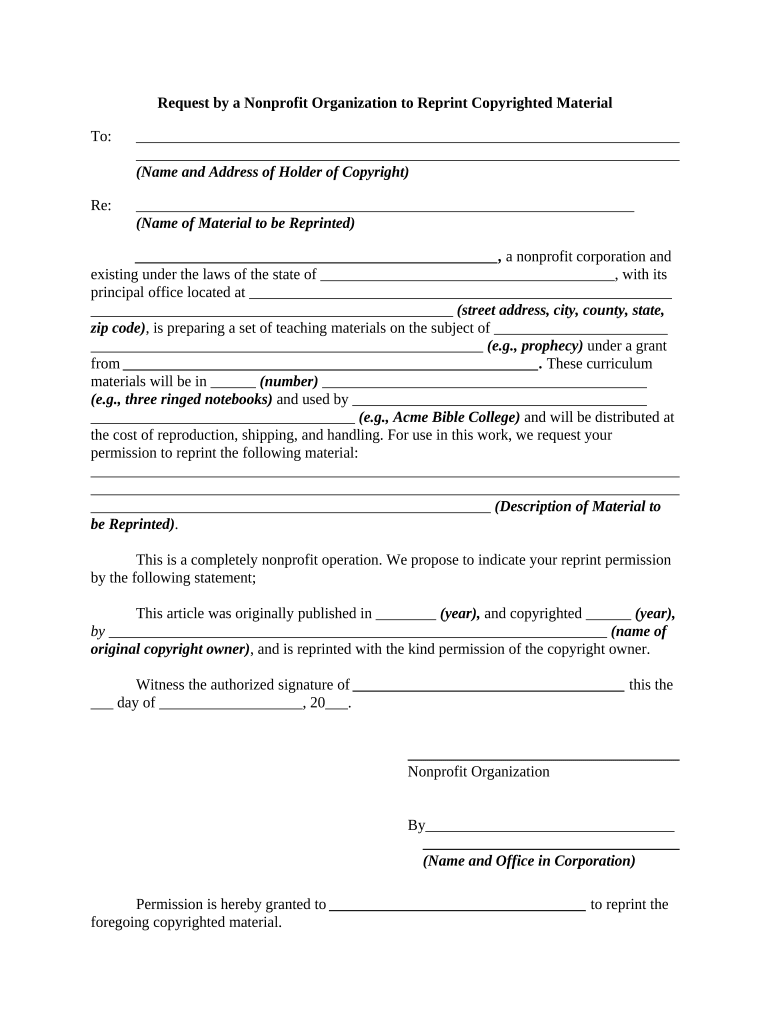

Request Nonprofit Form

What is the Request Nonprofit

The request nonprofit is a specific application form used by organizations seeking nonprofit status in the United States. This form provides essential information about the organization, including its purpose, structure, and operational plans. By submitting the request nonprofit application, organizations can apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code, which allows them to receive donations that are tax-deductible for the donor.

How to Use the Request Nonprofit

To effectively use the request nonprofit form, organizations should first gather all necessary documentation and information. This includes details about the organization’s mission, governance structure, and financial projections. Once the form is completed, it should be submitted to the appropriate state or federal agency, depending on the specific requirements for nonprofit registration in the organization’s location. Utilizing digital tools can streamline this process, ensuring that the form is filled out accurately and submitted in a timely manner.

Steps to Complete the Request Nonprofit

Completing the request nonprofit form involves several key steps:

- Gather necessary information, including the organization’s mission statement and bylaws.

- Complete the application form with accurate and detailed information.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on the requirements of the relevant agency.

- Keep a copy of the submitted form for your records.

Legal Use of the Request Nonprofit

The request nonprofit form must be completed in compliance with federal and state regulations to be considered legally binding. This includes adhering to the requirements set forth by the IRS and ensuring that the organization’s activities align with nonprofit guidelines. Proper use of the form can facilitate the approval process and help the organization maintain its tax-exempt status.

Eligibility Criteria

To qualify for submitting the request nonprofit application, organizations must meet specific eligibility criteria. These typically include having a clearly defined charitable purpose, operating primarily for public benefit, and not engaging in political campaigning or substantial lobbying. Understanding these criteria is crucial for organizations to ensure their eligibility before applying.

Required Documents

When completing the request nonprofit form, several documents are typically required to support the application. These may include:

- Articles of incorporation or organization.

- Bylaws that govern the organization.

- A detailed budget and financial projections.

- Information about the organization’s board members and their roles.

Form Submission Methods

The request nonprofit form can be submitted through various methods, depending on the agency’s guidelines. Common submission methods include:

- Online submission through the agency’s official website.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at designated agency locations.

Quick guide on how to complete request nonprofit

Effortlessly prepare Request Nonprofit on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Request Nonprofit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Request Nonprofit with ease

- Obtain Request Nonprofit and then click Get Form to start.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow caters to your document management needs with just a few clicks from your chosen device. Edit and eSign Request Nonprofit and ensure outstanding communication at any stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to request nonprofit pricing for airSlate SignNow?

To request nonprofit pricing for airSlate SignNow, simply visit our website and fill out the nonprofit request form. Our dedicated team will review your application and respond promptly with tailored pricing options that fit your organization's needs. This ensures that nonprofits can access our powerful eSigning solutions at an affordable rate.

-

What features does airSlate SignNow offer for nonprofit organizations?

AirSlate SignNow offers a wide range of features specifically beneficial for nonprofit organizations, including document eSigning, template creation, and integration with popular platforms. Nonprofits can streamline their processes with features like custom workflows and automated reminders, making it easier to manage documents and signatures efficiently.

-

Are there any specific benefits for nonprofits using airSlate SignNow?

Yes, nonprofits can enjoy numerous benefits when they choose to request nonprofit solutions with airSlate SignNow. These include cost savings through discounted pricing, improved efficiency in managing documents, and the ability to securely connect with supporters. Our platform helps streamline fundraising efforts and enhances donor engagement.

-

Can airSlate SignNow integrate with other tools commonly used by nonprofits?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of popular tools that nonprofits often use, such as CRM systems and project management software. By allowing for easy integration, nonprofits can enhance their existing workflows and ensure better collaboration across teams.

-

How does airSlate SignNow ensure the security of documents for nonprofits?

AirSlate SignNow prioritizes the security of all documents, including those of nonprofit organizations. We implement advanced encryption, secure data storage practices, and comprehensive compliance with legal regulations. Nonprofits can trust that their sensitive information remains protected while using our platform.

-

Is training available for nonprofits new to airSlate SignNow?

Yes, airSlate SignNow offers training resources for nonprofits that are new to our platform. We provide a range of tutorials, webinars, and customer support to ensure that your team can effectively use our eSigning solutions. This support helps organizations maximize the benefits of their investment.

-

What types of documents can nonprofits send for eSigning through airSlate SignNow?

Nonprofits can send a wide variety of documents for eSigning through airSlate SignNow, including donation agreements, vendor contracts, and volunteer applications. Our platform is versatile enough to accommodate the diverse administrative needs of nonprofit organizations, making document management more manageable.

Get more for Request Nonprofit

- Information update form

- Consent to provide employment information 1 29 15pdf

- Decod form

- Forms university of miami calder medical library

- Nsu college of pharmacy cpt application form

- Supplier of goods or services only to be completed by all firms or individuals proposing to do business with the university of form

- Middle t state university cheerleading college prep clinic form

- Ferpa request to withholdrelease directory information

Find out other Request Nonprofit

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple