Creditors Notifying Form

What is the Creditors Notifying

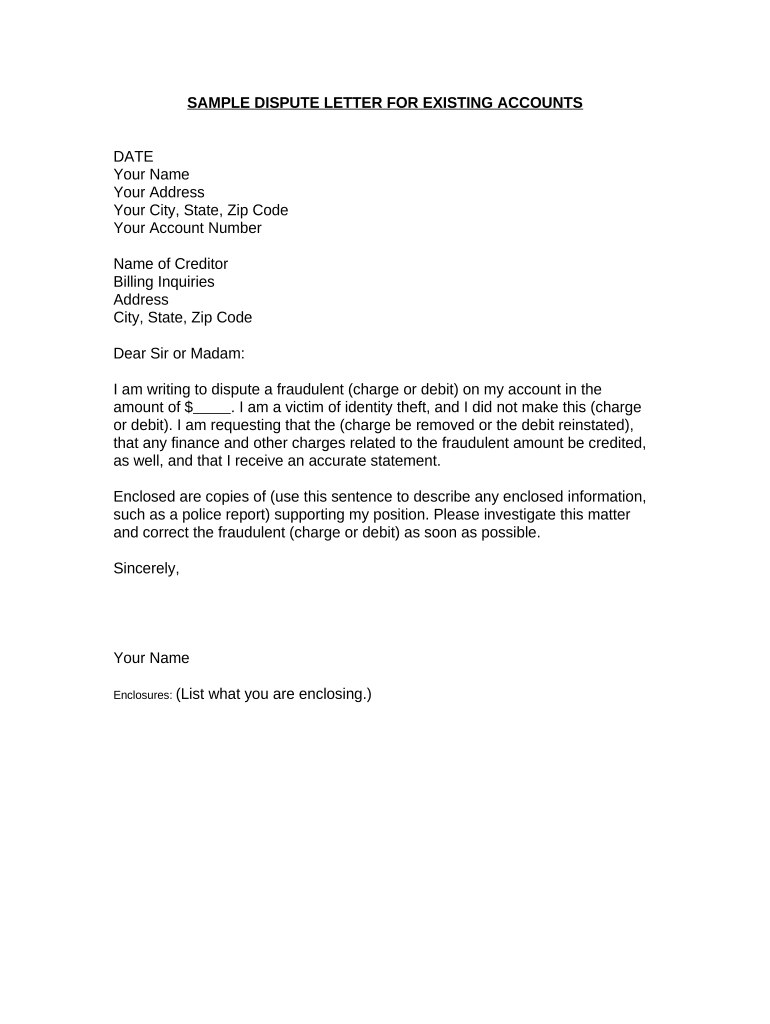

The creditors notifying is a formal document used to inform creditors about a debtor's financial situation or intention to settle debts. This letter serves as a notification that the debtor is either unable to meet their financial obligations or is seeking a resolution, such as a payment plan or settlement. It is essential for maintaining transparency and communication between debtors and creditors, ensuring that all parties are aware of the current status of the debts involved.

Key elements of the Creditors Notifying

A well-structured creditors notifying should include several key elements to ensure clarity and effectiveness:

- Debtor's Information: Full name, address, and contact details of the debtor.

- Creditor's Information: Name and address of the creditor being notified.

- Subject Line: A clear statement indicating the purpose of the letter.

- Details of the Debt: Specifics about the debt, including amounts owed and due dates.

- Proposed Plan: Any proposed payment plans or settlement offers.

- Signature: The debtor's signature to validate the document.

Steps to complete the Creditors Notifying

Completing a creditors notifying involves several straightforward steps:

- Gather all necessary information, including personal and creditor details.

- Clearly state the purpose of the letter in the subject line.

- Detail the debts owed, including amounts and due dates.

- Outline any proposed payment plans or settlement offers.

- Review the letter for accuracy and completeness.

- Sign the document to affirm its validity.

Legal use of the Creditors Notifying

For a creditors notifying to be legally binding, it must adhere to specific requirements set forth by relevant laws. This includes ensuring that the letter is clear, concise, and accurately represents the debtor's financial situation. Additionally, the document should comply with any applicable state laws regarding debt notification. Utilizing a reliable eSignature solution, like signNow, can enhance the legal standing of the document by providing a secure and verifiable signature.

Examples of using the Creditors Notifying

There are various scenarios in which a creditors notifying can be utilized:

- When a debtor is unable to make a scheduled payment and wishes to inform the creditor.

- To propose a new payment plan to creditors in light of financial difficulties.

- To formally acknowledge a debt and initiate discussions for settlement.

Form Submission Methods

The creditors notifying can be submitted through several methods, depending on the preferences of both the debtor and creditor:

- Online Submission: Many creditors accept electronic submissions, which can be done via email or secure online portals.

- Mail: A traditional method where the letter is printed and sent through postal services.

- In-Person Delivery: Delivering the letter directly to the creditor's office may provide immediate confirmation of receipt.

Quick guide on how to complete creditors notifying

Complete Creditors Notifying seamlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents swiftly without delays. Handle Creditors Notifying on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Creditors Notifying effortlessly

- Locate Creditors Notifying and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools offered specifically for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Dispose of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Creditors Notifying and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter creditors sample and how can it be used?

A letter creditors sample is a template that helps individuals or businesses communicate with creditors regarding debts. It serves as a formal document to request negotiation or settlement of payments. Utilizing a letter creditors sample can make the process efficient and ensure that all necessary details are included.

-

How can airSlate SignNow assist in creating a letter creditors sample?

airSlate SignNow offers a user-friendly platform to create, edit, and customize your letter creditors sample. With our intuitive interface, you can easily fill in the necessary information and make adjustments to meet your specific needs. This helps streamline your communication with creditors, making it more effective.

-

Are there any costs associated with using airSlate SignNow for a letter creditors sample?

airSlate SignNow provides several pricing plans that are designed to fit different business needs and budgets. You can access various features, including templates and eSignature capabilities, starting at an affordable rate. Evaluating our pricing plans will help you find the best option for accessing your letter creditors sample.

-

Can I send and sign a letter creditors sample electronically?

Yes, with airSlate SignNow, you can electronically send and sign your letter creditors sample. Our platform ensures that all documents are legally binding, providing you with a secure and efficient process. This convenience saves time while maintaining professionalism in your correspondence with creditors.

-

What features does airSlate SignNow offer for managing a letter creditors sample?

airSlate SignNow provides a variety of features for managing your letter creditors sample, including customizable templates, eSignature capabilities, and document tracking. You can also collaborate with team members in real time, ensuring that everyone involved is on the same page. These features help improve organization and efficiency in handling creditor communications.

-

Is it easy to integrate airSlate SignNow with other applications for managing letter creditors samples?

Yes, airSlate SignNow offers seamless integrations with numerous applications, allowing you to enhance your workflow around letter creditors samples. Whether it's CRM platforms, cloud storage solutions, or productivity tools, our integrations ensure that you can manage your documents efficiently. This flexibility makes it easier to keep all your necessary data connected.

-

What are the benefits of using a letter creditors sample through airSlate SignNow?

Utilizing a letter creditors sample through airSlate SignNow simplifies the process of communicating with your creditors. It ensures that your letters are professionally formatted and complete with the necessary legal requirements. Additionally, our platform allows for quick alterations and secure electronic signatures, making it a superior choice for creditor correspondence.

Get more for Creditors Notifying

- Dl 21sc 2007 2019 form

- Sc dmv form mv 37 2018 2019

- 447 nc application for beginners permit dricers or identification card form

- Dl 63 form 2018 2019

- Pwd 388 form 2017 2019

- Vtr 265 m form 2016 2019

- Motor vehicle appraisal for tax collector hearingbonded title form vtr 125 dmv texas

- Title and register your vehicle form

Find out other Creditors Notifying

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF