Receipt Property Form

What is the receipt property?

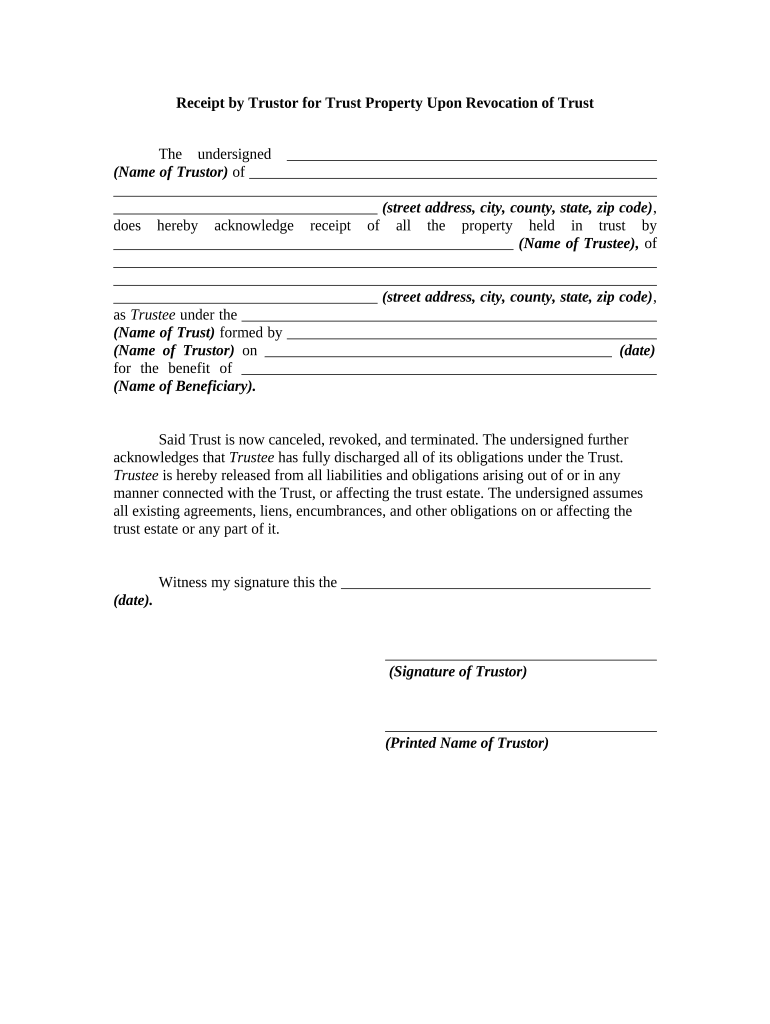

The receipt property refers to a documented acknowledgment of a transaction, typically indicating that a specific item or service has been received. This form serves as proof of delivery and can be essential for both individuals and businesses. In legal contexts, a receipt property form can be used to affirm the completion of a transaction, ensuring that all parties have a clear record of what was exchanged. It is crucial in various scenarios, including real estate transactions, service agreements, and sales exchanges.

How to use the receipt property

Using the receipt property involves several steps to ensure that the form is filled out correctly and serves its intended purpose. Initially, gather all relevant information about the transaction, including the names of the parties involved, the date of the transaction, and a detailed description of the items or services exchanged. Once this information is collected, you can fill out the receipt property form electronically. Ensure that all details are accurate and complete to avoid any disputes later. After completing the form, both parties should sign it to validate the transaction.

Steps to complete the receipt property

Completing the receipt property form can be straightforward if you follow these steps:

- Gather necessary information, including transaction details and party names.

- Access the receipt property form through a reliable electronic platform.

- Fill in the required fields, ensuring all information is accurate.

- Review the form for completeness and correctness.

- Sign the form electronically to validate the transaction.

- Distribute copies of the signed receipt property form to all parties involved.

Legal use of the receipt property

The legal use of the receipt property is vital in establishing proof of a transaction. In many jurisdictions, a properly completed and signed receipt property form can serve as evidence in court if disputes arise. It is essential to ensure that the form meets all legal requirements, including proper signatures and dates. Additionally, compliance with eSignature regulations, such as the ESIGN Act and UETA, is necessary for electronic versions of the receipt property form to be considered legally binding.

Key elements of the receipt property

Several key elements must be included in the receipt property form to ensure its validity:

- Transaction Date: The date when the transaction occurred.

- Parties Involved: Names and contact information of all parties involved in the transaction.

- Description of Goods/Services: A detailed description of what was exchanged.

- Signatures: Signatures of all parties to confirm agreement.

- Receipt Number: A unique identifier for tracking purposes.

Examples of using the receipt property

Receipt property forms are used in various scenarios, including:

- Real Estate Transactions: A receipt confirming the transfer of property ownership.

- Service Agreements: Acknowledgment of services rendered, such as repairs or consulting.

- Retail Sales: Proof of purchase for goods sold in stores.

- Online Transactions: Confirmation of digital purchases or subscriptions.

Quick guide on how to complete receipt property

Complete Receipt Property effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly and without delays. Manage Receipt Property on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Receipt Property with ease

- Find Receipt Property and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you would like to deliver your form, through email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your selection. Edit and eSign Receipt Property to guarantee excellent communication throughout any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a receipt property in airSlate SignNow?

A receipt property in airSlate SignNow refers to the feature that enables users to create and manage electronic receipts efficiently. This function streamlines the documentation process, making it easier to track transactions and ensure compliance. By utilizing receipt properties, businesses can enhance their record-keeping practices signNowly.

-

How does airSlate SignNow help with creating receipt properties?

airSlate SignNow simplifies the creation of receipt properties by providing customizable templates that users can fill out quickly. This feature allows businesses to generate professional-looking receipts that can be easily eSigned and sent to customers. The intuitive interface ensures that users can manage receipt properties without any hassle.

-

What are the pricing options for using receipt properties in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including the management of receipt properties. Users can choose from monthly or annual subscriptions, with additional benefits included in higher-tier plans. This pricing structure makes it accessible for businesses to utilize receipt properties without breaking the bank.

-

Can I integrate my existing systems with airSlate SignNow for receipt properties?

Yes, airSlate SignNow supports various integrations that allow users to connect their existing systems seamlessly. Whether you are using accounting software or customer relationship management tools, receipt properties can be managed efficiently within your workflow. This integration ensures that your processes remain streamlined.

-

What benefits do receipt properties provide for businesses?

Receipt properties provide numerous benefits, including improved accuracy, enhanced tracking, and time-saving efficiencies. By using airSlate SignNow, businesses can minimize errors in documentation and ensure that all receipts are stored electronically. This leads to better organization and quicker access to important financial records.

-

Is airSlate SignNow secure for managing receipt properties?

Absolutely, airSlate SignNow prioritizes security, ensuring that all receipt properties and documents are encrypted and stored securely. Users can rest assured knowing that their data is protected from unauthorized access. The platform also complies with industry regulations, making it a trustworthy solution for managing sensitive information.

-

How do I access and manage my receipt properties in airSlate SignNow?

Managing your receipt properties in airSlate SignNow is straightforward; users can log into their account and access the dashboard. From there, you can create, edit, and send receipt properties easily. The streamlined design of the interface allows for quick navigation and management of all your document needs.

Get more for Receipt Property

- West valley national bank form

- Irs tax offset hardship form

- Cbcbearden form

- Affidavit of domestic partnership harris county texas form

- Kroll international form

- Credit application and agreementb4562559docx1 b31549933font6 form

- Fhp defendant copy 111111e form

- Alarm monitoring certificate certificate form

Find out other Receipt Property

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word