Printable Rental Income and Expense Worksheet 1996-2026

What is the Printable Rental Income and Expense Worksheet

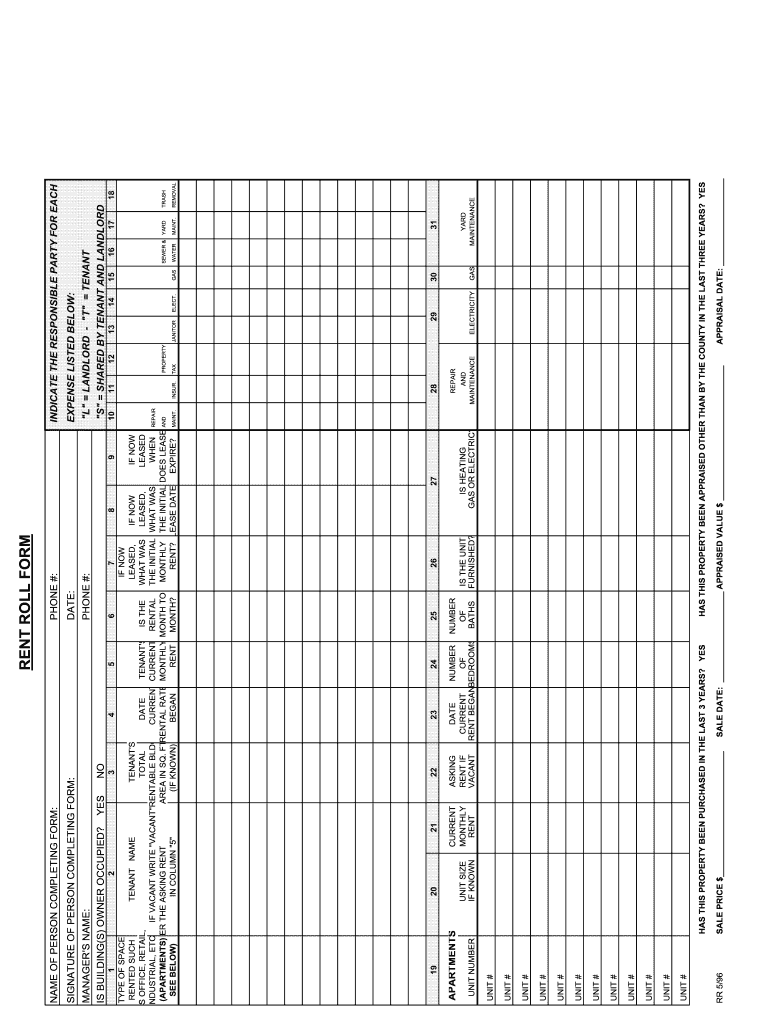

The printable rental income and expense worksheet is a structured document designed for landlords and property managers to track income and expenses related to rental properties. This worksheet provides a clear format for recording various financial transactions, including rental payments, maintenance costs, and other related expenses. Utilizing this worksheet can help landlords maintain accurate financial records, which is essential for tax reporting and overall financial management.

How to Use the Printable Rental Income and Expense Worksheet

To effectively use the printable rental income and expense worksheet, start by listing all rental properties you manage. For each property, record the rental income received, including the amount and date. Next, detail all expenses associated with the property, such as repairs, utilities, and property management fees. Ensure that you categorize expenses accurately to facilitate easier reporting and analysis. Regularly updating this worksheet can help you monitor your property's financial performance over time.

Steps to Complete the Printable Rental Income and Expense Worksheet

Completing the printable rental income and expense worksheet involves several key steps:

- Gather all relevant financial documents, including receipts and bank statements.

- Identify each rental property and create a section for each one in the worksheet.

- Input the total rental income for each property, noting the date of each payment.

- List all expenses, categorizing them into groups such as maintenance, utilities, and management fees.

- Calculate the total income and total expenses for each property to determine net income.

Legal Use of the Printable Rental Income and Expense Worksheet

The printable rental income and expense worksheet can serve as a valuable tool for legal compliance. Keeping accurate records of rental income and expenses is essential for tax purposes and can be used as evidence in case of disputes. It is important to ensure that all entries are truthful and documented with receipts where applicable. This adherence to accuracy can protect landlords from potential legal issues and penalties related to tax reporting.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the reporting of rental income and expenses. Landlords must report rental income on their tax returns, and the expenses can be deducted to reduce taxable income. The IRS allows deductions for various costs, including property management fees, repairs, and depreciation. Familiarizing yourself with these guidelines can help ensure compliance and optimize tax benefits.

Examples of Using the Printable Rental Income and Expense Worksheet

Using the printable rental income and expense worksheet can take various forms. For instance, a landlord may use it to track monthly rent payments and identify any late payments. Additionally, it can help in budgeting for upcoming repairs or renovations by providing a historical overview of past expenses. This worksheet can also assist in preparing for tax season by compiling necessary financial data in one place, making it easier to complete tax forms accurately.

Quick guide on how to complete printable rental income and expense worksheet

Prepare Printable Rental Income And Expense Worksheet seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as a superb eco-friendly substitute for conventional printed and signed documents, as it allows you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Printable Rental Income And Expense Worksheet on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest method to modify and eSign Printable Rental Income And Expense Worksheet without hassle

- Find Printable Rental Income And Expense Worksheet and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Printable Rental Income And Expense Worksheet and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable rental income and expense worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rental income and expense worksheet pdf?

A rental income and expense worksheet pdf is a customizable document used for tracking and managing rental income and associated expenses. It simplifies the process of organizing financial data, making it easier for landlords and property managers to assess their profitability. This worksheet can also assist in preparing for tax season by providing clear documentation of income and expenses.

-

How can I create a rental income and expense worksheet pdf using airSlate SignNow?

You can easily create a rental income and expense worksheet pdf with airSlate SignNow by using our customizable templates. Simply fill in your specific income and expense details, then save it as a PDF for your records. Our platform ensures that you have an efficient and accurate document ready for tracking your rental finances.

-

What features does the rental income and expense worksheet pdf include?

The rental income and expense worksheet pdf includes features such as customizable fields for income sources and expense categories, automatic calculations, and easy PDF export options. This allows landlords to efficiently monitor cash flow and improve financial management. With airSlate SignNow, you'll have a complete solution for managing your rental finances.

-

Is the rental income and expense worksheet pdf compatible with other software?

Yes, the rental income and expense worksheet pdf created with airSlate SignNow can be easily integrated with various accounting and financial software. This compatibility enhances your ability to manage financial data seamlessly. This means you can import and export information without hassle, ensuring accurate financial tracking.

-

What are the benefits of using a rental income and expense worksheet pdf?

Using a rental income and expense worksheet pdf offers numerous benefits, including better organization of financial records, simplified tax preparation, and improved cash flow visibility. It helps landlords identify profitable properties and manage expenses effectively. Overall, it contributes to more informed decision-making regarding your rental investments.

-

What is the pricing for using airSlate SignNow to manage my rental income and expense worksheet pdf?

airSlate SignNow offers flexible pricing plans that accommodate various needs, starting with free and affordable options for small landlords. Each plan provides access to features necessary for creating and managing your rental income and expense worksheet pdf. By selecting the right plan, you can ensure that you get the most value for your rental property management.

-

Can I share my rental income and expense worksheet pdf with others?

Absolutely! airSlate SignNow allows you to share your rental income and expense worksheet pdf with other parties, such as accountants or co-investors. You can invite collaborators via email or share the document securely. This facilitates better collaboration in managing your rental finances effectively.

Get more for Printable Rental Income And Expense Worksheet

- Ua star exam practice test form

- School elopement plan sample form

- Domestic electrical installation condition report form

- Tarrant county guardianship forms

- Enrollment forms 248713210

- Hhs hrsa photoimage release form nhsc nhsc hrsa

- Small claim cases and general information in arizona

- Ffmcareerex applicant acknowledgement permission form

Find out other Printable Rental Income And Expense Worksheet

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile