Trust Part Form

What is the Trust Part

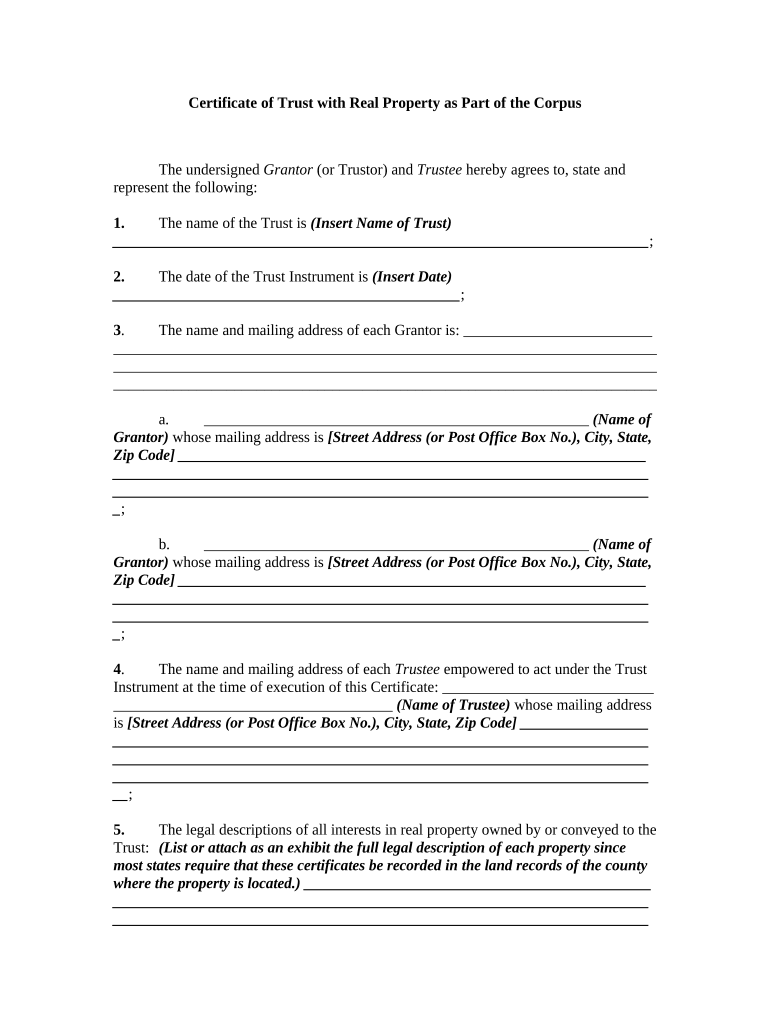

The trust part is a crucial component in various legal and financial documents, particularly in estate planning and asset management. It outlines the specific terms and conditions under which a trust operates, detailing the responsibilities of the trustee and the rights of the beneficiaries. Understanding the trust part is essential for ensuring that the intentions of the trust creator are honored and legally upheld.

How to Use the Trust Part

Utilizing the trust part involves several steps to ensure it is correctly integrated into your legal documents. Begin by clearly defining the purpose of the trust, including the assets involved and the beneficiaries. Next, draft the trust part to include essential details such as the trustee's powers, the duration of the trust, and any specific instructions regarding asset distribution. This section must be precise to prevent misunderstandings and ensure compliance with legal standards.

Steps to Complete the Trust Part

Completing the trust part requires careful attention to detail. Follow these steps:

- Identify the type of trust you are establishing, such as revocable or irrevocable.

- Gather necessary information about the assets, beneficiaries, and trustee.

- Draft the trust part, ensuring all legal language is clear and unambiguous.

- Review the document for compliance with state laws and regulations.

- Have the document signed and notarized, if required, to ensure its validity.

Legal Use of the Trust Part

The legal use of the trust part is governed by state laws, which can vary significantly. It is essential to ensure that the trust part complies with relevant statutes to be enforceable in a court of law. This includes adhering to regulations regarding the creation, modification, and termination of trusts. Consulting with a legal professional can help navigate these complexities and ensure that the trust part is legally sound.

Key Elements of the Trust Part

Several key elements must be included in the trust part to ensure its effectiveness:

- Trustee Information: Clearly identify the trustee and their responsibilities.

- Beneficiary Designation: List all beneficiaries and their respective shares of the trust assets.

- Asset Description: Provide a detailed description of the assets held in the trust.

- Distribution Terms: Outline how and when assets will be distributed to beneficiaries.

- Amendment and Revocation Clauses: Include provisions for modifying or dissolving the trust if necessary.

Who Issues the Form

The trust part is typically included in documents prepared by legal professionals, such as attorneys specializing in estate planning. While there is no specific government agency that issues a standardized trust part form, it is essential to ensure that the document complies with state laws. Legal professionals can provide tailored documents that meet individual needs and adhere to legal requirements.

Quick guide on how to complete trust part

Effortlessly Prepare Trust Part on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Trust Part using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Trust Part with Ease

- Obtain Trust Part and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Trust Part and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the trust part of using airSlate SignNow for document signing?

The trust part of using airSlate SignNow lies in its robust security measures and compliance with industry standards. Our platform ensures that your documents are signed securely and legally, protecting sensitive information throughout the process.

-

How does airSlate SignNow ensure document security?

The trust part of airSlate SignNow includes advanced encryption, secure access controls, and regular security audits. These features safeguard your documents from unauthorized access and ensure the integrity of your signed agreements.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to cater to different business needs. Each plan provides a trust part of affordable solutions with no hidden fees, allowing businesses to choose the best fit for their eSignature requirements.

-

What features does airSlate SignNow provide to improve workflow?

The trust part of airSlate SignNow's feature set includes customizable templates, automatic reminders, and real-time tracking. These tools streamline the signing process, enhance efficiency, and ensure that all parties stay informed throughout the workflow.

-

Can I integrate airSlate SignNow with my existing software?

Yes, the trust part of airSlate SignNow includes seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This functionality allows businesses to enhance their existing workflows without disrupting their operations.

-

What are the benefits of using airSlate SignNow for eSigning?

The trust part of choosing airSlate SignNow includes ease of use, cost-effectiveness, and versatility. Businesses can quickly send and eSign documents from anywhere, increasing productivity while ensuring compliance with legal standards.

-

Is there a mobile app for airSlate SignNow?

Indeed, the trust part of airSlate SignNow extends to its mobile app, which allows users to send, sign, and manage documents on the go. This feature provides convenience and flexibility, making it easy for teams to operate from any location.

Get more for Trust Part

- Coastcapital saving forms

- Charge dispute form icici online

- Trustee transfer form

- Simple ira contribution formquot keyword found websites listing

- Oba request spire intranet login form

- Visa consent form

- Required minimum distribution voya for professionals form

- Simple ira contribution remittance wells fargo funds form

Find out other Trust Part

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed