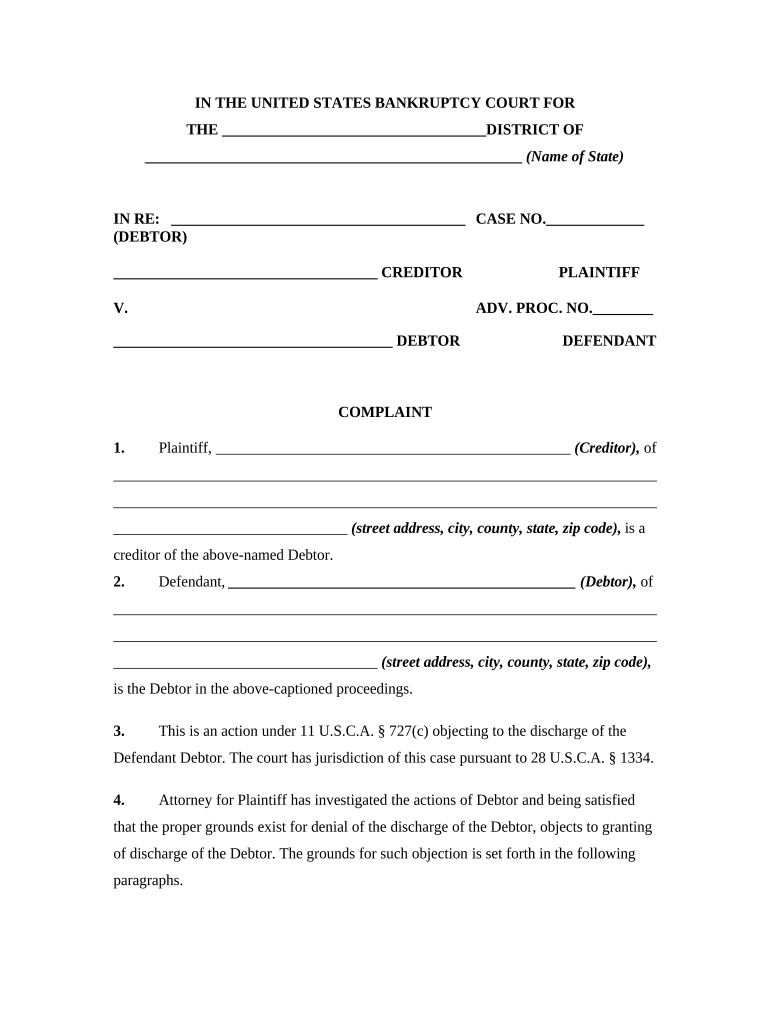

Discharge Bankruptcy Form

What is the Discharge Bankruptcy

The discharge bankruptcy is a legal process that releases a debtor from personal liability for certain types of debts. This means that the debtor is no longer legally required to pay these debts, allowing for a fresh financial start. Discharge is a crucial component of bankruptcy proceedings, particularly under Chapter seven and Chapter thirteen of the Bankruptcy Code. It is important to understand that not all debts can be discharged; certain obligations, such as student loans and child support, typically remain payable even after bankruptcy.

Steps to complete the Discharge Bankruptcy

Completing the discharge bankruptcy involves several key steps that ensure compliance with legal requirements. Initially, the debtor must file a bankruptcy petition with the appropriate court. This petition includes detailed information about the debtor's financial situation, including assets, liabilities, income, and expenses. Following the petition, the debtor must attend a meeting of creditors, where they answer questions regarding their financial affairs. After this meeting, the court will review the case and, if all requirements are met, will issue a discharge order, relieving the debtor of specified debts.

Legal use of the Discharge Bankruptcy

The legal use of the discharge bankruptcy is vital for individuals seeking relief from overwhelming debt. It serves as a protective measure under federal law, allowing individuals to reset their financial obligations. However, it is crucial for debtors to understand the legal implications of the discharge. For example, attempting to conceal assets or engage in fraudulent transfers during bankruptcy proceedings can lead to severe penalties, including denial of discharge or criminal charges. Therefore, transparency and adherence to legal standards are essential throughout the process.

Eligibility Criteria

Eligibility for discharge bankruptcy depends on several factors, including the type of bankruptcy filed and the debtor's financial situation. For Chapter seven bankruptcy, individuals must pass a means test that evaluates their income against the median income in their state. In contrast, Chapter thirteen bankruptcy is available to individuals with a regular income who can propose a repayment plan to creditors. Additionally, debtors must not have received a discharge in a previous bankruptcy case within a specific timeframe, typically eight years for Chapter seven and two years for Chapter thirteen.

Required Documents

To successfully navigate the discharge bankruptcy process, debtors must gather and submit various required documents. These typically include a bankruptcy petition, schedules of assets and liabilities, a statement of financial affairs, and tax returns for the previous two years. Additionally, debtors may need to provide proof of income, bank statements, and documentation of any recent financial transactions. Ensuring that all required documents are accurate and complete is essential for a smooth discharge process.

Penalties for Non-Compliance

Non-compliance with bankruptcy laws can result in significant penalties, including the denial of discharge, fines, or even criminal charges for fraudulent behavior. If a debtor is found to have concealed assets or provided false information during the bankruptcy process, the court may dismiss the case altogether. It is crucial for individuals to fully understand their obligations and the consequences of non-compliance to avoid jeopardizing their financial future.

Quick guide on how to complete discharge bankruptcy

Complete Discharge Bankruptcy effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork swiftly without delays. Handle Discharge Bankruptcy on any device using airSlate SignNow's mobile applications for Android or iOS and streamline any document-related procedure today.

How to modify and eSign Discharge Bankruptcy with ease

- Obtain Discharge Bankruptcy and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Discharge Bankruptcy to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is concealment fraudulently in the context of document signing?

Concealment fraudulently refers to the deliberate hiding of information during the signing of documents which can lead to legal issues. With airSlate SignNow, you can ensure transparency in the signing process, minimizing the risks associated with concealment fraudulently.

-

How can airSlate SignNow help prevent concealment fraudulently?

airSlate SignNow provides features such as audit trails and document authentication to deter concealment fraudulently. By tracking every action taken on a document, businesses can maintain accountability and prevent unauthorized alterations or hidden information.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing tiers to suit different business sizes and needs, including plans that can accommodate concerns regarding concealment fraudulently. Each plan includes essential features aimed at streamlining document management and ensuring secure eSigning.

-

Are there integration options available with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various third-party applications like CRM systems and productivity tools, which can help mitigate risks related to concealment fraudulently. This integration ensures that all relevant data is synced, boosting both efficiency and compliance.

-

What features does airSlate SignNow offer to enhance document security?

airSlate SignNow boasts various security features, such as multi-factor authentication and encryption, to combat concealment fraudulently effectively. These measures protect sensitive information during document transfers, ensuring that all signatories verify their identities.

-

Can airSlate SignNow assist with legal compliance regarding concealment fraudulently?

Absolutely! airSlate SignNow is designed to help businesses stay compliant with legal standards, which is crucial in addressing concealment fraudulently. Our platform includes templates that align with regulatory requirements, reducing the likelihood of non-compliance.

-

How user-friendly is airSlate SignNow for new users concerned about concealment fraudulently?

airSlate SignNow is intuitive and user-friendly, catering to users regardless of their technical expertise. This ease of use is especially beneficial for those looking to understand avoidance strategies related to concealment fraudulently without a steep learning curve.

Get more for Discharge Bankruptcy

- Louisiana bar examination civil code iii february 2019 form

- Instructions for petition for order of form

- Question 1 40 points 476792712 form

- Federal jursidiction and procedure form

- Georgia department of human resources dfcs dhs georgia form

- Customer acknowledgement form

- 2709 mail service center ncdhhs form

- Link to notice 5000 1401 for sba form 912 sba form 1081

Find out other Discharge Bankruptcy

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple