Contract Employee Foreign Form

What is the Contract Employee Foreign

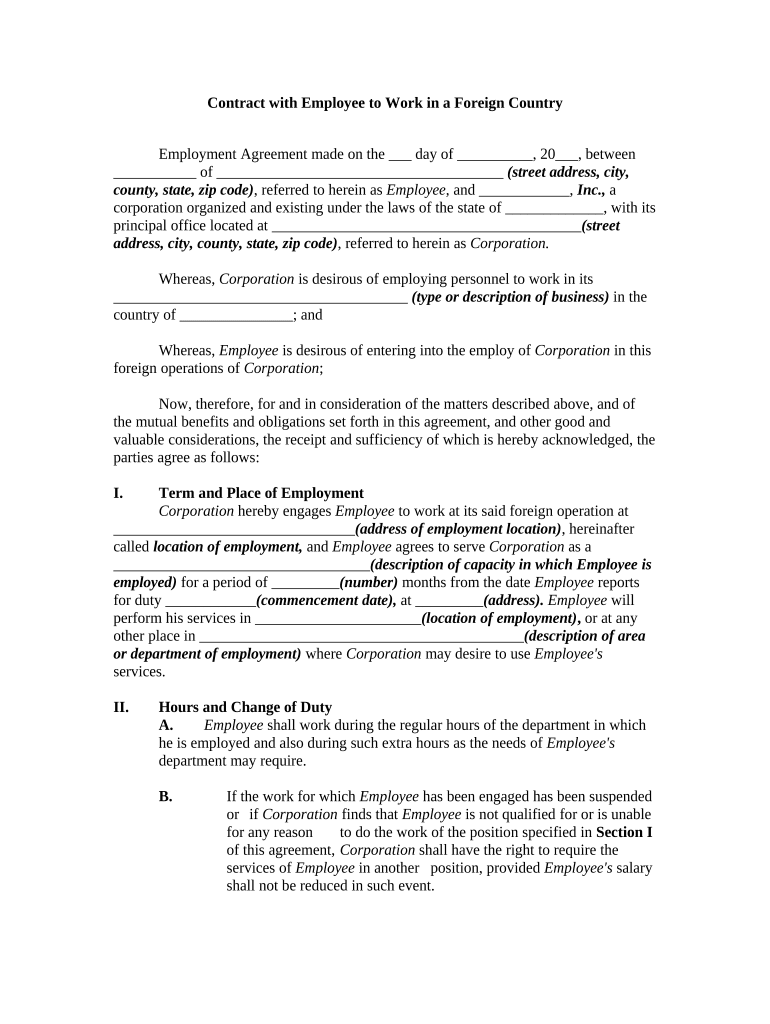

The Contract Employee Foreign refers to a specific agreement between a business and an employee who is not a U.S. citizen or resident. This type of contract outlines the terms of employment, including job responsibilities, compensation, and compliance with relevant immigration laws. It is essential for businesses hiring foreign workers to ensure that the contract adheres to both federal and state regulations, providing clarity and protection for both parties involved.

Steps to complete the Contract Employee Foreign

Completing the Contract Employee Foreign involves several critical steps to ensure compliance and clarity. First, gather all necessary information about the employee, including their legal status and work eligibility. Next, draft the contract, ensuring it includes key elements such as job description, payment terms, and duration of employment. After drafting, both parties should review the document for accuracy. Once finalized, both the employer and employee should sign the contract, ideally using a secure eSigning platform to maintain a digital record.

Legal use of the Contract Employee Foreign

The legal use of the Contract Employee Foreign is governed by various U.S. laws, including immigration regulations and labor laws. To be legally binding, the contract must comply with the Fair Labor Standards Act (FLSA) and any relevant state laws. It is crucial to include specific clauses that address the rights and responsibilities of both the employer and the employee, ensuring that the contract is enforceable in a court of law. Using a reliable eSigning solution can further enhance the legal standing of the document by providing a secure and verifiable signature process.

Key elements of the Contract Employee Foreign

Key elements of the Contract Employee Foreign should include the following components: job title and description, compensation details, duration of employment, and termination conditions. Additionally, the contract should outline any benefits, such as health insurance or relocation assistance, and specify compliance with applicable immigration laws. Including confidentiality and non-compete clauses can also protect the employer's interests. Each element must be clearly defined to prevent misunderstandings and potential legal disputes.

How to use the Contract Employee Foreign

To effectively use the Contract Employee Foreign, businesses should ensure that the contract is tailored to the specific role and the individual employee's circumstances. Start by customizing the template to reflect the unique aspects of the job and the employee's qualifications. Once the contract is prepared, present it to the employee for review and discussion. After both parties agree on the terms, proceed with signing the document electronically to facilitate a smooth and efficient process. This approach not only saves time but also ensures that both parties have access to a secure copy of the signed agreement.

Examples of using the Contract Employee Foreign

Examples of using the Contract Employee Foreign can vary widely based on industry and job function. For instance, a tech company may hire a software developer from abroad under this contract, outlining specific project deliverables and timelines. Alternatively, a hospitality business might employ foreign workers for seasonal positions, detailing the duration of employment and any required training. Each example highlights the importance of clearly defined roles and expectations, ensuring compliance with labor laws and fostering a positive working relationship.

Quick guide on how to complete contract employee foreign

Complete Contract Employee Foreign effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Contract Employee Foreign on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Contract Employee Foreign effortlessly

- Find Contract Employee Foreign and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to retain your changes.

- Choose your preferred method to submit your form: via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and electronically sign Contract Employee Foreign and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with work foreign?

airSlate SignNow is an eSignature solution that allows businesses to send and electronically sign documents seamlessly. With work foreign, it simplifies the signing process across international borders, making it easier for companies to manage documents with clients or partners abroad.

-

What are the pricing plans for airSlate SignNow to assist with work foreign?

airSlate SignNow offers several pricing plans to cater to different business needs. Each plan provides essential features to support workflows with work foreign, ensuring that you can choose a cost-effective solution that fits your budget without compromising on quality.

-

What features does airSlate SignNow offer for work foreign documentation?

airSlate SignNow provides robust features like templates, automated workflows, and customizable branding to enhance your documentation process. These features are specifically designed to streamline work foreign, making it more efficient to obtain signatures on necessary documents from global collaborators.

-

How does airSlate SignNow enhance collaboration with work foreign?

With airSlate SignNow, collaboration becomes effortless, even when dealing with work foreign. The platform allows multiple parties to sign and comment on documents in real-time, ensuring that every stakeholder stays informed, regardless of their geographic location.

-

Can airSlate SignNow integrate with other applications for work foreign transactions?

Yes, airSlate SignNow offers extensive integrations with various applications such as CRM, project management, and cloud storage solutions. These integrations help streamline processes and enhance productivity when dealing with work foreign, allowing businesses to manage all their documentation needs in one place.

-

Is airSlate SignNow secure for handling sensitive work foreign documents?

Absolutely. airSlate SignNow prioritizes security by utilizing encryption, secure storage, and compliance with industry standards. This ensures that all documents related to work foreign remain confidential and protected from unauthorized access.

-

How does the user experience of airSlate SignNow cater to users working with work foreign?

The user experience of airSlate SignNow is designed to be intuitive and easy to navigate. This simplicity allows users working with work foreign to quickly learn the platform, reducing the learning curve and enabling faster implementation of electronic signatures in their international dealings.

Get more for Contract Employee Foreign

Find out other Contract Employee Foreign

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation