1031 Exchange Documents Form

What are the 1031 Exchange Documents?

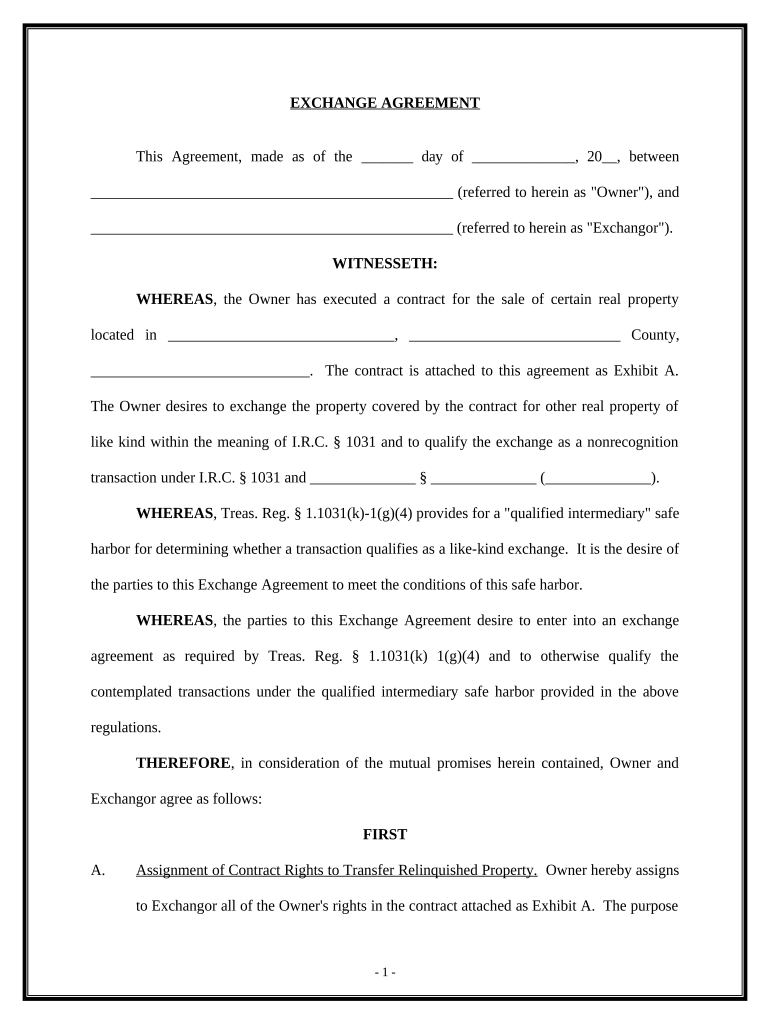

The 1031 exchange documents are essential for real estate investors looking to defer capital gains taxes on the sale of an investment property. These documents facilitate the exchange of one investment property for another, allowing investors to maintain their investment portfolio without incurring immediate tax liabilities. The primary document involved is the IRS federal tax form 1031, which outlines the specifics of the exchange, including details about the properties involved and the parties participating in the transaction. Additional documents may include an exchange agreement, which sets the terms of the exchange, and any necessary disclosures required by state law.

Steps to Complete the 1031 Exchange Documents

Completing the 1031 exchange documents involves several key steps to ensure compliance with IRS regulations. First, identify the property you wish to sell and the replacement property you intend to acquire. Next, engage a qualified intermediary who will hold the proceeds from the sale to facilitate the exchange. You must then complete the IRS form 1031, accurately detailing both properties and the transaction timeline. It is crucial to adhere to the 45-day identification period for the replacement property and the 180-day deadline for completing the exchange. Finally, ensure all documents are signed and submitted to the appropriate parties to finalize the exchange.

Legal Use of the 1031 Exchange Documents

The legal use of the 1031 exchange documents is governed by specific IRS guidelines that dictate how the exchange must be conducted. To qualify for tax deferral, the properties involved must be held for investment or business purposes, and the exchange must meet the criteria set forth in section 1031 of the Internal Revenue Code. It is important to ensure that all documentation is complete and accurate, as any discrepancies can lead to disqualification of the exchange and potential tax penalties. Utilizing a qualified intermediary and consulting with a tax professional can help navigate the legal complexities of the process.

Required Documents for the 1031 Exchange

To successfully execute a 1031 exchange, several documents are required. The primary document is the IRS form 1031, which must be completed and filed with your tax return. Additionally, an exchange agreement is necessary to outline the terms of the transaction between the parties involved. Other important documents include a closing statement from the sale of the relinquished property, identification of the replacement property, and any relevant disclosures required by state law. Keeping thorough records of all transactions and communications is also recommended to support the exchange process.

IRS Guidelines for the 1031 Exchange

The IRS guidelines for the 1031 exchange are crucial for ensuring compliance and maximizing tax benefits. According to these guidelines, the properties exchanged must be of like-kind, meaning they must be similar in nature or character, even if they differ in grade or quality. The investor must also adhere to strict timelines: identifying a replacement property within 45 days of selling the original property and completing the exchange within 180 days. Additionally, the use of a qualified intermediary is required to facilitate the exchange, ensuring that the investor does not take possession of the sale proceeds, which could trigger tax liabilities.

Filing Deadlines and Important Dates for the 1031 Exchange

Filing deadlines and important dates are critical components of the 1031 exchange process. Investors must identify a replacement property within 45 days of the sale of the relinquished property. The entire exchange must be completed within 180 days. These timelines are strictly enforced by the IRS, and failure to meet them can result in the loss of tax deferral benefits. It is advisable to maintain a calendar of these important dates and consult with a tax professional to ensure compliance throughout the exchange process.

Quick guide on how to complete 1031 exchange documents

Effortlessly Prepare 1031 Exchange Documents on Any Device

The use of online document management has surged among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage 1031 Exchange Documents on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign 1031 Exchange Documents

- Obtain 1031 Exchange Documents and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1031 Exchange Documents and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 1031 exchange documents?

1031 exchange documents are essential legal papers required to facilitate a tax-deferred exchange of investment properties. These documents ensure compliance with IRS regulations and help investors defer capital gains taxes during real estate transactions. Using a reliable eSigning platform like airSlate SignNow can streamline the preparation and signing process.

-

How does airSlate SignNow handle 1031 exchange documents?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning 1031 exchange documents. Our solution allows you to customize documents based on your specific needs, making it easy to collaborate with clients and partners. The platform also ensures secure storage and easy access to your essential documents at any time.

-

What are the benefits of using airSlate SignNow for 1031 exchange documents?

Using airSlate SignNow to manage your 1031 exchange documents offers various benefits, including reduced turnaround times, enhanced security, and seamless collaboration. Our solution allows for real-time tracking of document status, ensuring that all parties are informed and on the same page. Additionally, eSigning eliminates the need for physical paperwork, making the process faster and more efficient.

-

What features does airSlate SignNow offer for 1031 exchange documents?

airSlate SignNow offers several features tailored for 1031 exchange documents, such as customizable templates, secure eSigning, and automated reminders. Our platform also includes advanced analytics to track document engagement and completion rates. These features enhance the overall user experience and simplify the transactions involved in a 1031 exchange.

-

Is there a free trial available for airSlate SignNow's 1031 exchange documents?

Yes, airSlate SignNow offers a free trial that allows you to explore our features for handling 1031 exchange documents. This trial period gives prospective customers the opportunity to test our tools and see how they can simplify their document management processes. Registering for the trial is quick and straightforward, providing immediate access to all functionalities.

-

Can I integrate airSlate SignNow with other software for 1031 exchange documents?

Absolutely! airSlate SignNow integrates seamlessly with numerous popular software platforms, enhancing your workflow when managing 1031 exchange documents. This includes integration with CRMs, cloud storage services, and accounting software, allowing you to keep all your tools connected. These integrations help maintain a streamlined process and increase overall productivity.

-

What security measures does airSlate SignNow implement for 1031 exchange documents?

AirSlate SignNow prioritizes the security of your 1031 exchange documents through advanced encryption methods and secure cloud storage. Our platform also complies with industry standards and regulations, ensuring that all sensitive information remains protected. Additionally, we utilize multi-factor authentication to further enhance the security of your eSigned documents.

Get more for 1031 Exchange Documents

Find out other 1031 Exchange Documents

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple