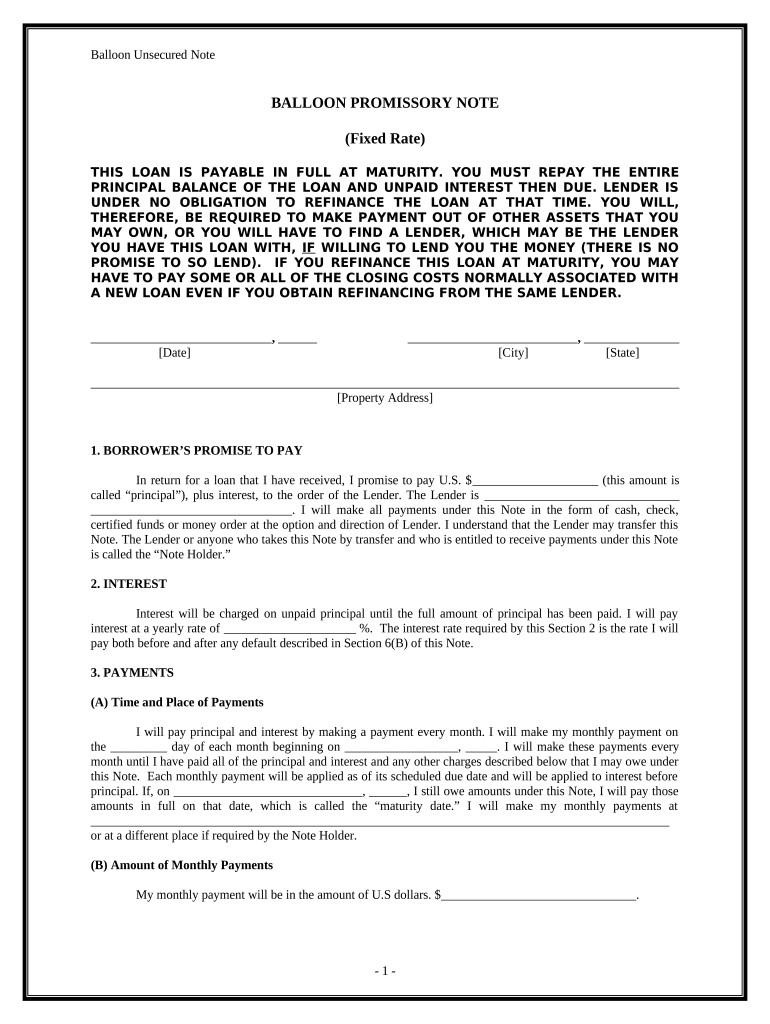

A balloon promissory note is a financial instrument that outlines a loan agreement where the borrower makes regular payments over a specified period, followed by a larger final payment, known as the balloon payment. This type of note is often used in real estate transactions and can be beneficial for borrowers who expect to refinance or sell the property before the balloon payment is due. The balloon note typically includes the loan amount, interest rate, payment schedule, and the due date for the balloon payment.

How to Use the Balloon Promissory

Using a balloon promissory note involves several key steps. First, both the lender and borrower should agree on the terms of the loan, including the amount, interest rate, and payment schedule. Once these terms are established, the borrower fills out the balloon form, ensuring all information is accurate. After completing the form, both parties must sign it to make it legally binding. It is advisable to keep a copy of the signed document for future reference.

Steps to Complete the Balloon Promissory

Completing a balloon promissory note requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including borrower and lender details.

- Specify the loan amount and interest rate.

- Outline the payment schedule, including the frequency of payments.

- Clearly state the due date for the balloon payment.

- Review the document for accuracy before signing.

- Ensure both parties sign the document to validate it.

Legal Use of the Balloon Promissory

The legal use of a balloon promissory note is governed by state laws and regulations. It is crucial to ensure that the note complies with local lending laws, including interest rate limits and disclosure requirements. In the United States, the note must be signed by both parties and may need to be notarized, depending on state requirements. Proper documentation helps protect both the lender's and borrower's rights in case of disputes.

Key Elements of the Balloon Promissory

Several key elements define a balloon promissory note:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The rate at which interest will accrue on the loan.

- Payment Schedule: Details on how often payments will be made.

- Balloon Payment: The final, larger payment due at the end of the term.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

Examples of Using the Balloon Promissory

Balloon promissory notes are commonly used in various scenarios, including:

- Real estate transactions where buyers may not have enough capital for a full mortgage.

- Short-term loans where borrowers plan to refinance before the balloon payment is due.

- Business loans for startups that expect significant growth and increased cash flow in the near future.

Quick guide on how to complete balloon promissory

Complete Balloon Promissory effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without interruptions. Manage Balloon Promissory on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign Balloon Promissory without hassle

- Locate Balloon Promissory and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign feature, which only takes a moment and holds the same legal validity as a traditional ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Balloon Promissory and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a balloon form in airSlate SignNow?

A balloon form in airSlate SignNow refers to a customizable document template that allows users to create dynamic forms that can adjust based on the information inputted. This feature streamlines the data collection process, making it easier for businesses to manage information efficiently and effectively. With the balloon form, you can enhance user experience and improve form completion rates.

-

How much does airSlate SignNow cost for using balloon forms?

Pricing for airSlate SignNow varies based on the subscription plan chosen, but it is generally known for being cost-effective. When you opt for a plan that includes the balloon form feature, you can benefit from affordable solutions tailored to your business needs. For the most accurate information, it’s best to visit the pricing page on our website.

-

What are the benefits of using balloon forms in airSlate SignNow?

Balloon forms in airSlate SignNow provide signNow benefits such as improved user engagement and reduced errors during data entry. By allowing fields to dynamically adjust based on previous answers, businesses can ensure a smoother process for users. This leads to quicker turnaround times and more accurate data collection.

-

Can I integrate balloon forms with other tools and apps?

Yes, airSlate SignNow allows for seamless integration of balloon forms with various third-party applications. This means you can connect your balloon forms to CRM systems, cloud storage services, and more, enhancing workflow efficiency. These integrations enable you to automate processes and leverage your existing infrastructure.

-

Is it easy to create a balloon form in airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive interface that makes creating balloon forms simple, even for users with minimal technical expertise. You can easily drag and drop elements, customize fields, and set conditions to build your balloon form quickly and efficiently.

-

Are balloon forms secure for collecting sensitive information?

Yes, security is a top priority at airSlate SignNow. Balloon forms are designed with industry-standard encryption and security features to protect sensitive information collected through forms. You can confidently use balloon forms knowing that your data is safeguarded.

-

Can I track the performance of my balloon forms?

Yes, airSlate SignNow offers analytics features that allow you to track the performance of your balloon forms. You can monitor completion rates, user interactions, and gather insights to optimize your forms for better results. This data is invaluable for improving future form deployments.

Get more for Balloon Promissory

- Riverbend authorization form v2 draft 050616xlsx

- Unicare fitness form reimbursement 2018 2019

- Nflpn gerontology certification 2018 2019 form

- Nflpn gerontology certification 2016 form

- Printable invoice for a homecare service provided 2018 2019 form

- Informal caregiver invoice ltcfedscom federal long term care

- Wesco nj 2016 2019 form

- To be used when a member changes from another health plan to anthem blue cross and blue shield form

Find out other Balloon Promissory

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now