Bookkeeper Client Consent Form

What is the Bookkeeper Client Consent Form

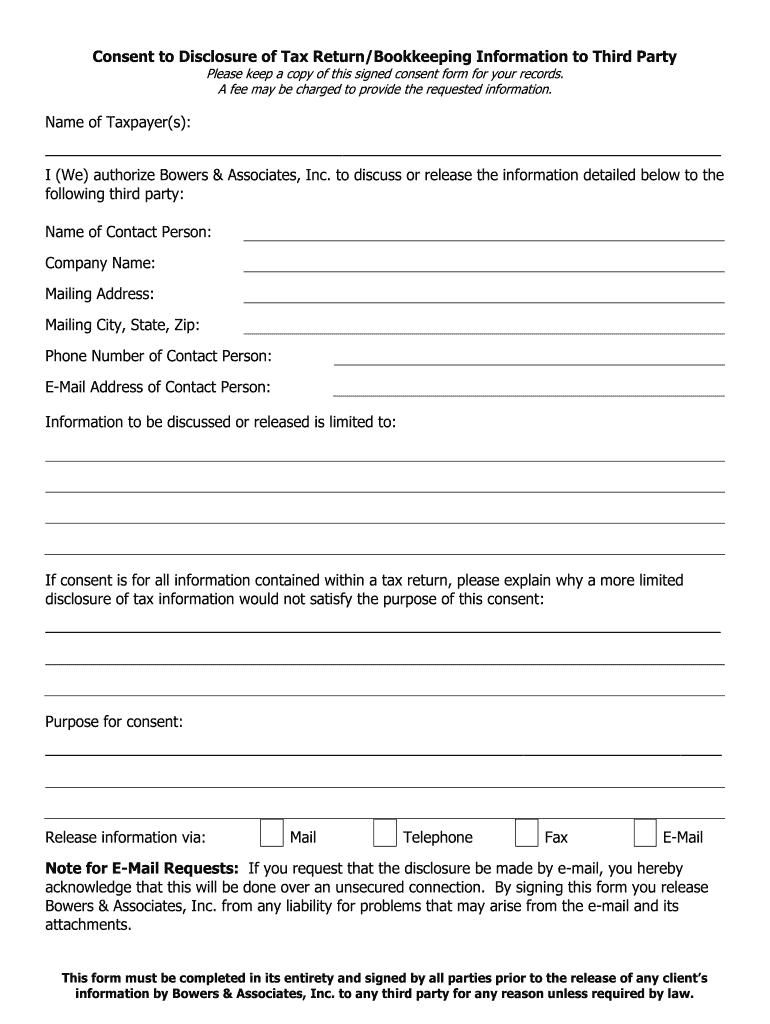

The Bookkeeper Client Consent Form is a crucial document that allows clients to authorize their bookkeepers to access and manage their financial information. This form ensures that sensitive data, such as tax records and personal financial details, can be shared with third parties, such as accountants or auditors, while maintaining compliance with privacy regulations. By signing this form, clients provide explicit consent for their information to be disclosed, which is essential for effective bookkeeping and financial management.

How to use the Bookkeeper Client Consent Form

Using the Bookkeeper Client Consent Form involves several straightforward steps. First, the client must complete the form by providing their personal information, including their name, address, and contact details. Next, they should specify the type of information that can be shared and identify the third parties who will receive access. Once the form is filled out, the client needs to sign it, either electronically or in print. This signed document can then be securely stored and shared with the designated third parties to facilitate the necessary financial transactions.

Steps to complete the Bookkeeper Client Consent Form

Completing the Bookkeeper Client Consent Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including full name, address, and contact information.

- Identify the specific information that the client wishes to authorize for release.

- List the names of the third parties who will receive the information.

- Review the form for accuracy and completeness.

- Sign and date the form, ensuring it complies with any relevant eSignature laws.

Key elements of the Bookkeeper Client Consent Form

The Bookkeeper Client Consent Form contains several key elements that ensure its effectiveness and legal validity. These elements include:

- Client Information: The form must clearly state the client's name and contact details.

- Authorized Information: A detailed description of the information being authorized for release.

- Third Party Identification: Names and contact information of the individuals or entities authorized to receive the information.

- Client Signature: The client's signature, which confirms their consent.

- Date of Authorization: The date on which the consent was given, which is important for record-keeping.

Legal use of the Bookkeeper Client Consent Form

The legal use of the Bookkeeper Client Consent Form is governed by various privacy laws and regulations, such as the Gramm-Leach-Bliley Act and the Health Insurance Portability and Accountability Act (HIPAA) when applicable. These laws require that clients provide explicit consent before their financial information can be shared. It is essential for bookkeepers to ensure that the form is completed accurately and stored securely to protect client confidentiality and comply with legal standards.

Disclosure Requirements

Disclosure requirements for the Bookkeeper Client Consent Form dictate that clients must be informed about the nature and extent of the information being shared. This includes clarifying the purpose of the disclosure, the identity of the third parties involved, and any potential risks associated with sharing their information. Ensuring that clients fully understand these aspects is vital for maintaining trust and compliance with applicable privacy laws.

Quick guide on how to complete consent to release tax returnbookkeeping information to third party zero2done

Discover how to effortlessly navigate the Bookkeeper Client Consent Form completion with these simple instructions

Submitting and filling out forms digitally is gaining traction and has become the preferred choice for numerous clients. It offers several advantages over traditional printed documents, including convenience, time savings, enhanced precision, and greater security.

With solutions like airSlate SignNow, you can access, edit, sign, enhance, and send your Bookkeeper Client Consent Form without getting bogged down in endless printing and scanning. Follow this brief guide to begin and finalize your paperwork.

Utilize these steps to retrieve and complete Bookkeeper Client Consent Form

- Begin by clicking the Get Form button to launch your document in our editor.

- Pay attention to the green label on the left that indicates mandatory fields to ensure you don’t miss any.

- Make use of our advanced features to annotate, edit, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable form using the appropriate tab options.

- Review the document and look for errors or inconsistencies.

- Click on DONE to complete your edits.

- Rename your document or keep it as is.

- Select the storage service you prefer for your document, send it via USPS, or click the Download Now button to save your file.

If Bookkeeper Client Consent Form is not what you were seeking, you can explore our comprehensive collection of pre-existing forms that you can fill out with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

If I am jointly filing tax returns can I release my returns to a third party without the other party’s consent?

That question is better answered by an attorney than a tax specialist. I am not an attorney, and cannot offer legal advice, but I have done taxes and worked with attorneys in the US, I suspect the answer might look like this:1. Regardless, it is generally best to acquire permission from the other party if at all possible.2. You are in control of whatever documents you possess. You (therefore) could (physically) copy the documents and hand them to another party. However, it MIGHT be illegal and/or unethical for you to do so, that requires the insights of an attorney familiar with your jurisdiction (generally state-by-state in the US) and the reason your reluctant/unable to seek permission (divorce agreements may stipulate regarding this). If you share the documents without first getting an attorney’s advice, you risk being sued for damages, and possibly even worse if that action is illegal.3. Most organizations requiring tax returns, would like to have the IRS verify the reported information (if you are in the US, they would probably want you to file https://www.irs.gov/pub/irs-pdf/... )4. If the other person on the tax return does not ALSO submit the form, I am pretty certain the IRS will not release the information.So, IMO, this question is best answered by an attorney. If you mention where you are, and ask it as a legal question, you might find a helpful answer. If it’s due to divorce, you might even check the divorce agreement and decree to see if there is a provision regarding income taxes. Any other separation overseen by a court may likewise list it. It is possible insightful attorneys may have spelled it out at the time of the agreement. Good luck.

-

When I file my taxes electronically is my tax return information sold to third parties?

The actual information in your return cannot be sold to third parties. Some online processors may be able to sell your email address, but if they sold any identifiable information from your return, they would be subject to serious penalties from the IRS. Even employees of the IRS cannot access your individual return unless they have authorization to do so in the normal course of performing their job at the service.Confidentiality is something they take VERY serious at the IRS.

-

How do I signNow out to small businesses in order to help them with tax returns/bookkeeping?

Most small businesses are notoriously bad at bookkeeping, and desparately need your services. But, they’re experts in their trade, not experts in running abusiness, so most do not realise the severity of the problem, or what could be gained with better bookkeeping practises. Many use a familiy member or friend to help, and mistakes are made that are difficult to untangle, often long-running.Chartered Accountants are used to this, and seldom seem to do much about it (other than bill their clients more, to cover the hassle of dealing with poor organisation).The way a bookkeeper can motivate small businesses, is to sell the benefits, not the features. Consider this, how most bookkeepers sell their services - expressed as features:Look what I can do for you!Tax returnsVAT / BAS (quarterly sales tax) returnsClient invoicingAccounting administrationPay billsSure, it’s the stuff most businesses need. But most small business owners eyes glaze over - it’s boring, complicated, they don’t understand it, they often don’t want to understand it. They wish it’d go away. To make matters worse, they know it’s a mess, and as soon as someone starts digging, they are going to be asked questions they do not know the answer to.Consider an alternative, expressed as benefits:Look what I can do for you!Maximise taxable deductions: pay less taxReduce stress and save money by ensuring no late notices or penalty interest from Tax OfficeMaximise money in your bank account by chasing people who owe you money, and paying bills at the last responsible momentReduce stress by ensuring administration tasks like business registration, insurance, duties, reports, and fees are submitted on timeReduce stress: Provide monthly reports to advise on the overall health of your business. (Am I making money? How much better was December this year, than December last year? How much did I spend on xyz last quarter, compare to this quarter? Is the business profitable? How much could I sell my business for? What’s my equity? How much do I owe?)Know if you have enough money to pay bills and salary this month, or to buy new stock or new plant-and-equipment (cashflow prediction)Make it quick and easy to apply for a business loan (up to date Profit and Loss, Balance sheet and cashflow always available).Sleep well at night knowing, not guessing or hopingNo risk: All data backed up securely, and accessible from anywhere.Comfort and reduce costs: I’ll make an end-of-month process that meets all government requirements, and will reduce costs at your CPA at end of year.Everything I do is open and transparent, you have access to all data. I am certified by xyz. I’ll provide top-level and detailed reports for you to ask questions about, and provide advice on accounting.The idea, of course, is to push their buttons: they are scared, uncomfortable, don’t sleep well at night, stressed, and worried.I also think it’s important to communicate when you’re courting a new Client, that you separate out fixing the current mess, and ongoing work. They are different tasks, skills and costs.There’s a huge market for this - almost every small business owner I meet (professionally, and in my day to day life) has these problems, and are willing to pay to fix it, if approached the right way. Most of them have unrealistic expectations (ie, just start doing stuff right and it’ll be all good!), but you’ll need to explain the importance of fixing the backlog first.

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

-

How do I file tax returns in the USA? How much do I need to pay to the third party to file it on my behalf?

To file income taxes:You could use do-it-yourself (DIY) software like TurboTax.You could go to a tax shop like H&R Block, Liberty Tax, or Jackson Hewitt.You could use an EA or Enrolled Agent with the IRS.Or, you could use a CPA or Certified Public Accountant.The best at income tax preparation, I believe, are CPA’s. The tax shops hire people for $10 an hour to do your taxes. Enrolled Agent exams are easier than the CPA exams. Even though it’s the cheapest, the DIY software misses stuff, and you have to invest a lot of your personal time into it. As far as pricing goes for Tax Shops, EA’s, and CPA’s, they vary greatly, but it can range from $100 for a simple individual return to $1,500 for a corporate return.Hope this helps!Brian

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the consent to release tax returnbookkeeping information to third party zero2done

How to create an eSignature for your Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done online

How to generate an eSignature for your Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done in Google Chrome

How to make an eSignature for signing the Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done in Gmail

How to create an electronic signature for the Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done right from your smart phone

How to make an electronic signature for the Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done on iOS

How to make an eSignature for the Consent To Release Tax Returnbookkeeping Information To Third Party Zero2done on Android devices

People also ask

-

What is a Bookkeeper Client Consent Form?

A Bookkeeper Client Consent Form is a legal document that grants permission from a client to a bookkeeper to manage their financial records. This form is essential for establishing trust and outlining the scope of services provided, ensuring both parties are clear about their responsibilities.

-

How can I create a Bookkeeper Client Consent Form using airSlate SignNow?

Creating a Bookkeeper Client Consent Form with airSlate SignNow is simple. You can use our intuitive document builder to customize your form, add necessary fields for signatures, and include any specific terms that are relevant to your bookkeeping services.

-

Is there a cost associated with using the Bookkeeper Client Consent Form in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. While creating a Bookkeeper Client Consent Form is included in our plans, additional features or higher usage levels may require an upgraded subscription.

-

What features does airSlate SignNow offer for the Bookkeeper Client Consent Form?

airSlate SignNow provides features like customizable templates, electronic signature capabilities, and secure storage for your Bookkeeper Client Consent Form. Additionally, you can track document status and send reminders to clients to ensure timely responses.

-

Can I integrate airSlate SignNow with other tools for managing my Bookkeeper Client Consent Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including accounting software and CRM systems. This integration allows you to streamline the process of managing your Bookkeeper Client Consent Form alongside other business operations.

-

How does airSlate SignNow ensure the security of my Bookkeeper Client Consent Form?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Bookkeeper Client Consent Form and any sensitive client information it contains, ensuring compliance with industry standards.

-

What are the benefits of using airSlate SignNow for a Bookkeeper Client Consent Form?

Using airSlate SignNow for your Bookkeeper Client Consent Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced client communication. Our platform simplifies the signing process, making it quick and easy for clients to provide their consent.

Get more for Bookkeeper Client Consent Form

- Petition for partition of community property with list of commercial property louisiana form

- Property partition form

- Louisiana motion compel form

- Motion to compel answers to interrogatories and plaintiffs request for production louisiana form

- Compilation of child support and alimony pendente lite due louisiana form

- Non marital cohabitation living together agreement louisiana form

- Motion and order to dismiss by defendant louisiana form

- Louisiana concursus 497308702 form

Find out other Bookkeeper Client Consent Form

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form