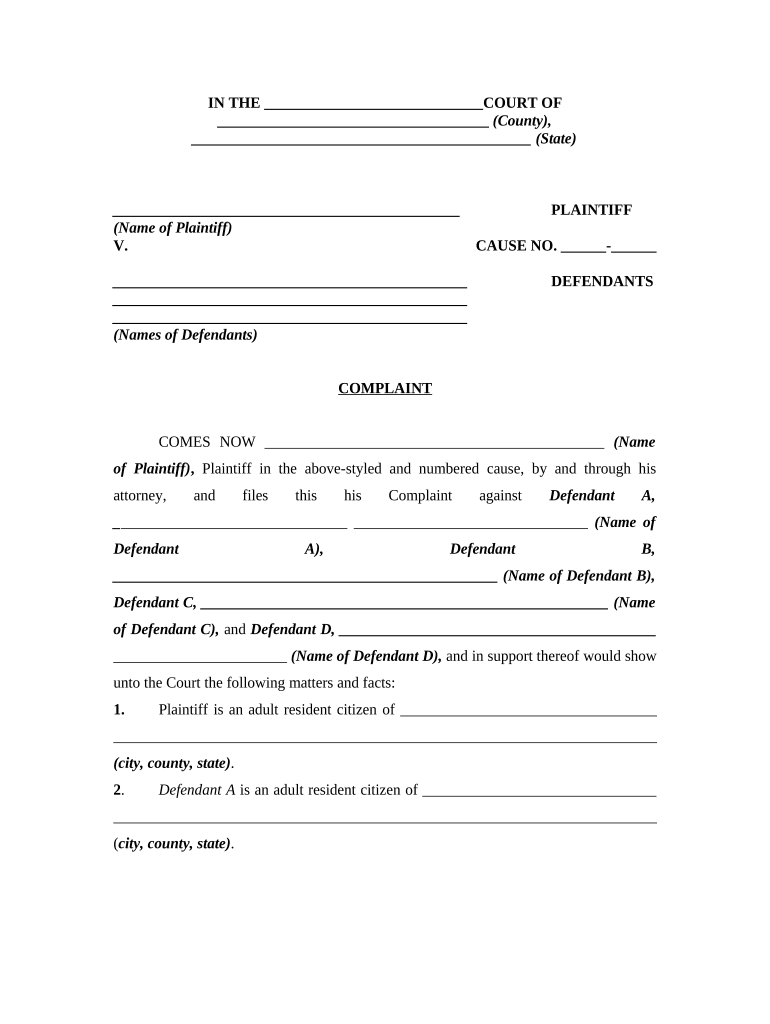

Personal Guarantors Form

Understanding Personal Guarantors

Personal guarantors are individuals who agree to take responsibility for the debt or obligations of another person or business. This arrangement is often used in various financial transactions, such as loans or leases, where the lender or landlord seeks additional security. By signing a promissory note, a personal guarantor provides a legal assurance that they will fulfill the obligations if the primary party defaults. This relationship is crucial in mitigating risks for lenders and landlords, ensuring that they have recourse in case of non-payment.

Steps to Complete the Personal Guarantors

Completing the personal guarantors section in a promissory note involves several key steps:

- Identify the parties involved: Clearly state the names and addresses of the borrower and the guarantor.

- Specify the obligations: Outline the specific debts or obligations that the guarantor is responsible for.

- Include terms of the agreement: Detail the terms under which the guarantor will be liable, including any conditions or limitations.

- Sign and date the document: Ensure that both the borrower and the guarantor sign the document, along with the date of signing.

Legal Use of Personal Guarantors

The legal use of personal guarantors is governed by state laws and regulations. It is essential for both parties to understand their rights and obligations under the agreement. A properly executed promissory note with a personal guarantor can be enforced in court if necessary. Compliance with relevant laws, such as the Uniform Commercial Code (UCC) and any state-specific regulations, is vital to ensure that the agreement is legally binding and enforceable.

Key Elements of Personal Guarantors

Several key elements must be present for a personal guarantor agreement to be valid:

- Clear identification: All parties involved must be clearly identified in the document.

- Specificity of obligations: The obligations guaranteed must be explicitly stated.

- Consideration: There must be a legal consideration, such as a loan or lease, that benefits the guarantor.

- Signature: The guarantor must sign the document to indicate their acceptance of the terms.

Examples of Using Personal Guarantors

Personal guarantors are commonly used in various scenarios, including:

- Business loans, where a business owner may require a personal guarantor to secure financing.

- Commercial leases, where landlords may ask for personal guarantees from business owners to ensure rent payment.

- Personal loans, where lenders may require a family member or friend to act as a guarantor for the borrower.

Eligibility Criteria for Personal Guarantors

To qualify as a personal guarantor, individuals typically need to meet certain criteria, including:

- Being of legal age, usually eighteen years or older.

- Having a good credit history to instill confidence in lenders or landlords.

- Demonstrating financial stability, which may involve providing income statements or asset documentation.

Quick guide on how to complete personal guarantors

Effortlessly prepare Personal Guarantors on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect sustainable alternative to traditional printed and signed papers, allowing you to obtain the needed form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without any delays. Manage Personal Guarantors on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-driven process today.

The easiest way to modify and eSign Personal Guarantors with ease

- Obtain Personal Guarantors and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes needing new printed copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Personal Guarantors and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a complaint promissory and how does it work?

A complaint promissory is a legal document that outlines a promise to pay a debt or fulfill an obligation. With airSlate SignNow, you can easily create, send, and eSign a complaint promissory, ensuring that all parties have a clear and binding agreement.

-

How can airSlate SignNow enhance the eSigning of a complaint promissory?

airSlate SignNow simplifies the eSigning process for a complaint promissory by providing a user-friendly interface. You can quickly send the document for signatures, track its status in real-time, and store it securely for future reference.

-

What are the pricing options for using airSlate SignNow for complaint promissory documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you're a solo entrepreneur or part of a large organization, you can find a plan that allows unlimited eSigning of complaint promissory documents without breaking your budget.

-

What features does airSlate SignNow provide for managing complaint promissory agreements?

With airSlate SignNow, you get access to features like customizable templates, real-time collaboration, and automated workflows. These tools streamline the creation and management of complaint promissory documents, making them more efficient and less time-consuming.

-

Can I integrate airSlate SignNow with other applications for complaint promissory handling?

Yes, airSlate SignNow integrates seamlessly with a range of applications such as Google Drive, Salesforce, and more. This integration allows you to handle complaint promissory documents in conjunction with your existing workflows and maintain better document management.

-

Is it safe to eSign a complaint promissory with airSlate SignNow?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and secure access controls, to protect your complaint promissory agreements. You can eSign with confidence knowing that your documents are safe and secure.

-

What are the benefits of using airSlate SignNow for my complaint promissory needs?

Using airSlate SignNow for your complaint promissory documents allows for faster turnaround times, enhanced security, and improved organization of your documents. It empowers businesses to streamline the signing process and reduce administrative overhead.

Get more for Personal Guarantors

Find out other Personal Guarantors

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online