House Property Rental Form

What is the House Property Rental

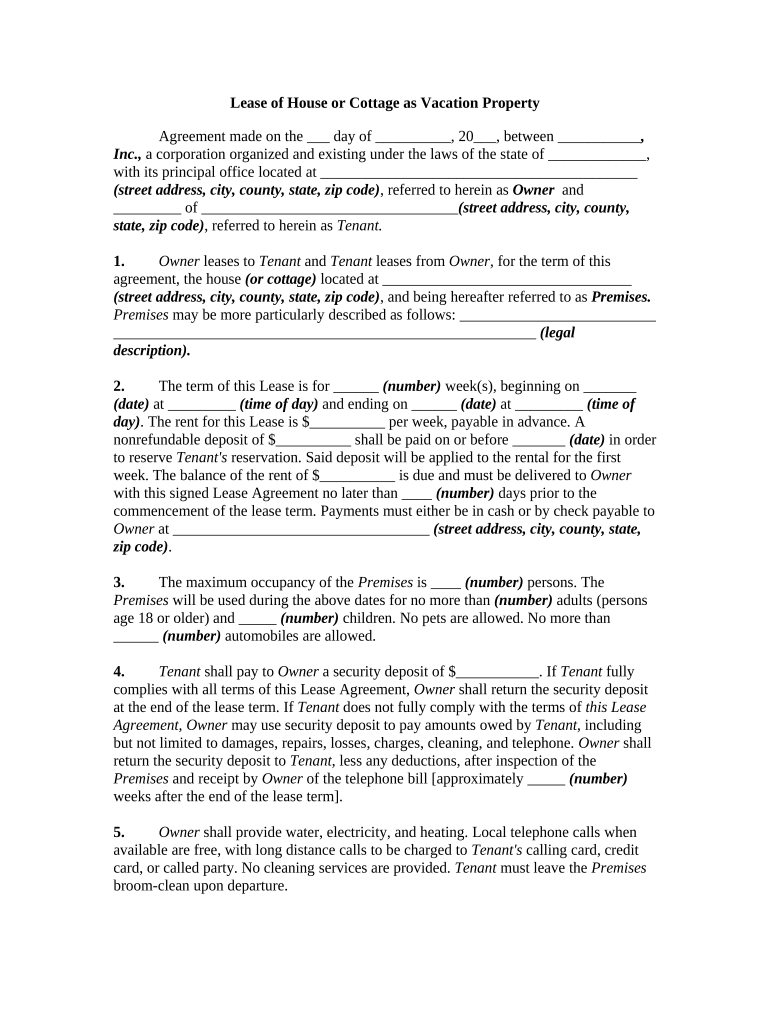

The house property rental refers to the legal agreement between a landlord and a tenant for the leasing of residential property. This document outlines the terms of the rental arrangement, including the duration of the lease, rental payment amounts, and responsibilities of both parties. It is essential for protecting the rights of both landlords and tenants, ensuring clarity in the rental relationship.

How to Use the House Property Rental

Using the house property rental involves several key steps. First, both parties should review the terms of the rental agreement to ensure mutual understanding. Next, the landlord and tenant should fill out the necessary details, including names, property address, rental amount, and lease duration. Once completed, both parties should sign the document to make it legally binding. Utilizing electronic signature tools can streamline this process, ensuring a secure and efficient signing experience.

Steps to Complete the House Property Rental

Completing the house property rental involves the following steps:

- Review the rental agreement carefully.

- Fill in the required information, such as tenant and landlord details.

- Specify the rental amount and payment schedule.

- Outline the responsibilities of both parties, including maintenance and repairs.

- Sign the document electronically or in person to finalize the agreement.

Legal Use of the House Property Rental

The house property rental is legally binding when it meets specific requirements. It must include essential elements such as the names of the parties, a clear description of the property, the rental amount, and the lease term. Compliance with state laws is crucial, as regulations may vary significantly. Using a reliable electronic signature service can enhance the legal standing of the document by providing a secure and verifiable signing process.

State-Specific Rules for the House Property Rental

Each state in the U.S. has its own regulations governing house property rentals. These rules can dictate aspects such as security deposits, eviction processes, and tenant rights. It is important for both landlords and tenants to familiarize themselves with their state's specific laws to ensure compliance and avoid potential disputes. Consulting legal resources or professionals can provide valuable insights into state-specific requirements.

Required Documents

When preparing for a house property rental, several documents are typically required. These may include:

- A completed rental application from the tenant.

- Proof of income or employment verification.

- Credit reports or background checks.

- A copy of the rental agreement or lease.

Having these documents readily available can facilitate a smoother rental process and ensure that all necessary information is provided.

Examples of Using the House Property Rental

Examples of using the house property rental include various scenarios such as:

- A family renting a single-family home for a year.

- A group of college students leasing an apartment for the academic year.

- A landlord renting out a property while relocating for work.

In each case, the rental agreement serves to clarify the expectations and responsibilities of both parties, fostering a positive rental experience.

Quick guide on how to complete house property rental 497329238

Effortlessly Prepare House Property Rental on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the solutions required to create, edit, and electronically sign your documents swiftly and without complications. Manage House Property Rental on any platform utilizing the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to Edit and Electronically Sign House Property Rental with Ease

- Locate House Property Rental and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and electronically sign House Property Rental while ensuring exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is house property rental and how can airSlate SignNow help?

House property rental refers to the process of leasing a residential property to tenants. With airSlate SignNow, you can streamline the documentation process related to house property rental by easily sending and eSigning rental agreements and other essential documents, ensuring a smooth transaction.

-

What features does airSlate SignNow offer for house property rental management?

AirSlate SignNow offers features such as templates for house property rental agreements, electronic signatures, document tracking, and secure storage. These tools aid landlords and property managers in efficiently managing rental agreements and maintaining compliance.

-

How does pricing work for airSlate SignNow when dealing with house property rental documents?

AirSlate SignNow offers various pricing plans that cater to different needs, including a tier that suits those focused on house property rental. The plans are designed to be budget-friendly and cost-effective, ensuring you get value while managing your rental documentation.

-

Can airSlate SignNow integrate with other tools for house property rental?

Yes, airSlate SignNow seamlessly integrates with various property management software and CRM systems, which enhances the house property rental process. These integrations facilitate the automated exchange of data, making it easier to manage tenants and their information.

-

How can I ensure security when eSigning house property rental agreements?

AirSlate SignNow prioritizes security with robust encryption and secure access controls. When eSigning house property rental agreements, you can rest assured that your documents and sensitive information are protected against unauthorized access.

-

Is it easy to use airSlate SignNow for first-time users in house property rental?

Absolutely! AirSlate SignNow is designed to be user-friendly, making it easy for first-time users involved in house property rental to navigate the platform. The intuitive interface allows landlords and property managers to quickly get started with minimal training.

-

What benefits can I expect from using airSlate SignNow for house property rental?

Using airSlate SignNow for house property rental can signNowly reduce the time spent on paperwork and enhance efficiency. This tool also helps in minimizing errors associated with manual processes, leading to better tenant experiences and smoother leasing transactions.

Get more for House Property Rental

- Nyu diploma form

- Cheerleadind sing up sheet printable form

- Field trip curriculum form

- Student information sheet buncombe county schools buncombe k12 nc

- Form excused

- Letter of recommendation for promotion for physician form

- Year 4 rotation evaluation form away electives ttuhsc

- Albany medical center financial aid forms

Find out other House Property Rental

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast