Stock Pledge Form

Understanding the Stock Pledge

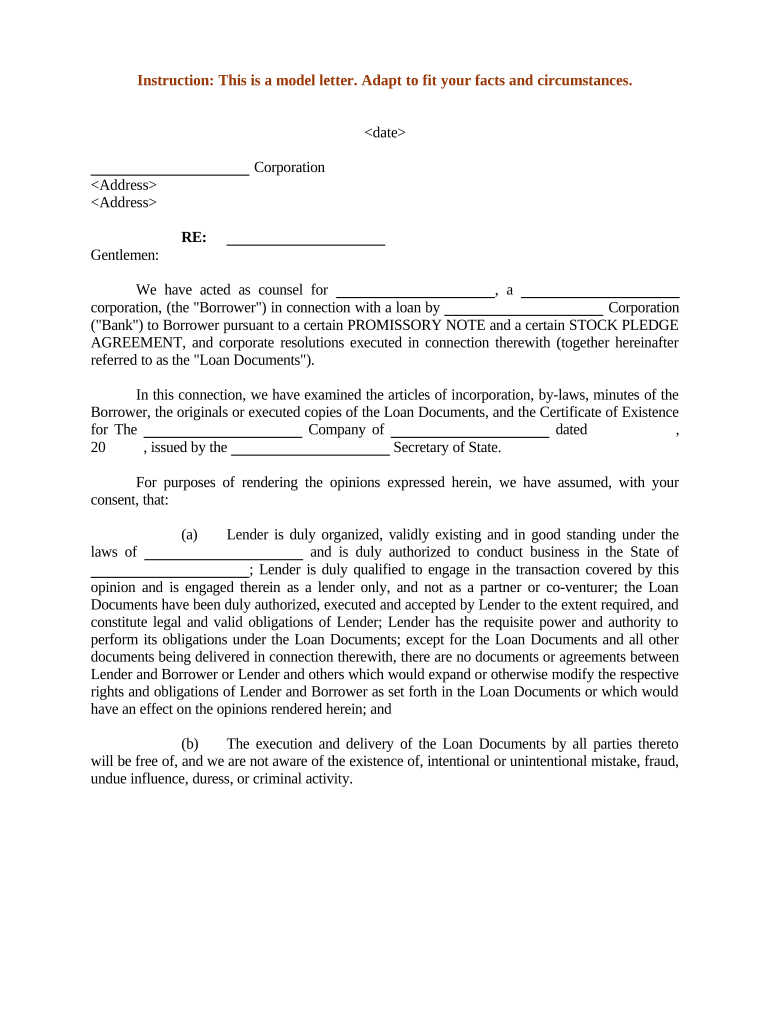

A stock pledge is a legal agreement where a borrower offers shares of stock as collateral for a loan or other obligation. This arrangement ensures that the lender has a claim to the stock if the borrower defaults on the loan. The stock pledge agreement outlines the terms and conditions under which the shares are pledged, including the rights and responsibilities of both parties. Understanding the legal implications and the specific terms of the stock pledge is essential for both lenders and borrowers to protect their interests.

Steps to Complete the Stock Pledge

Completing a stock pledge involves several key steps to ensure that the agreement is legally binding and enforceable. First, both parties should clearly define the terms of the pledge, including the amount of the loan, the number of shares pledged, and any conditions for release of the shares. Next, the borrower must provide the lender with the necessary documentation, such as proof of ownership of the shares. After that, both parties should sign the stock pledge agreement, and it may be advisable to have the document notarized. Finally, the lender should securely hold the stock certificate or ensure that the shares are recorded in a manner that reflects the pledge.

Legal Use of the Stock Pledge

The stock pledge must comply with applicable laws and regulations to be enforceable. In the United States, this includes adhering to state laws governing secured transactions, which often require that the pledge be properly documented and executed. Additionally, the stock pledge should be recorded with the appropriate regulatory bodies if required, to provide public notice of the lender's interest in the pledged shares. Understanding these legal requirements helps ensure that the pledge is valid and protects the rights of both parties involved.

Key Elements of the Stock Pledge

Several key elements must be included in a stock pledge agreement to ensure clarity and enforceability. These elements typically include:

- Identification of Parties: Clearly state the names and addresses of the borrower and lender.

- Description of Collateral: Provide a detailed description of the shares being pledged, including the number of shares and the company name.

- Terms of the Loan: Outline the loan amount, interest rate, and repayment terms.

- Default Provisions: Specify what constitutes a default and the lender's rights in such an event.

- Governing Law: Indicate which state’s laws will govern the agreement.

Examples of Using the Stock Pledge

Stock pledges are commonly used in various financial transactions. For instance, a startup may pledge shares to secure a loan from a bank to fund operations. Similarly, an investor may use a stock pledge to obtain a margin loan, allowing them to borrow against the value of their stock portfolio. These examples illustrate how stock pledges can facilitate access to capital while providing security for lenders.

Required Documents for the Stock Pledge

To complete a stock pledge, certain documents are typically required. These may include:

- Stock Certificate: Proof of ownership of the shares being pledged.

- Stock Pledge Agreement: The formal agreement detailing the terms of the pledge.

- Loan Agreement: If applicable, the agreement outlining the terms of the loan secured by the pledge.

- Identification: Valid identification for both parties to verify their identities.

Quick guide on how to complete stock pledge

Prepare Stock Pledge effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without delays. Manage Stock Pledge on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-focused process today.

The easiest way to edit and eSign Stock Pledge seamlessly

- Locate Stock Pledge and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Stock Pledge and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a note pledge agreement?

A note pledge agreement is a legal document that outlines the terms under which one party pledges an asset as collateral for a loan or obligation. It serves to protect the lender's interests and specifies the rights and responsibilities of both parties. Understanding this document is crucial for both borrowers and lenders in managing their financial dealings.

-

How does airSlate SignNow simplify creating a note pledge agreement?

airSlate SignNow provides an intuitive platform for drafting and signing your note pledge agreement. With our easy-to-use templates and customizable fields, you can create a legally binding document quickly. This saves time and reduces errors, allowing you to focus on your business operations.

-

Is there a cost associated with using airSlate SignNow for a note pledge agreement?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. We offer various pricing plans, including options for solo users and teams, ensuring you find a fit for your budget. The investment is well worth it for the time saved and enhanced efficiency in managing your note pledge agreement.

-

Can I integrate airSlate SignNow with other tools for managing a note pledge agreement?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to streamline your workflow. Whether you use CRM systems or project management tools, you can easily connect them to manage your note pledge agreement alongside your other business operations.

-

What are the benefits of using airSlate SignNow for a note pledge agreement?

Using airSlate SignNow for a note pledge agreement offers several benefits, including enhanced security, quick turnaround times, and reduced paper waste. The platform ensures that all documents are stored securely in the cloud, making access easy and efficient. Additionally, the e-signature functionality speeds up the signing process, which can signNowly improve your business transactions.

-

Is the note pledge agreement legally binding with airSlate SignNow?

Yes, a note pledge agreement created and signed through airSlate SignNow is legally binding. Our platform complies with eSignature laws, ensuring that your electronic signatures hold the same legal weight as traditional handwritten signatures. This gives you peace of mind when finalizing agreements.

-

How can I ensure the security of my note pledge agreement on airSlate SignNow?

airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption protocols and secure cloud storage to protect your note pledge agreement from unauthorized access. Additionally, our authentication measures ensure that only authorized parties can sign and access sensitive information.

Get more for Stock Pledge

Find out other Stock Pledge

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe