Charitable Lead Form

What is the charitable lead?

A charitable lead trust is a financial tool designed to support charitable organizations while providing potential tax benefits to the donor. This type of trust allows the donor to transfer assets into the trust, which then generates income for a specified charity for a set period. After this period, the remaining assets are passed on to the donor’s beneficiaries. This arrangement can help donors fulfill philanthropic goals while also managing their estate planning effectively.

How to use the charitable lead trust

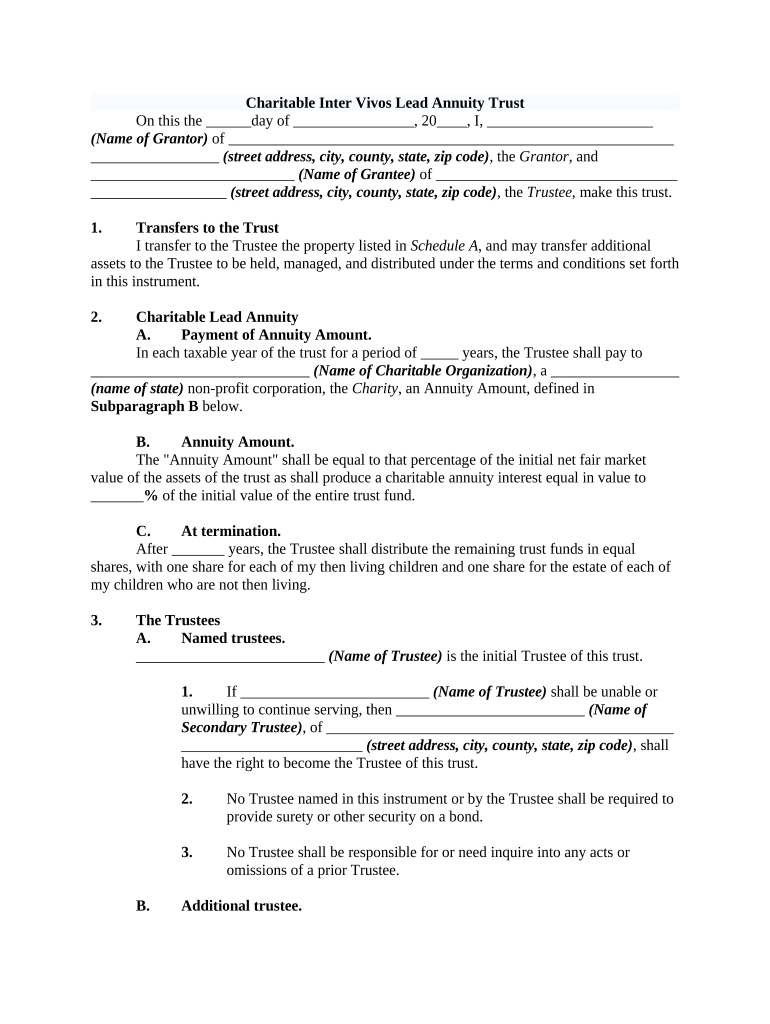

To utilize a charitable lead trust, a donor must first establish the trust by drafting a trust agreement that outlines the terms. This includes specifying the charitable organization that will receive the income generated from the trust, the duration of the trust, and the beneficiaries who will receive the remaining assets. Once the trust is funded with assets, the income generated can be distributed to the designated charity, ensuring that the donor's philanthropic intentions are met while potentially reducing estate taxes.

Steps to complete the charitable lead trust form

Completing the charitable lead trust form involves several key steps:

- Gather necessary information about the trust, including the name of the trust, the trustee, and the charitable organization.

- Determine the duration of the trust and the amount of income to be distributed to the charity.

- Consult with a legal or tax professional to ensure compliance with IRS regulations and to optimize tax benefits.

- Complete the form accurately, providing all required details and signatures.

- Submit the completed form to the appropriate tax authorities or financial institutions as needed.

Legal use of the charitable lead trust

The legal use of a charitable lead trust is governed by specific regulations set forth by the IRS. To ensure that the trust is valid and that the donor receives the intended tax benefits, it is crucial to adhere to these regulations. This includes properly documenting the trust's terms, ensuring that the charitable organization is qualified under IRS guidelines, and accurately reporting income distributions on tax returns. Legal compliance helps protect the donor and the trust from potential disputes or penalties.

IRS guidelines

The IRS provides specific guidelines for charitable lead trusts, which outline the requirements for establishing and maintaining these trusts. Key points include:

- The trust must be irrevocable, meaning the donor cannot alter its terms once established.

- The charitable organization must be recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code.

- Income distributions to the charity must be made at least annually.

- Donors may be eligible for a charitable deduction based on the present value of the income stream to the charity.

Eligibility criteria

Eligibility to establish a charitable lead trust typically requires the donor to be an individual or entity with the legal capacity to create a trust. Donors must also have assets to fund the trust and a desire to support charitable causes. While there are no specific income requirements, potential tax benefits may vary based on the donor's financial situation and the structure of the trust. Consulting with a financial advisor can help clarify eligibility and optimize the trust's benefits.

Quick guide on how to complete charitable lead

Finish Charitable Lead effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Charitable Lead on any platform using airSlate SignNow's Android or iOS applications and streamline your document processes today.

The easiest way to modify and eSign Charitable Lead without stress

- Obtain Charitable Lead and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Purge concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Adapt and eSign Charitable Lead while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable lead in the context of airSlate SignNow?

A charitable lead refers to a type of donation where the donor provides funding to a non-profit organization while still retaining the right to use the funds during their lifetime. airSlate SignNow simplifies the process of managing these charitable leads by allowing organizations to easily send and eSign donor agreements, ensuring compliance and clarity for all parties involved.

-

How does airSlate SignNow help organizations manage charitable leads?

airSlate SignNow offers a seamless eSignature platform that enables organizations to efficiently send, track, and store documents related to charitable leads. This streamlines the donation process, ensuring that organizations can quickly respond to donor inquiries and manage their charitable lead agreements with ease.

-

What features does airSlate SignNow provide for handling charitable lead agreements?

Some key features include customizable templates for charitable lead agreements, real-time tracking of document status, and secure cloud storage. These features ensure that organizations have all the tools they need to effectively manage their charitable leads while maintaining a secure and user-friendly experience.

-

Is there a cost associated with using airSlate SignNow for charitable lead management?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of different organizations. Each plan is designed to provide excellent value, especially for non-profits aiming to manage their charitable leads efficiently and cost-effectively.

-

How can I integrate airSlate SignNow with other tools for managing charitable leads?

airSlate SignNow provides seamless integrations with popular CRM and fundraising software, allowing organizations to efficiently manage their charitable leads. By integrating these tools, users can centralize their data and track their fundraising efforts more effectively, enhancing overall productivity.

-

Can airSlate SignNow help me improve my nonprofit's outsignNow for charitable leads?

Absolutely! With airSlate SignNow's easy-to-use platform, your nonprofit can streamline the donation process, making it more appealing to potential donors. By effectively managing your charitable leads, you can enhance donor relationships and improve outsignNow efforts through timely communication and follow-ups.

-

What security measures does airSlate SignNow implement for charitable lead documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption, secure user authentication, and robust data storage practices to ensure that all charitable lead documents are protected, maintaining confidentiality and compliance throughout the signing process.

Get more for Charitable Lead

Find out other Charitable Lead

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors