Bankruptcy Which Have Form

What is the Bankruptcy Which Have

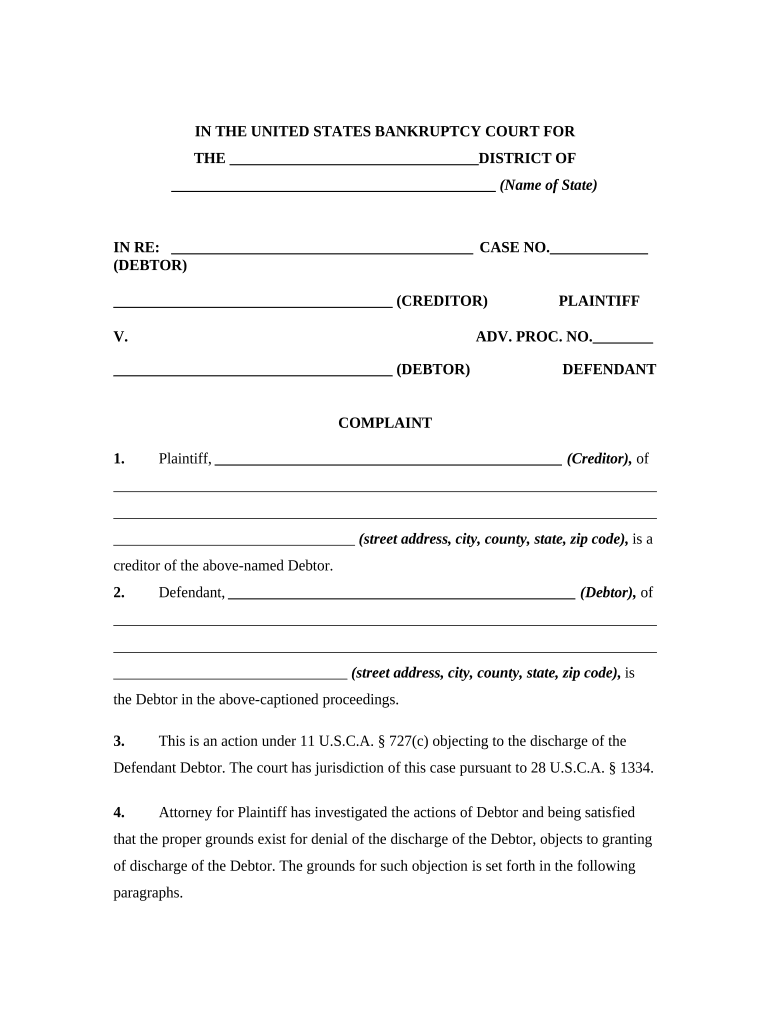

The Bankruptcy Which Have is a legal document that outlines a debtor's financial situation and the circumstances leading to their inability to pay debts. This form is crucial for individuals or businesses seeking relief under bankruptcy laws. It serves as a formal request to the court to discharge certain debts, allowing the debtor a fresh financial start. Understanding the specifics of this document is essential for anyone navigating the bankruptcy process, as it can significantly impact the outcome of their case.

Steps to complete the Bankruptcy Which Have

Completing the Bankruptcy Which Have involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary financial documents, including income statements, asset lists, and liabilities. Next, fill out the form accurately, providing detailed information about your financial situation. It is important to review the form for completeness and correctness before submission. Finally, submit the completed form to the appropriate court, either electronically or by mail, depending on local regulations.

Legal use of the Bankruptcy Which Have

The legal use of the Bankruptcy Which Have is governed by federal bankruptcy laws, which dictate how the form must be completed and submitted. To be legally binding, the form must include specific information about the debtor's financial status and be signed by the debtor. Compliance with the legal requirements ensures that the court recognizes the document and considers the debtor's request for discharge. Failure to adhere to these regulations can result in delays or dismissal of the bankruptcy case.

Required Documents

When filing the Bankruptcy Which Have, several supporting documents are required to provide a complete picture of the debtor's financial situation. These documents typically include:

- Proof of income, such as pay stubs or tax returns

- A list of all debts, including secured and unsecured obligations

- A detailed inventory of assets, including property and financial accounts

- Documentation of any recent financial transactions, such as large purchases or transfers

Having these documents ready can streamline the filing process and help avoid potential complications.

Filing Deadlines / Important Dates

Filing deadlines for the Bankruptcy Which Have are critical to ensure that the debtor's case proceeds without unnecessary delays. Typically, the form must be filed within a specific timeframe after the debtor decides to pursue bankruptcy. It is essential to be aware of local court deadlines, as they can vary by jurisdiction. Missing a deadline can lead to complications, including the dismissal of the case or the inability to discharge certain debts.

Examples of using the Bankruptcy Which Have

Understanding how the Bankruptcy Which Have is used can provide valuable insights for those considering bankruptcy. For instance, an individual facing overwhelming credit card debt may use this form to seek discharge of those debts, allowing for a fresh start. Similarly, a small business struggling to manage operational costs may file the form to protect its assets while reorganizing its financial obligations. Each case is unique, and the form’s application can vary based on individual circumstances.

Quick guide on how to complete bankruptcy which have

Effortlessly Prepare Bankruptcy Which Have on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents rapidly and without holdup. Manage Bankruptcy Which Have on any device with the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to Edit and eSign Bankruptcy Which Have with Ease

- Locate Bankruptcy Which Have and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Bankruptcy Which Have and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if my complaint have been ignored by customer support?

If your complaint have been ignored by customer support, we recommend following up through our support channels. You can signNow out via email or through our help center to escalate the issue. Ensuring you provide all relevant details can help expedite the resolution process.

-

How can I voice my complaint have been about the pricing?

If your complaint have been regarding our pricing, we encourage you to fill out our feedback form available on the pricing page. Your feedback is essential for us to improve our services, and our support team will review your concerns and get back to you shortly.

-

Can I submit a complaint have been related to a document error?

Absolutely! If your complaint have been related to an error in a document, please contact our support team immediately. Providing detailed information about the error will assist us in resolving it as quickly as possible.

-

What features can help prevent future complaints have been on document management?

To prevent future complaints have been on document management, airSlate SignNow offers features like automated workflows and templates. These tools help ensure that all documents are filled out correctly and reduce the likelihood of errors, providing a smoother experience.

-

How has airSlate SignNow addressed past complaints have been regarding usability?

We take all feedback seriously, and past complaints have been addressed by implementing a user-friendly interface and offering tutorials. Our goal is to ensure that our platform is intuitive and accessible to all users, enhancing their overall experience.

-

What integrations are available to help manage complaints have been effectively?

To manage complaints have been effectively, airSlate SignNow integrates with various CRM systems and project management tools. These integrations allow users to streamline their workflows and keep track of complaints within their existing systems.

-

Are there any benefits to using airSlate SignNow to manage complaints have been?

Yes, using airSlate SignNow to manage complaints have been offers signNow benefits, including enhanced tracking of communication and document management. This leads to quicker resolution times and a more organized approach to handling customer issues.

Get more for Bankruptcy Which Have

- Rebuilders title to regular title coloradogov colorado form

- Annual eeo submission forms montana department of mdt mt

- Write it right california bureau of automotive repair bar ca form

- I 918 supplement b expiration 2017 2019 form

- Alaska employer registration form 2017 2018

- Alberta commercial drivers abstract consent form

- Form 21 0960j 1

- 26 4555c veterans benefits administration form

Find out other Bankruptcy Which Have

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy