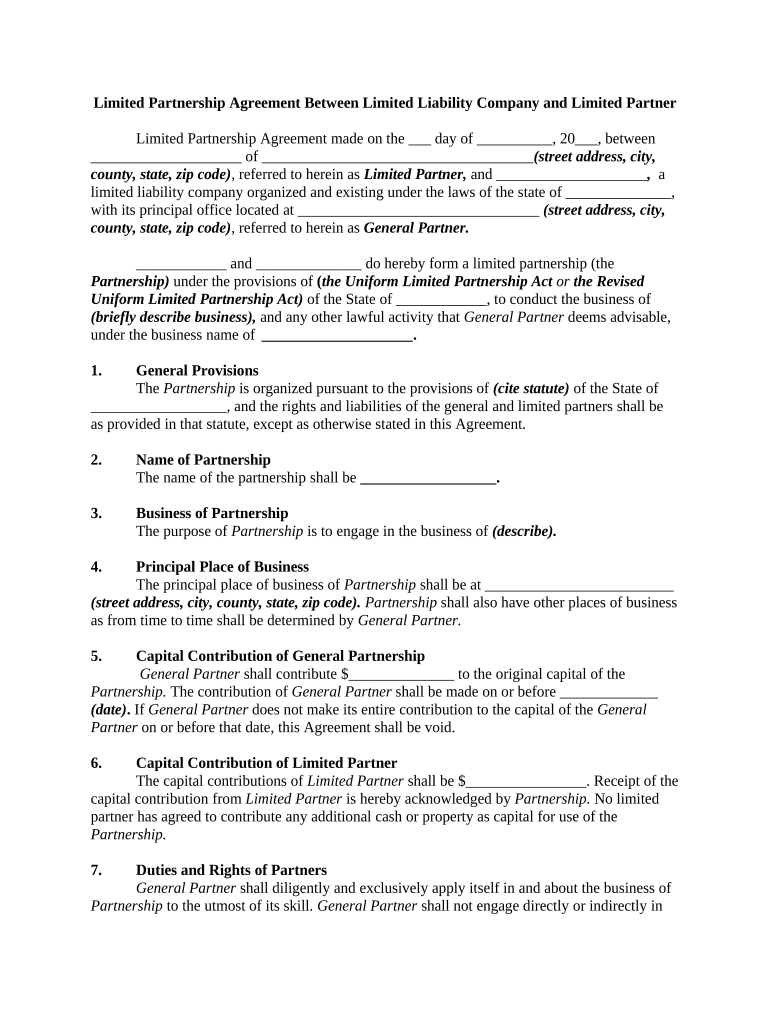

Limited Liability Company Form

What is a limited liability company?

A limited liability company (LLC) is a business structure that combines the benefits of both a corporation and a partnership. It offers limited liability protection to its owners, known as members, meaning their personal assets are generally protected from business debts and claims. This structure is popular among small businesses due to its flexibility and favorable tax treatment. An LLC can have one or more members, and it can be managed by its members or appointed managers.

Key elements of a limited liability company

Several key elements define a limited liability company:

- Limited liability protection: Members are not personally liable for the company's debts.

- Pass-through taxation: Profits and losses can be reported on members' personal tax returns, avoiding double taxation.

- Flexible management structure: Members can choose to manage the LLC themselves or appoint managers.

- Less formalities: LLCs have fewer compliance requirements compared to corporations, making them easier to operate.

Steps to complete the limited liability company

To form a limited liability company, follow these steps:

- Choose a name: Select a unique name that complies with state regulations.

- Designate a registered agent: Appoint a person or business entity to receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit the required formation documents to your state’s business filing agency.

- Create an operating agreement: Outline the management structure and operating procedures of the LLC.

- Obtain necessary permits and licenses: Check local regulations to ensure compliance with business licensing requirements.

Required documents for forming a limited liability company

When forming an LLC, you will typically need to prepare and submit the following documents:

- Articles of Organization: This document officially establishes the LLC and includes basic information about the business.

- Operating Agreement: Although not always required, this internal document outlines the management structure and member rights.

- Employer Identification Number (EIN): Obtain this from the IRS for tax purposes if the LLC has more than one member or hires employees.

State-specific rules for limited liability companies

Each state has its own regulations governing the formation and operation of limited liability companies. It is essential to review the specific rules applicable in your state, which may include:

- Filing fees: Costs associated with submitting Articles of Organization.

- Annual reporting requirements: Some states require periodic reports to maintain good standing.

- Business licenses: Certain industries may need additional permits or licenses to operate legally.

Legal use of the limited liability company

The limited liability company structure is recognized legally in the United States, providing various advantages. This includes the ability to enter into contracts, sue or be sued, and own property in the name of the LLC. To ensure legal compliance, it is crucial to adhere to state-specific regulations and maintain proper documentation, such as the operating agreement and financial records.

Quick guide on how to complete limited liability company 497329111

Complete Limited Liability Company effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Limited Liability Company on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

How to alter and eSign Limited Liability Company with ease

- Locate Limited Liability Company and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Limited Liability Company to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a limited liability partner?

A limited liability partner is an individual who partners with a business entity like a limited liability partnership (LLP) while enjoying limited liability protection against debts and obligations. This means they are not personally responsible for the partnership's liabilities beyond their investment. Understanding this role is crucial for ensuring compliance and protecting personal assets.

-

How can airSlate SignNow benefit limited liability partners?

AirSlate SignNow provides limited liability partners with an efficient way to manage and sign important documents securely. By utilizing our easy-to-use platform, partners can streamline the document signing process, enhance document tracking, and ensure compliance, all while maintaining a professional image. This saves time and reduces stress in business operations.

-

What features does airSlate SignNow offer for limited liability partners?

AirSlate SignNow offers a variety of features for limited liability partners, including electronic signature capabilities, customizable templates, and advanced document management tools. These features help partners to easily generate, send, and track documents. Additionally, the platform ensures that all documents are legally binding and secure.

-

Is airSlate SignNow a cost-effective solution for limited liability partners?

Yes, airSlate SignNow is a cost-effective solution for limited liability partners looking to manage their documents efficiently. Our subscription plans are designed to fit various budgets, and they provide access to all the essential features without hidden costs. It's an investment that pays off by saving time and resources in document management.

-

Can limited liability partners integrate airSlate SignNow with other tools?

Absolutely! Limited liability partners can seamlessly integrate airSlate SignNow with various third-party applications, such as CRM systems, cloud storage solutions, and project management tools. This integration enhances workflow efficiency and ensures that document management aligns with existing business processes.

-

How secure is airSlate SignNow for limited liability partners?

Security is a top priority at airSlate SignNow, especially for limited liability partners handling sensitive documents. Our platform uses advanced encryption protocols to protect your data and complies with industry standards. You can trust that your documents are secure and that your business operations remain confidential.

-

What customer support options are available for limited liability partners using airSlate SignNow?

Limited liability partners using airSlate SignNow can access a range of customer support options, including live chat, email support, and detailed online documentation. Our dedicated support team is available to assist you with any inquiries or technical issues. This ensures that you can maximize the benefits of our platform without disruptions.

Get more for Limited Liability Company

- Contract summary continuation form

- Great seal order form gsa

- General services administration gsagov form

- Notification of federal supply schedule improvement form

- General services administration acquisition manual gsam form

- Emergency managementabout the departmenthays county form

- Creating julian date with batch file experts exchange form

- Status report of orders and shipments gsa form

Find out other Limited Liability Company

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement