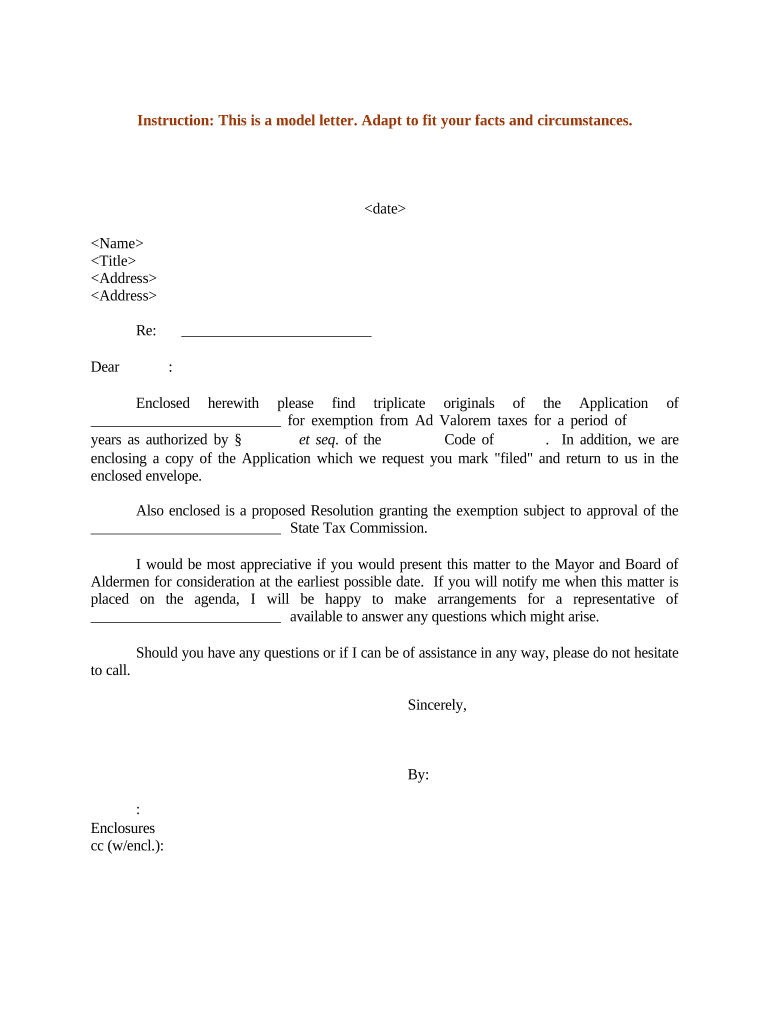

Ad Valorem Tax Form

What is the Ad Valorem Tax

The ad valorem tax is a property tax based on the assessed value of real estate or personal property. This tax is commonly levied by local governments and is calculated as a percentage of the property's value. The term "ad valorem" is Latin for "according to value," indicating that the tax amount varies with the value of the property. It is essential for property owners to understand how this tax is calculated and applied, as it can significantly impact their overall tax liability.

How to use the Ad Valorem Tax

Using the ad valorem tax effectively involves understanding its implications for property ownership. Property owners should regularly review their property assessments to ensure accuracy. If a property is overvalued, owners can appeal the assessment to potentially lower their tax burden. Additionally, understanding local tax rates and exemptions can help property owners manage their finances better. Utilizing digital tools, such as eSigning platforms, can streamline the process of submitting necessary documents related to property assessments and appeals.

Steps to complete the Ad Valorem Tax

Completing the ad valorem tax process involves several key steps:

- Determine the assessed value of your property through local tax assessments.

- Review local tax rates to calculate the estimated tax amount.

- Gather necessary documentation, including property deeds and previous tax statements.

- Complete any required forms for tax exemptions or appeals.

- Submit the completed forms electronically or via mail to the appropriate tax authority.

Legal use of the Ad Valorem Tax

The legal framework surrounding ad valorem taxes varies by state, but generally, these taxes must comply with local and state regulations. Property owners have the right to appeal their assessments if they believe their property has been incorrectly valued. It is crucial to follow the legal procedures outlined by local tax authorities to ensure compliance and avoid penalties. Understanding the legal aspects of ad valorem tax can help property owners navigate their obligations effectively.

Required Documents

When dealing with ad valorem taxes, several documents may be required, including:

- Property deeds that establish ownership.

- Previous tax statements for reference.

- Assessment notices from local tax authorities.

- Documentation supporting any claims for exemptions or appeals.

Filing Deadlines / Important Dates

Filing deadlines for ad valorem taxes can vary by state and locality. Typically, property owners must submit their tax assessments or appeals by a specific date each year. It is important to stay informed about these deadlines to avoid late fees or penalties. Check with local tax authorities for the most accurate and up-to-date information regarding filing deadlines.

Examples of using the Ad Valorem Tax

Examples of how ad valorem taxes are applied include:

- Residential property taxes calculated based on the market value of homes.

- Commercial property taxes assessed on business properties, which may vary based on location and use.

- Personal property taxes on vehicles, boats, and other personal assets.

Quick guide on how to complete ad valorem tax 497329016

Complete Ad Valorem Tax seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents efficiently without any holdups. Manage Ad Valorem Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Ad Valorem Tax effortlessly

- Find Ad Valorem Tax and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ad Valorem Tax and guarantee exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is ad valorem tax and how does it impact my business?

Ad valorem tax is a property tax based on the assessed value of real estate or personal property. Understanding this tax is crucial for businesses as it directly affects their financial responsibilities. Knowing how ad valorem tax works helps in budgeting and complying with local regulations.

-

How can airSlate SignNow assist with ad valorem tax documentation?

airSlate SignNow simplifies the process of managing ad valorem tax documents by allowing businesses to easily send and eSign required forms. This streamlines communication with tax assessors and ensures that all documentation is submitted on time. With airSlate SignNow, businesses can manage ad valorem tax paperwork efficiently.

-

What are the pricing options for using airSlate SignNow related to ad valorem tax documents?

airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. Each plan provides robust features to manage ad valorem tax documents effectively, ensuring that firms only pay for what they need. Flexible pricing makes it easy to budget for your ad valorem tax documentation needs.

-

What features does airSlate SignNow offer for eSigning ad valorem tax forms?

Our platform provides advanced features such as remote signing, templates, and automated workflows specifically for ad valorem tax forms. These tools help reduce bottlenecks in the document process and ensure that signatures are gathered quickly and securely. With user-friendly interfaces, airSlate SignNow enhances your experience in managing ad valorem tax documents.

-

Can I integrate airSlate SignNow with my existing accounting software for ad valorem tax?

Yes, airSlate SignNow offers seamless integrations with various accounting software, making it easy to manage ad valorem tax records. These integrations allow for smooth data transfer, ensuring that your tax calculations reflect current document statuses. Streamlining workflows between platforms minimizes errors associated with ad valorem tax documentation.

-

What are the benefits of using airSlate SignNow for ad valorem tax processes?

Using airSlate SignNow for ad valorem tax processes can save time and reduce manual errors. Our electronic signature solution ensures compliance with legal standards while making document management more efficient. Additionally, it provides a secure environment for storing sensitive tax documents related to ad valorem tax.

-

Is airSlate SignNow compliant with regulations regarding ad valorem tax?

Absolutely! airSlate SignNow adheres to industry standards and regulations, ensuring that all eSigned documents are legally compliant. This compliance is crucial for businesses dealing with ad valorem tax, as it ensures the integrity and credibility of submissions. Trusting our solution means you're aligned with legal requirements surrounding ad valorem tax.

Get more for Ad Valorem Tax

Find out other Ad Valorem Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors