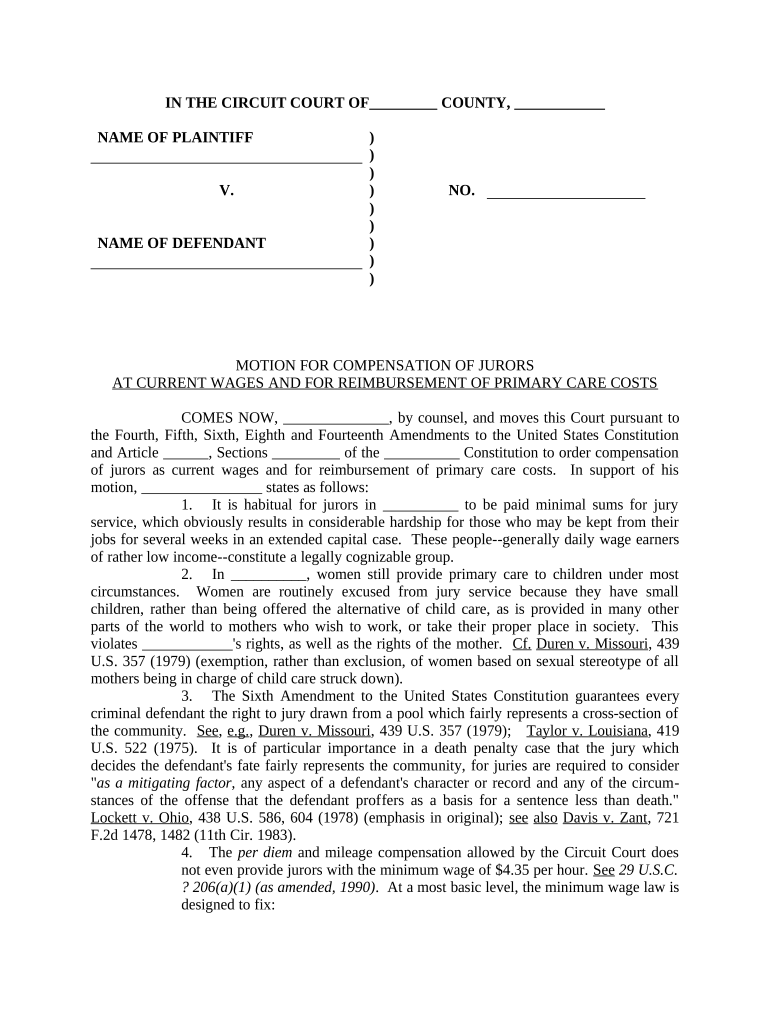

Compensation Wages Form

What is the compensation wages?

The compensation wages form is a document used to report and calculate the wages paid to employees for their work. This form is essential for businesses to ensure accurate payroll processing and compliance with tax regulations. Compensation wages can include various forms of payment, such as salaries, hourly wages, bonuses, and other forms of remuneration. Understanding this form is crucial for both employers and employees to ensure that all compensation is reported correctly and that employees receive their due earnings.

Steps to complete the compensation wages

Completing the compensation wages form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information, including employee details, wage rates, and hours worked.

- Calculate total wages for each employee, factoring in any overtime or bonuses.

- Fill out the form with the calculated wages, ensuring all fields are completed correctly.

- Review the form for accuracy, checking for any errors or omissions.

- Submit the completed form to the appropriate tax authority or payroll department as required.

Legal use of the compensation wages

The legal use of the compensation wages form is governed by federal and state employment laws. Employers must ensure that the information reported is truthful and complies with regulations set forth by the Internal Revenue Service (IRS) and other relevant authorities. Accurate reporting of compensation wages is crucial to avoid legal penalties and ensure that employees receive the correct tax withholdings. Employers should also be aware of any specific state regulations that may apply to compensation reporting.

Key elements of the compensation wages

Several key elements must be included in the compensation wages form to ensure it is complete and compliant:

- Employee name and identification number.

- Employer name and identification number.

- Total wages paid during the reporting period.

- Breakdown of different types of compensation, such as hourly wages, salaries, and bonuses.

- Any deductions or withholdings that apply to the wages reported.

Examples of using the compensation wages

Understanding how to use the compensation wages form can be illustrated through various scenarios. For instance, a business owner may need to report the wages of their employees at the end of the fiscal year for tax purposes. Another example is an employer calculating compensation wages for an employee who worked overtime during a busy season. In both cases, accurate completion of the form ensures compliance with tax regulations and proper employee compensation.

Filing deadlines / important dates

Filing deadlines for the compensation wages form are critical for employers to avoid penalties. Typically, businesses must submit this form annually, with specific deadlines varying based on the type of employer and the state. Employers should be aware of the following important dates:

- Annual filing deadline, usually by January 31 for the previous tax year.

- Quarterly deadlines for estimated tax payments, if applicable.

- State-specific deadlines that may differ from federal requirements.

Required documents

To accurately complete the compensation wages form, several documents may be required. These documents help verify the information provided and ensure compliance with tax regulations. Commonly required documents include:

- Employee time sheets or records of hours worked.

- Payroll records detailing wages paid.

- Tax identification numbers for both the employer and employees.

- Any relevant contracts or agreements regarding compensation.

Quick guide on how to complete compensation wages

Complete Compensation Wages effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the suitable form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly without any hitches. Manage Compensation Wages on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to amend and electronically sign Compensation Wages with ease

- Find Compensation Wages and then click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Mark important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Compensation Wages to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are compensation wages, and how does airSlate SignNow help in managing them?

Compensation wages refer to the total earnings of an employee, including base pay, bonuses, and any benefits. airSlate SignNow streamlines the documentation process for compensation wages, allowing businesses to send and eSign necessary contracts and agreements quickly, ensuring compliance and accuracy.

-

How does airSlate SignNow assist with the calculation of compensation wages?

While airSlate SignNow does not calculate compensation wages directly, it simplifies the process by enabling easy collaboration on compensation-related documents. You can create and manage offers, payroll agreements, and expense reimbursements that contribute to transparent compensation wages.

-

What pricing plans does airSlate SignNow offer for businesses managing compensation wages?

airSlate SignNow offers various pricing plans tailored to different business sizes. Each plan includes features that facilitate the management of documents related to compensation wages, making it a cost-effective solution for efficiently handling employee agreements.

-

Are there features in airSlate SignNow that specifically benefit HR departments handling compensation wages?

Yes, airSlate SignNow includes features such as document templates, automated reminders, and status tracking, all of which are particularly beneficial for HR departments managing compensation wages. These tools enhance efficiency and ensure timely processing of compensation-related agreements.

-

Can I integrate airSlate SignNow with payroll software for compensation wages management?

Absolutely! airSlate SignNow can easily integrate with various payroll software solutions. This integration allows businesses to seamlessly manage documentation for compensation wages, enhancing the workflow between payroll and contracts.

-

What benefits do I gain from using airSlate SignNow for compensation wages documents?

Using airSlate SignNow for compensation wages documents provides time savings, enhanced security, and improved accuracy. The platform's user-friendly interface allows for quick eSigning and tracking, ensuring your compensation agreements are processed smoothly.

-

How secure is airSlate SignNow when handling sensitive compensation wages information?

AirSlate SignNow prioritizes security, employing advanced encryption and secure data storage to protect compensation wages information. Our compliance with industry standards ensures that sensitive employee data remains confidential throughout the signing process.

Get more for Compensation Wages

Find out other Compensation Wages

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself