Ne Schedule Iii Form

What is the Nebraska Schedule III?

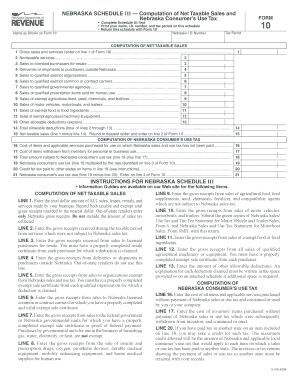

The Nebraska Schedule III is a tax form used by individuals and businesses to report specific types of income, deductions, and credits on their state tax returns. This form is essential for accurately calculating tax liabilities and ensuring compliance with Nebraska tax laws. It typically includes sections for detailing various sources of income, such as wages, interest, and dividends, as well as deductions that may apply to the taxpayer's situation.

Steps to Complete the Nebraska Schedule III

Completing the Nebraska Schedule III involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand specific requirements and guidelines.

- Fill out the income sections, ensuring all sources of income are accurately reported.

- Complete the deductions section, listing any eligible expenses that can reduce taxable income.

- Double-check all entries for accuracy and completeness before submission.

Legal Use of the Nebraska Schedule III

The Nebraska Schedule III is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, it is crucial to follow the guidelines set forth by the Nebraska Department of Revenue. This includes using the correct form version, providing accurate information, and adhering to filing deadlines. Failure to comply with these requirements may result in penalties or legal issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the Nebraska Schedule III to avoid penalties. Typically, the filing deadline aligns with the federal tax return deadline, which is April 15. However, for those who require an extension, the extended deadline is usually October 15. It is essential to verify specific dates each tax year, as they may vary.

Required Documents

To complete the Nebraska Schedule III, taxpayers must gather several key documents, including:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Receipts for deductible expenses, including business-related costs and medical expenses.

Who Issues the Form

The Nebraska Schedule III is issued by the Nebraska Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax preparation services.

Penalties for Non-Compliance

Failure to file the Nebraska Schedule III accurately and on time can result in significant penalties. Common consequences include monetary fines, interest on unpaid taxes, and potential audits by the Nebraska Department of Revenue. It is crucial for taxpayers to understand these risks and ensure timely and accurate submissions to avoid complications.

Quick guide on how to complete ne schedule iii

Easily prepare Ne Schedule Iii on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without any delays. Manage Ne Schedule Iii on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The most efficient way to modify and electronically sign Ne Schedule Iii effortlessly

- Locate Ne Schedule Iii and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Ne Schedule Iii to ensure clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ne schedule iii

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the Nebraska Schedule III form?

The Nebraska Schedule III form is a document used in the state for reporting specific tax-related information. It is crucial for accurate filing and compliance with Nebraska tax regulations. Understanding this form helps businesses avoid penalties and ensures they take advantage of any eligible credits.

-

How can airSlate SignNow help with the Nebraska Schedule III?

airSlate SignNow streamlines the process of filling out and electronically signing the Nebraska Schedule III form. Our platform allows users to easily upload, edit, and share the document securely. This reduces errors and ensures compliance with state regulations.

-

Is airSlate SignNow cost-effective for managing Nebraska Schedule III documents?

Yes, airSlate SignNow offers a cost-effective solution for handling Nebraska Schedule III documents. With various pricing plans, businesses can choose the option that best fits their needs without breaking the bank. This ensures that even small businesses can manage their document workflows efficiently.

-

What features make airSlate SignNow ideal for the Nebraska Schedule III?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking. These functionalities simplify the preparation and submission of the Nebraska Schedule III, making the process more efficient. Users can also automate reminders to ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for Nebraska Schedule III processes?

Absolutely! airSlate SignNow offers integrations with various third-party applications that facilitate the management of Nebraska Schedule III forms. This includes CRM systems, cloud storage solutions, and accounting software, making it easy to sync your workflows.

-

What are the benefits of using airSlate SignNow for Nebraska Schedule III compliance?

Using airSlate SignNow for Nebraska Schedule III compliance helps businesses improve accuracy and reduces the risk of errors. The platform’s intuitive interface allows users to complete and sign documents quickly. Additionally, it enhances collaboration among team members, ensuring everyone is aligned.

-

Are there any security features associated with airSlate SignNow for Nebraska Schedule III?

Yes, airSlate SignNow provides robust security features to protect your Nebraska Schedule III documents. Enhanced encryption, secure cloud storage, and access controls ensure that sensitive information is safeguarded. This commitment to security allows businesses to focus on compliance without compromising confidentiality.

Get more for Ne Schedule Iii

Find out other Ne Schedule Iii

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors