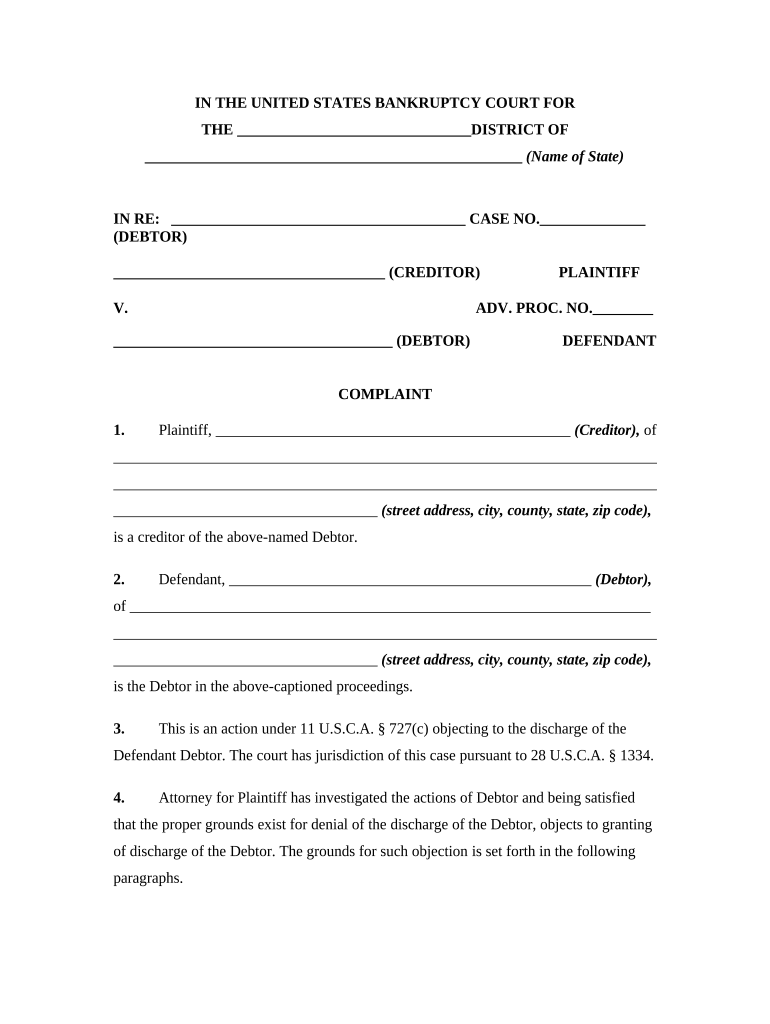

Discharge Bankruptcy Assets Form

What is the Discharge Bankruptcy Assets

The discharge bankruptcy assets refer to the property and financial interests that a debtor can eliminate from their bankruptcy obligations. When a bankruptcy case concludes, the court issues a discharge order that releases the debtor from personal liability for certain debts. This means that creditors can no longer pursue collection actions against the debtor for those discharged debts. Understanding what constitutes discharge bankruptcy assets is crucial for individuals navigating bankruptcy, as it affects their financial recovery and future creditworthiness.

Steps to Complete the Discharge Bankruptcy Assets

Completing the discharge bankruptcy assets process involves several key steps. First, the debtor must gather all relevant financial documents, including income statements, tax returns, and a list of assets and liabilities. Next, the debtor files a bankruptcy petition with the court, detailing their financial situation. Following this, a meeting of creditors is scheduled, where the debtor answers questions about their financial status. After the meeting, the court reviews the case and issues a discharge order if all requirements are met. It is essential to follow these steps carefully to ensure a smooth discharge process.

Legal Use of the Discharge Bankruptcy Assets

The legal use of discharge bankruptcy assets is governed by federal and state bankruptcy laws. Once a discharge is granted, the debtor is legally protected from any further claims related to the discharged debts. This protection allows individuals to rebuild their financial lives without the burden of previous obligations. However, it is important to note that certain types of debts, such as student loans and tax obligations, may not be eligible for discharge. Understanding these legal parameters helps debtors make informed decisions during the bankruptcy process.

Required Documents

To successfully navigate the discharge bankruptcy assets process, specific documents are required. These typically include:

- Bankruptcy petition

- Schedules of assets and liabilities

- Income and expense statements

- Tax returns for the previous two years

- Proof of credit counseling

Having these documents prepared and organized is essential for a smooth filing and discharge process.

Eligibility Criteria

Eligibility for discharging bankruptcy assets depends on various factors, including the type of bankruptcy filed. For example, in a Chapter Seven bankruptcy, individuals must pass a means test to qualify, which assesses their income against the median income for their state. Additionally, individuals must not have received a discharge in a previous bankruptcy case within a certain time frame. Understanding these criteria is vital for determining whether one can successfully discharge their debts.

Filing Deadlines / Important Dates

Filing deadlines and important dates play a critical role in the discharge bankruptcy assets process. Debtors must file their bankruptcy petition within specific time limits to ensure eligibility for discharge. Generally, the timeline includes:

- Filing the bankruptcy petition and schedules

- Meeting of creditors, typically held within 20 to 40 days after filing

- Deadline for creditors to file objections, usually 60 days after the meeting

Missing these deadlines can jeopardize the discharge process, making it essential to stay organized and informed.

Quick guide on how to complete discharge bankruptcy assets

Complete Discharge Bankruptcy Assets effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Discharge Bankruptcy Assets on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The most efficient way to edit and eSign Discharge Bankruptcy Assets without hassle

- Obtain Discharge Bankruptcy Assets and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a standard ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Discharge Bankruptcy Assets to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is objecting discharge and how is it handled in airSlate SignNow?

Objecting discharge refers to the process of contesting a legal discharge or liability associated with documents. With airSlate SignNow, users can easily track and manage documents related to objecting discharge, ensuring that all parties have clear visibility of agreements and disputes. Our platform simplifies the workflow, making it easier to gather necessary signatures and feedback.

-

How does airSlate SignNow enhance the objecting discharge process?

AirSlate SignNow streamlines the objecting discharge process by providing a user-friendly interface for document preparation and signing. Users can create, send, and sign documents electronically, reducing delays and improving efficiency. Our software also supports advanced features like document versioning to keep all parties updated on changes.

-

What pricing options are available for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to cater to various business needs, including feature-rich options specifically designed for managing objecting discharge documentation. All plans come with a free trial period, allowing potential customers to explore our services without any commitment. Check our website for detailed pricing information based on your usage requirements.

-

Can airSlate SignNow integrate with other tools for managing objecting discharge?

Yes, airSlate SignNow seamlessly integrates with various productivity tools and platforms, making it easier to handle objecting discharge processes within your existing workflows. Integrations include popular services such as Google Drive, Salesforce, and more. This compatibility enhances collaboration and efficiency for teams working on legal documents.

-

What are the main benefits of using airSlate SignNow for objecting discharge?

The primary benefit of using airSlate SignNow for objecting discharge is the signNow time savings associated with eSigning and document management. Our solution ensures compliance and accuracy in the legal processes, reducing the risk of errors. Additionally, the ability to track document status in real-time empowers teams to respond quickly to any objections.

-

Is airSlate SignNow secure for handling sensitive objecting discharge documents?

Absolutely! AirSlate SignNow prioritizes security and compliance, implementing industry-standard encryption and authentication processes to protect your sensitive objecting discharge documents. Our platform is compliant with regulations like GDPR and HIPAA, giving users peace of mind when managing their legal paperwork.

-

How does airSlate SignNow support collaboration on objecting discharge documents?

AirSlate SignNow supports collaboration by allowing multiple users to access and make comments on objecting discharge documents in real time. Users can collect feedback and signatures from stakeholders quickly, facilitating a smoother resolution process. This collaboration feature ensures that all relevant parties are included, which is crucial for effective objecting discharge management.

Get more for Discharge Bankruptcy Assets

Find out other Discharge Bankruptcy Assets

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed