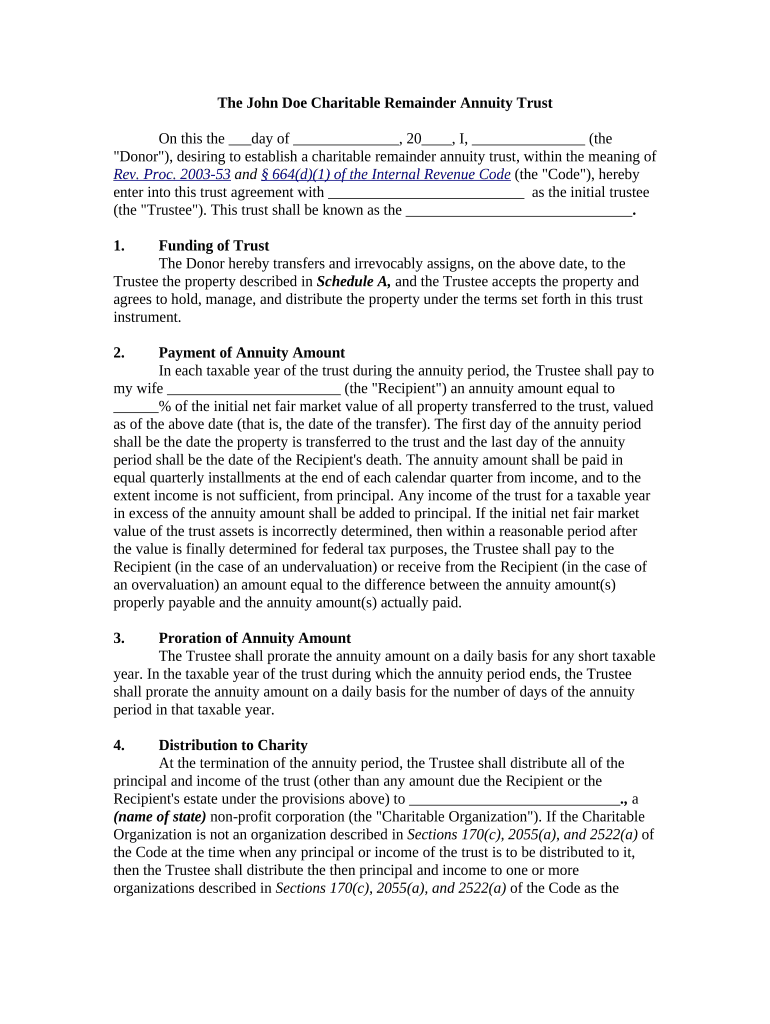

Charitable Remainder Trust Form

What is the charitable remainder trust?

A charitable remainder trust (CRT) is a legal arrangement that allows individuals to donate assets to a trust while retaining the right to receive income from those assets for a specified period or until their death. After this period, the remaining assets in the trust are distributed to designated charities. This type of trust can provide significant tax benefits, including a charitable deduction for the present value of the remainder interest that will go to charity.

Key elements of the charitable remainder trust

Understanding the key elements of a charitable remainder trust is essential for effective planning. These elements include:

- Income Distribution: The trust must pay a specified percentage of its assets to the income beneficiaries, which can be the donor or other individuals.

- Charitable Beneficiary: The trust must designate one or more qualified charities to receive the remaining assets after the income distribution period.

- Term Length: The trust can be structured as either a term of years or a lifetime trust, determining how long the income will be paid.

- Tax Benefits: Donors can receive an immediate charitable deduction based on the present value of the remainder interest, which can reduce their taxable income.

Steps to complete the charitable remainder trust

Completing a charitable remainder trust involves several important steps:

- Choose the Assets: Decide which assets to place in the trust, such as cash, stocks, or real estate.

- Select a Trustee: Appoint a trustee who will manage the trust assets and ensure compliance with legal requirements.

- Determine Income Beneficiaries: Identify who will receive income from the trust during its term.

- Draft the Trust Document: Work with an attorney to create the trust agreement, detailing all terms and conditions.

- Fund the Trust: Transfer the chosen assets into the trust to officially establish it.

- File Necessary Tax Forms: Ensure compliance with IRS requirements by filing any required forms related to the trust.

Legal use of the charitable remainder trust

The legal use of a charitable remainder trust is governed by federal and state laws. It is essential to comply with the Internal Revenue Service (IRS) regulations to ensure that the trust qualifies for tax benefits. This includes adhering to rules regarding the minimum payout percentage, the designation of charitable beneficiaries, and the proper documentation of the trust's terms. Legal advice is often recommended to navigate these requirements effectively.

IRS guidelines

The IRS provides specific guidelines for charitable remainder trusts to ensure they meet tax-exempt criteria. Key guidelines include:

- Payout Requirement: The trust must pay out at least five percent of its assets annually to income beneficiaries.

- Charitable Deduction: Donors can only claim a deduction for the present value of the remainder interest that will eventually go to charity.

- Trust Structure: The trust must be irrevocable, meaning that once assets are transferred, they cannot be reclaimed by the donor.

Eligibility criteria

Eligibility to establish a charitable remainder trust typically includes the following criteria:

- Donor Status: The donor must be an individual or entity eligible to create a trust under state law.

- Asset Type: The assets contributed to the trust must be eligible, such as appreciated securities or real estate.

- Charitable Beneficiary: The trust must designate one or more qualified charitable organizations as beneficiaries.

Quick guide on how to complete charitable remainder trust

Complete Charitable Remainder Trust effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Charitable Remainder Trust on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to edit and eSign Charitable Remainder Trust without hassle

- Obtain Charitable Remainder Trust and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Charitable Remainder Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable remainder trust form?

A charitable remainder trust form is a legal document that establishes a trust allowing you to make a charitable donation while receiving income from the trust during your lifetime. This form is essential for ensuring that your assets are managed according to your wishes and that the charity benefits from your generosity upon your passing.

-

How can I obtain a charitable remainder trust form using airSlate SignNow?

You can easily obtain a charitable remainder trust form through airSlate SignNow by accessing our template library. Simply sign up for an account, search for the charitable remainder trust form, and customize it to suit your needs before sending it out for signature.

-

What are the benefits of using airSlate SignNow for charitable remainder trust forms?

Using airSlate SignNow for charitable remainder trust forms offers numerous benefits, including easy document creation, electronic signatures, and secure storage. Our platform streamlines the process, making it more efficient for you to manage your charitable giving while ensuring compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for charitable remainder trust forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including a cost-effective solution for managing charitable remainder trust forms. You can choose from different tiers based on the features you require, allowing you to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other software for managing charitable remainder trust forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, which allows you to manage your charitable remainder trust forms alongside other essential business tools. This integration can enhance your workflow and improve efficiency.

-

How secure is the charitable remainder trust form process with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. When you create or sign a charitable remainder trust form, your data is encrypted and stored securely, ensuring that sensitive information remains confidential and protected.

-

How long does it take to complete a charitable remainder trust form with airSlate SignNow?

Completing a charitable remainder trust form with airSlate SignNow is designed to be quick and efficient. Typically, you can fill out and send the form for electronic signature in just a few minutes, allowing for a streamlined experience.

Get more for Charitable Remainder Trust

Find out other Charitable Remainder Trust

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form