Beneficiary Rights under Form

What is the Beneficiary Rights Under

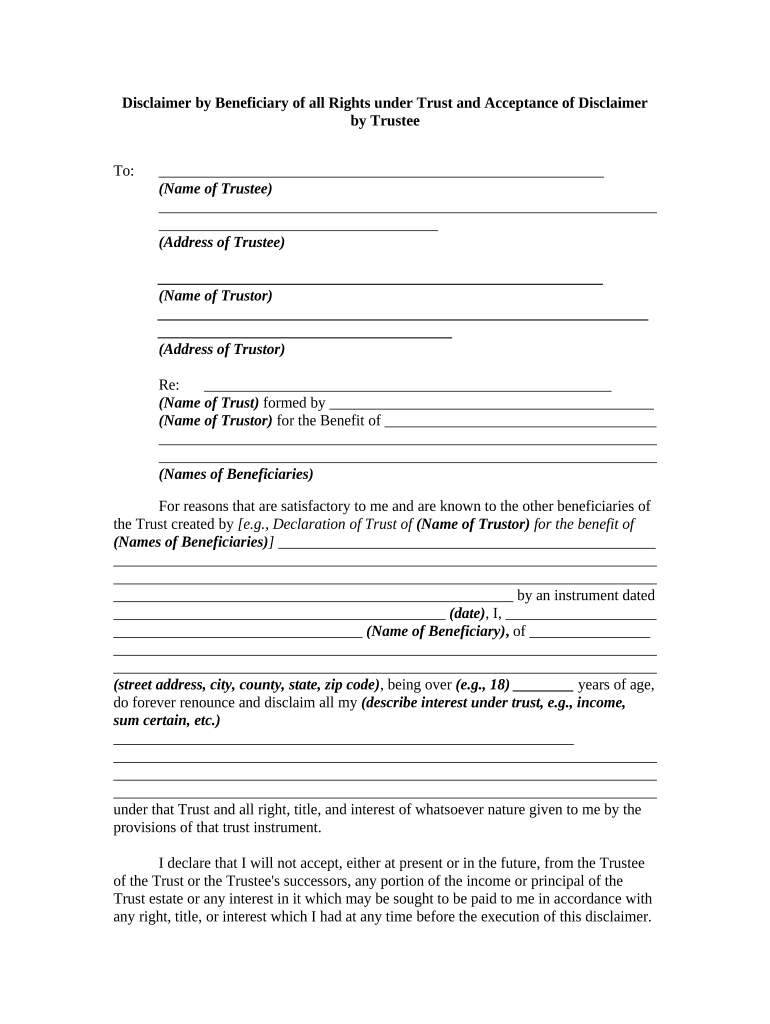

The beneficiary rights under trust refer to the legal entitlements of individuals designated as beneficiaries within a trust agreement. These rights ensure that beneficiaries receive their specified share of the trust's assets according to the terms outlined in the trust document. Understanding these rights is crucial for beneficiaries to protect their interests and ensure compliance with the trust's provisions.

Beneficiary rights typically include the right to information about the trust, the right to receive distributions, and the right to challenge decisions made by the trustee if they believe those decisions violate the trust's terms. It is essential for beneficiaries to be aware of their rights to navigate trust-related matters effectively.

Steps to complete the Beneficiary Rights Under

Completing the beneficiary rights under trust involves several key steps to ensure accuracy and compliance with legal requirements. Here are the essential steps to follow:

- Review the trust document to understand the specific rights and obligations outlined.

- Gather necessary personal information and documentation, including identification and any relevant financial records.

- Complete any required forms, ensuring all information is accurate and up to date.

- Obtain necessary signatures from the trustee or other parties as required by the trust agreement.

- Submit the completed forms to the appropriate parties, which may include the trustee, financial institutions, or legal representatives.

Following these steps can help ensure that the beneficiary rights under trust are executed properly, safeguarding the interests of all parties involved.

Legal use of the Beneficiary Rights Under

The legal use of beneficiary rights under trust is governed by state laws and the specific terms of the trust agreement. Beneficiaries must understand that these rights are enforceable in court, allowing them to seek legal remedies if their rights are violated. This includes the right to request an accounting of the trust's assets, challenge the trustee's actions, and receive timely distributions.

Beneficiaries should also be aware of the potential legal implications of their rights. For instance, if a beneficiary believes that the trustee is mismanaging the trust, they may need to consult with an attorney to explore their options for legal recourse. Understanding the legal framework surrounding beneficiary rights is essential for effective advocacy and protection of interests.

Key elements of the Beneficiary Rights Under

Several key elements define the beneficiary rights under trust, ensuring that beneficiaries can effectively exercise their entitlements. These elements include:

- Right to Information: Beneficiaries have the right to receive relevant information about the trust, including its assets, liabilities, and performance.

- Right to Distributions: Beneficiaries are entitled to receive distributions as specified in the trust document, ensuring they benefit from the trust's assets.

- Right to Challenge Decisions: Beneficiaries can contest decisions made by the trustee that they believe are not in accordance with the trust's terms.

- Right to Legal Recourse: If beneficiaries feel their rights are being violated, they have the right to seek legal action to protect their interests.

Understanding these key elements empowers beneficiaries to navigate their rights effectively, ensuring they receive the benefits intended for them under the trust.

How to obtain the Beneficiary Rights Under

Obtaining beneficiary rights under trust involves a clear understanding of the trust document and the legal processes involved. Here are steps to help beneficiaries secure their rights:

- Request a copy of the trust document from the trustee or legal representative.

- Review the document to identify specific rights and obligations associated with your beneficiary status.

- Consult with an attorney specializing in trust law to clarify any questions and understand your rights fully.

- Engage with the trustee to discuss your rights and any distributions you may be entitled to.

- Document all communications and agreements related to your rights under the trust.

By following these steps, beneficiaries can ensure they are informed and prepared to exercise their rights effectively.

Quick guide on how to complete beneficiary rights under

Complete Beneficiary Rights Under effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage Beneficiary Rights Under on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Beneficiary Rights Under with ease

- Locate Beneficiary Rights Under and click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal authority as a conventional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Beneficiary Rights Under and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary rights trust?

A beneficiary rights trust is a legal arrangement designed to protect the rights and assets of beneficiaries. By establishing this trust, you can ensure that the benefits are distributed according to your wishes, safeguarding your beneficiaries' interests and providing peace of mind.

-

How can airSlate SignNow help manage beneficiary rights trust documents?

AirSlate SignNow simplifies the management of beneficiary rights trust documents by providing an easy-to-use platform for sending and eSigning crucial legal papers. With its cost-effective solution, you can streamline your workflows and ensure the timely execution of these essential documents.

-

What are the benefits of using airSlate SignNow for beneficiary rights trust?

Using airSlate SignNow for your beneficiary rights trust offers numerous benefits, including enhanced security, reduced paperwork, and faster turnaround times for document completion. The platform's intuitive interface makes it easy for all parties involved to review and sign documents digitally, improving overall efficiency.

-

Is airSlate SignNow secure for handling beneficiary rights trust documentation?

Absolutely! AirSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect your beneficiary rights trust documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What pricing options does airSlate SignNow offer for beneficiary rights trust management?

AirSlate SignNow provides flexible pricing plans tailored to meet your needs for managing beneficiary rights trust documents. Their plans cater to individuals, small businesses, and larger enterprises, allowing you to choose an option that fits your budget while still benefiting from all essential features.

-

Can airSlate SignNow integrate with other software for managing beneficiary rights trust?

Yes, airSlate SignNow offers seamless integrations with a variety of business applications to enhance your management of beneficiary rights trust documents. You can connect with CRM systems, cloud storage solutions, and other tools to create a streamlined workflow that meets your unique business needs.

-

How does airSlate SignNow ensure compliance with legal standards for beneficiary rights trusts?

AirSlate SignNow is designed to comply with relevant legal standards and regulations, ensuring that your beneficiary rights trust documents are legally binding. The platform regularly updates its features to remain compliant with changing laws, providing you with peace of mind during the document management process.

Get more for Beneficiary Rights Under

Find out other Beneficiary Rights Under

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online