Lien Real Property Form

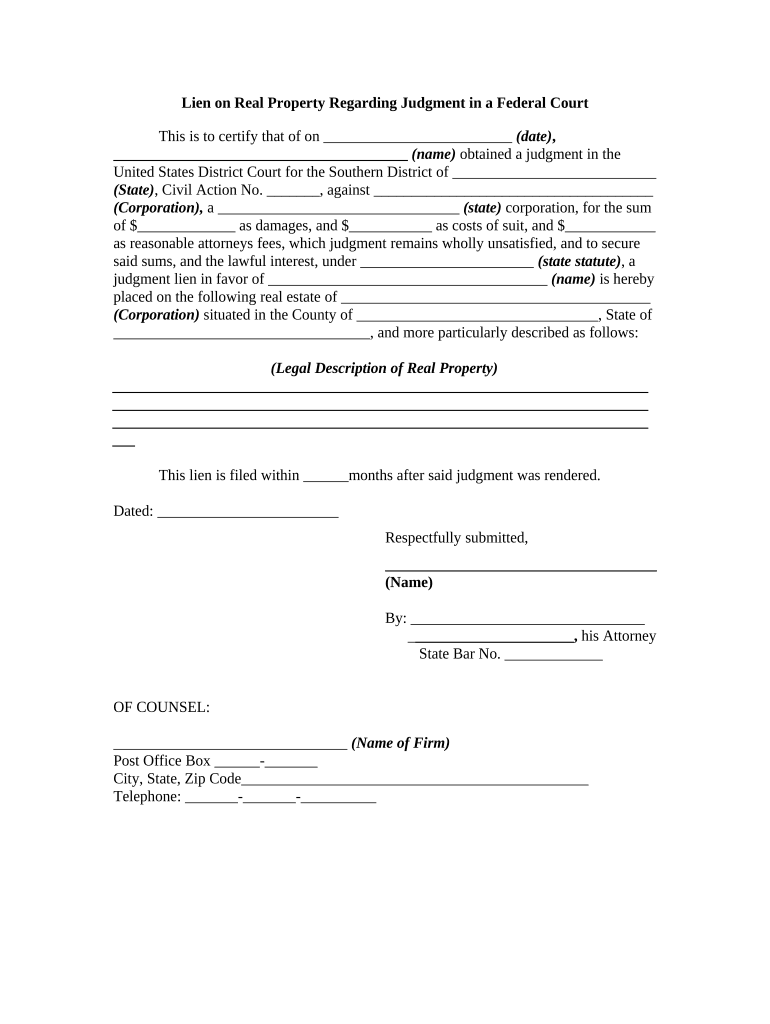

What is the lien real property?

A lien on real property is a legal claim against a property that ensures payment of a debt or obligation. This claim gives the lienholder the right to possess the property if the debt is not paid. Common examples include mortgage liens, tax liens, and mechanic's liens. Understanding the nature of these liens is crucial for property owners, as they can affect the ability to sell or refinance the property. In the United States, liens can arise from various situations, including unpaid taxes or services rendered on the property.

How to use the lien real property

Using a lien on real property involves several steps. First, the lienholder must file the appropriate documentation with the local government or court. This documentation typically includes details about the debt, the property in question, and the parties involved. Once filed, the lien becomes a matter of public record. Property owners should be aware of any existing liens before purchasing property, as these can impact ownership rights. Additionally, lienholders must follow specific legal procedures to enforce their claims, often requiring court involvement.

Key elements of the lien real property

Several key elements define a lien on real property. These include:

- Legal basis: The lien must be based on a legal obligation, such as a loan agreement or a service contract.

- Property description: The lien must clearly identify the property it pertains to, including its legal description.

- Amount owed: The lien must specify the amount of debt or obligation that is secured by the lien.

- Filing requirements: The lien must be filed with the appropriate governmental authority to be enforceable.

These elements ensure that the lien is valid and enforceable under U.S. law, protecting the rights of both the lienholder and the property owner.

Steps to complete the lien real property

Completing a lien on real property involves a series of steps that must be followed to ensure legality and enforceability:

- Determine the type of lien needed based on the situation, such as a tax lien or a mechanic's lien.

- Gather all necessary documentation, including contracts, invoices, and any other supporting materials.

- File the lien with the appropriate local or state authority, ensuring all required forms are completed accurately.

- Notify the property owner of the lien, as required by law, to ensure they are aware of the claim against their property.

- Monitor the lien status and be prepared to take further legal action if the debt remains unpaid.

Following these steps can help ensure that the lien is properly executed and enforceable in court.

Legal use of the lien real property

The legal use of a lien on real property is governed by state and federal laws. Liens must be filed according to specific legal requirements, which can vary by jurisdiction. It is important for lienholders to understand these laws to avoid potential disputes. For instance, some states have strict timelines for filing liens after a debt is incurred, while others may require specific forms or notices to be provided to the property owner. Compliance with these legal standards is essential to maintain the validity of the lien.

Who can put a lien on real property?

Various parties can place a lien on real property, including:

- Creditors: Individuals or businesses owed money for services rendered or goods provided.

- Government agencies: Entities that impose liens for unpaid taxes or assessments.

- Contractors and subcontractors: Professionals who have not been paid for work performed on the property.

- Judgment creditors: Parties who have obtained a court judgment against the property owner for unpaid debts.

Understanding who can place a lien is crucial for property owners to manage potential claims against their assets.

Quick guide on how to complete lien real property

Manage Lien Real Property effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Access Lien Real Property on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Lien Real Property with ease

- Find Lien Real Property and click Obtain Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal significance as a standard wet ink signature.

- Review all the information and click the Finish button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Edit and eSign Lien Real Property and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien real property?

A lien real property is a legal claim against a property that secures a loan or obligation. It gives creditors rights to the property until the debt is paid off. Understanding this concept is crucial for anyone handling documents related to real estate transactions.

-

How can airSlate SignNow help with lien real property documents?

airSlate SignNow streamlines the process of sending and eSigning lien real property documents. Our easy-to-use platform ensures that all parties involved can sign and manage their documents efficiently. This reduces paperwork and accelerates the completion of real estate transactions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that suit various business needs. Whether you're a small business or a large enterprise, our cost-effective solutions ensure you're well-equipped to manage lien real property documentation without breaking the bank.

-

What features does airSlate SignNow offer for lien real property transactions?

Our platform provides features tailored for lien real property transactions, including customizable templates, in-app notifications, and document tracking. This enhances collaboration among parties and ensures that important documents are signed promptly and securely.

-

Are there any integrations available with airSlate SignNow for lien real property management?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your lien real property management. You can connect with CRM systems, cloud storage, and other essential tools to streamline your workflow and keep everything organized.

-

What benefits does airSlate SignNow offer for businesses dealing with lien real property?

Using airSlate SignNow for lien real property transactions offers several benefits, including improved efficiency, reduced turnaround times, and enhanced security for sensitive documents. Our platform helps businesses focus on growth while we handle the paperwork.

-

How secure is airSlate SignNow for lien real property documentation?

airSlate SignNow prioritizes security for all lien real property documentation. We implement advanced encryption methods and comply with industry standards to ensure that your documents are protected, giving you peace of mind during your transactions.

Get more for Lien Real Property

Find out other Lien Real Property

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed