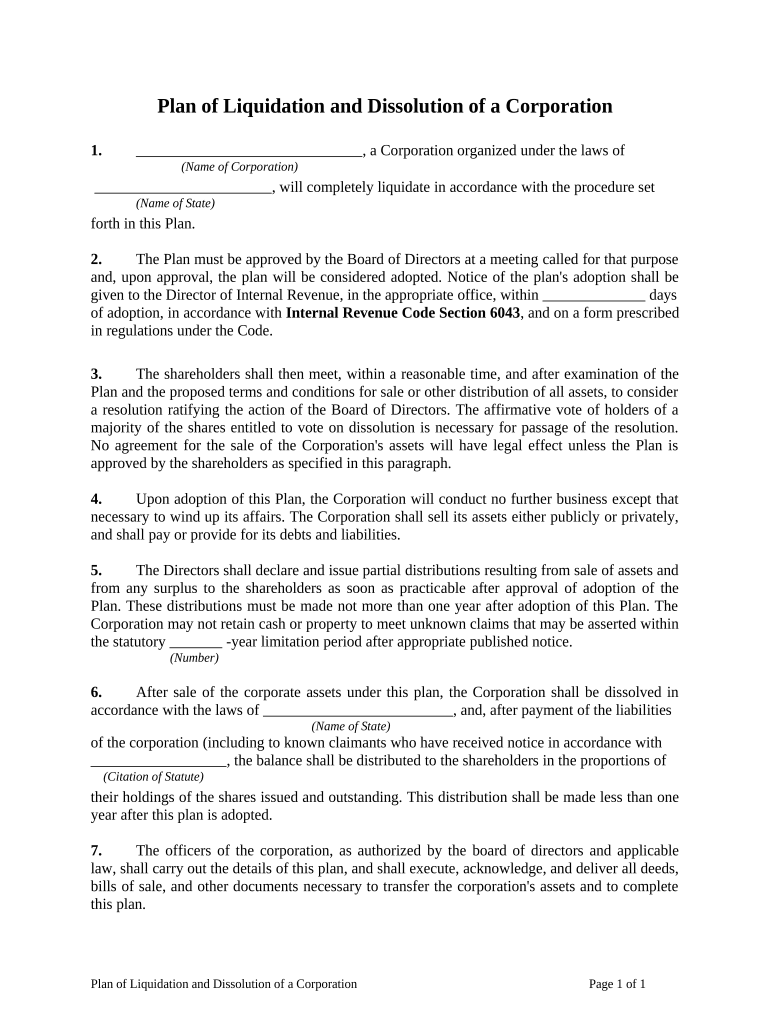

Plan of Liquidation and Dissolution of a Corporation Form

Understanding the plan of dissolution template

The plan of dissolution template serves as a formal document outlining the process by which a corporation ceases operations and distributes its assets. This template is essential for ensuring that all legal requirements are met during the dissolution process. It typically includes details such as the reasons for dissolution, the method of asset distribution, and the steps to notify creditors and stakeholders. By using a structured template, businesses can streamline the dissolution process and maintain compliance with state laws.

Steps to complete the plan of dissolution template

Completing the plan of dissolution template involves several key steps to ensure accuracy and compliance. First, gather all necessary corporate documents, including bylaws and financial statements. Next, outline the reasons for dissolution clearly, as this will be important for both legal and tax purposes. Then, detail the method of asset distribution, specifying how remaining assets will be allocated among shareholders and creditors. After filling out the template, review it for completeness and accuracy before obtaining the required signatures from authorized individuals within the corporation.

Legal considerations for the plan of dissolution template

When using the plan of dissolution template, it is crucial to understand the legal implications involved. Each state has specific laws governing the dissolution of corporations, which may dictate how the template should be filled out and submitted. Additionally, compliance with federal regulations, such as IRS guidelines for tax reporting, is necessary to avoid penalties. It is advisable to consult with a legal professional to ensure that the plan adheres to all applicable laws and regulations, thus protecting the interests of the corporation and its stakeholders.

Key elements of the plan of dissolution template

A comprehensive plan of dissolution template should include several key elements to be effective. These elements typically encompass:

- Corporation Information: Name, address, and registration details.

- Reasons for Dissolution: Clear explanation of why the corporation is dissolving.

- Asset Distribution Plan: Detailed plan for how assets will be divided among shareholders and creditors.

- Notification Procedures: Steps for informing stakeholders and creditors about the dissolution.

- Signature Section: Area for authorized individuals to sign and date the document.

State-specific rules for the plan of dissolution template

Each state has unique rules and regulations regarding the dissolution of corporations, which can affect how the plan of dissolution template is structured and submitted. It is important to research the specific requirements in your state, as some may require additional documentation or filing fees. Additionally, states may have different timelines for processing dissolution requests. Familiarizing yourself with these state-specific rules ensures that the dissolution process proceeds smoothly and legally.

Obtaining the plan of dissolution template

The plan of dissolution template can typically be obtained through various sources, including state government websites, legal resource centers, or business advisory services. Many states provide downloadable forms that can be customized to meet specific corporate needs. Additionally, legal professionals may offer templates tailored to comply with local regulations. It is important to ensure that the template used is the most current version to avoid any legal complications during the dissolution process.

Quick guide on how to complete plan of liquidation and dissolution of a corporation

Complete Plan Of Liquidation And Dissolution Of A Corporation effortlessly on any device

Online document management has become widely valued by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without complications. Manage Plan Of Liquidation And Dissolution Of A Corporation on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Plan Of Liquidation And Dissolution Of A Corporation without hassle

- Obtain Plan Of Liquidation And Dissolution Of A Corporation and click Get Form to start.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Plan Of Liquidation And Dissolution Of A Corporation to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a plan of dissolution template?

A plan of dissolution template is a standardized document that outlines the process for dissolving a business entity. It provides essential information regarding asset distribution, liability settlement, and formal termination of business operations. Using a well-structured plan of dissolution template ensures all legal requirements are met, facilitating a smoother dissolution process.

-

How can I create a plan of dissolution template using airSlate SignNow?

Creating a plan of dissolution template with airSlate SignNow is simple and user-friendly. You can easily customize the template to include your specific business details and requirements, ensuring it meets your unique needs. With our intuitive interface, you can design, save, and share the plan of dissolution template in just a few clicks.

-

What are the benefits of using a plan of dissolution template?

Using a plan of dissolution template streamlines the process of dissolving a business by providing a clear framework. It helps ensure that all necessary legal and financial matters are addressed, reducing the risk of errors. Additionally, a plan of dissolution template saves time and resources by eliminating the need to draft a document from scratch.

-

Is there a cost associated with the plan of dissolution template on airSlate SignNow?

Yes, there is a cost associated with using the plan of dissolution template on airSlate SignNow, which varies depending on the subscription plan you choose. We offer several pricing tiers that cater to different business needs and budgets. You can check our pricing page for detailed information and choose the plan that best fits your requirements.

-

Can I integrate other tools with my plan of dissolution template on airSlate SignNow?

Absolutely! airSlate SignNow supports integration with a variety of tools and platforms, enhancing the functionality of your plan of dissolution template. You can easily connect with CRM systems, cloud storage services, and more to streamline your document management process and improve overall efficiency.

-

What features does the plan of dissolution template include?

The plan of dissolution template on airSlate SignNow includes features like customizable fields, eSignature capabilities, and document sharing options. These features ensure that your template not only meets your business needs but also facilitates quick and secure document signing. You can also track the status of your document in real time.

-

How secure is my plan of dissolution template on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our plan of dissolution template is protected with advanced encryption and compliance measures, ensuring that your sensitive business information remains confidential. Additionally, we offer features like access controls to keep your documents safe from unauthorized access.

Get more for Plan Of Liquidation And Dissolution Of A Corporation

Find out other Plan Of Liquidation And Dissolution Of A Corporation

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed