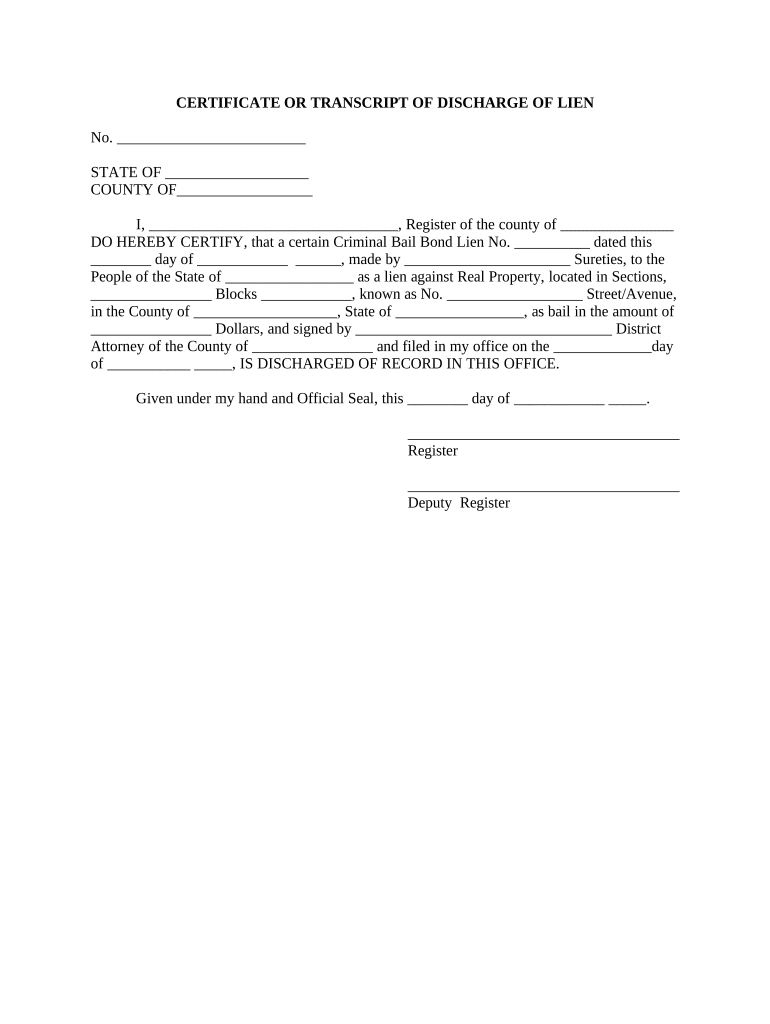

Bond Lien Form

What is the Bond Lien

A bond lien is a legal claim against a property that secures the payment of a debt or obligation. This type of lien is often used in real estate transactions to ensure that a contractor or supplier is paid for work performed or materials supplied. When a bond lien is filed, it creates a public record that can affect the property owner's ability to sell or refinance the property. Understanding the nature of a bond lien is crucial for property owners, contractors, and suppliers alike.

How to Use the Bond Lien

Using a bond lien involves several steps to ensure it is legally enforceable. First, the claimant must determine the amount owed and gather any supporting documentation, such as contracts or invoices. Next, the bond lien must be properly filed with the appropriate local government office, typically the county clerk or recorder's office. This filing creates a public record of the claim. Once filed, the claimant may need to notify the property owner and any other interested parties, which may include lenders or other lienholders.

Steps to Complete the Bond Lien

Completing a bond lien involves a systematic approach:

- Gather necessary documentation, including contracts and payment records.

- Determine the correct jurisdiction for filing the lien.

- Fill out the bond lien form accurately, ensuring all required information is included.

- File the completed form with the appropriate local office.

- Notify the property owner and any other relevant parties of the lien.

Legal Use of the Bond Lien

The legal use of a bond lien is governed by state laws, which can vary significantly. Typically, a bond lien is used to secure payment for services rendered or materials provided. It is essential for the claimant to adhere to state-specific regulations regarding the filing process, deadlines, and notification requirements. Failure to comply with these laws can result in the lien being deemed invalid.

Key Elements of the Bond Lien

Several key elements must be present for a bond lien to be valid:

- The amount owed must be clearly stated.

- The lien must identify the property against which the claim is made.

- The claimant's information, including name and contact details, must be included.

- The lien must be signed and dated by the claimant.

State-Specific Rules for the Bond Lien

Each state has its own rules and regulations governing bond liens. These rules may dictate the time frame for filing, the necessary documentation, and the process for notifying property owners. It is vital for claimants to familiarize themselves with their state's specific requirements to ensure compliance and protect their rights. Consulting with a legal professional can also provide valuable guidance.

Quick guide on how to complete bond lien

Complete Bond Lien effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Bond Lien on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to alter and eSign Bond Lien with ease

- Find Bond Lien and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Bond Lien and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a bond lien and how does it work?

A bond lien is a legal claim placed on an asset to secure the payment of a bond obligation. When a bond is issued, the bond lien serves to protect the interests of bondholders, ensuring that they can recover their investment if the issuer defaults. Understanding how bond liens work is crucial for businesses considering using them in financial agreements.

-

How can airSlate SignNow help with bond lien documentation?

airSlate SignNow simplifies the process of creating, sending, and eSigning bond lien documents. With our user-friendly platform, you can quickly generate templates that adhere to legal standards, ensuring compliance and efficiency. This not only saves time but also reduces the risk of errors in your bond lien paperwork.

-

What are the costs associated with using airSlate SignNow for bond lien transactions?

airSlate SignNow offers a cost-effective solution for managing bond lien transactions without sacrificing quality. Our pricing plans cater to businesses of all sizes, ensuring you only pay for the features you need. By using our platform, you can decrease operational costs associated with traditional document handling methods.

-

Can multiple parties sign a bond lien through airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to eSign a bond lien document simultaneously. This feature enhances collaboration and speeds up the signing process, making it easier to finalize agreements. With our secure eSigning technology, you can ensure that all parties are engaged in a seamless flow.

-

What integrations does airSlate SignNow offer for managing bond lien processes?

airSlate SignNow seamlessly integrates with various platforms such as CRM systems, cloud storage solutions, and productivity tools. This allows users to streamline their bond lien processes by automating workflows and ensuring that all related documents are easily accessible. Integrating with your existing tools enhances user experience and efficiency.

-

Is airSlate SignNow compliant with regulations regarding bond lien documents?

Absolutely! airSlate SignNow is designed to meet stringent compliance standards for bond lien documentation. Our platform applies advanced security measures and adheres to electronic signature laws, giving you confidence that your bond lien agreements are legitimate and enforceable.

-

What benefits does using airSlate SignNow provide for bond lien processing?

Using airSlate SignNow for bond lien processing provides numerous benefits, including improved efficiency, reduced paper usage, and enhanced document security. Our platform ensures quick turnaround times and can help you manage large volumes of bond lien documents effortlessly. This leads to higher productivity and better resource management for your business.

Get more for Bond Lien

- 9113 1 404 in the district court of kansas judicial council kansasjudicialcouncil form

- In the district court of county kansas kansas judicial council kansasjudicialcouncil 6969396 form

- 5113 1 400 in the district court of county kansas in kansasjudicialcouncil form

- Kansas guardianship program forms for annual accounting and conservator reports

- Rules beginning number page ingov kansasjudicialcouncil form

- Kansas answer form

- Adopted 710 kansas judicial council kansasjudicialcouncil form

- Je of adjudication and sentencing kansas judicial council kansasjudicialcouncil form

Find out other Bond Lien

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free