Penn Mutual Forms 2003-2026

What are Penn Mutual Forms?

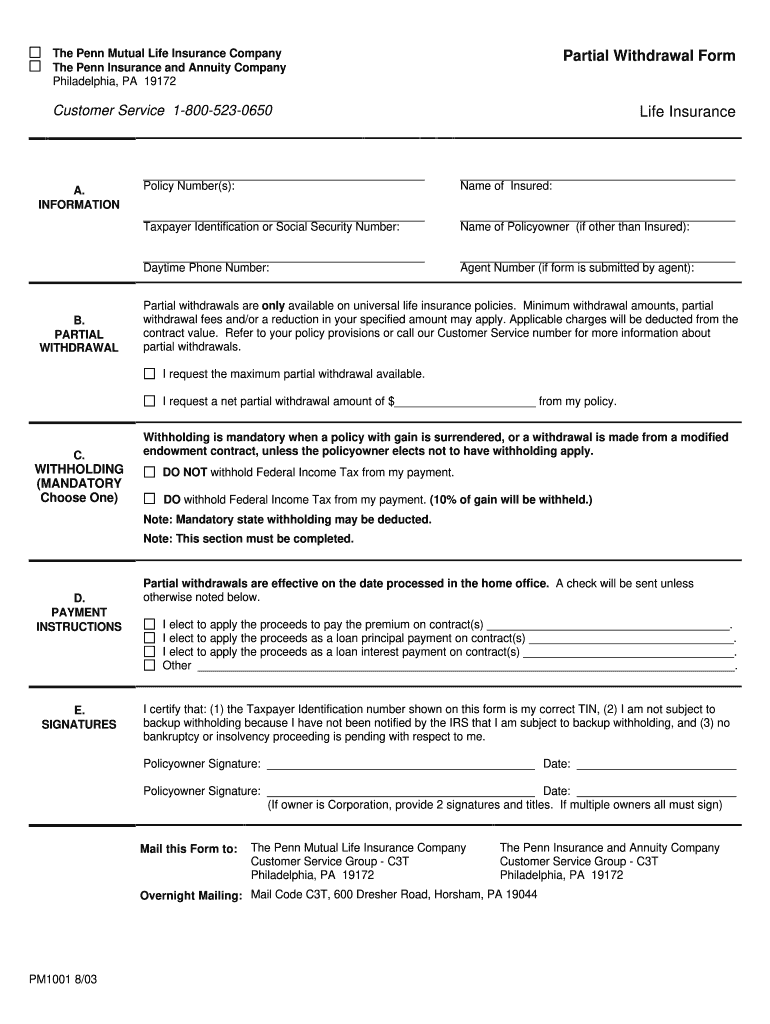

Penn Mutual forms are essential documents used for various transactions and processes related to insurance and annuity products offered by the Penn Insurance and Annuity Company. These forms facilitate actions such as beneficiary designations, partial withdrawals, and policy changes. Understanding the specific purpose of each form is crucial for ensuring compliance and proper handling of insurance matters. Common forms include the Penn Mutual beneficiary form, the partial withdrawal form, and the change of beneficiary form.

How to Use the Penn Mutual Forms

Using Penn Mutual forms involves several straightforward steps. First, identify the specific form required for your transaction, such as the Penn Mutual beneficiary designation form or the Penn Mutual annuity withdrawal form. Next, download the appropriate form from the official Penn Mutual website or request it directly from their customer service. Once you have the form, fill it out carefully, ensuring that all necessary information is provided accurately. After completing the form, review it for any errors before submitting it through the designated method, whether online, via mail, or in person.

Steps to Complete the Penn Mutual Forms

Completing Penn Mutual forms requires attention to detail. Follow these steps to ensure accuracy:

- Obtain the correct form based on your needs.

- Read the instructions provided with the form carefully.

- Fill in all required fields, including personal information and policy details.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form using the preferred method outlined in the instructions.

Legal Use of the Penn Mutual Forms

The legal validity of Penn Mutual forms is governed by various regulations, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). When completed and submitted correctly, these forms are legally binding. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal issues. Additionally, using a secure platform for electronic submissions can enhance the integrity and security of the process.

Required Documents for Penn Mutual Forms

When completing Penn Mutual forms, certain documents may be required to support your application or request. Commonly needed documents include:

- Proof of identity, such as a government-issued ID.

- Policy number and details of the insurance or annuity product.

- Any previous forms or documents related to the policy.

- Financial information if applicable, especially for withdrawal requests.

Form Submission Methods

Penn Mutual forms can typically be submitted through various methods, depending on the specific form and the preferences of the user. Common submission methods include:

- Online submission via the Penn Mutual website or a secure portal.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at a local Penn Mutual office or authorized representative.

Quick guide on how to complete partial withdrawal form life insurance penn mutual life

The optimal method to locate and sign Penn Mutual Forms

At the level of an entire organization, ineffective workflows concerning paper approval can consume a signNow amount of work hours. Signing documents such as Penn Mutual Forms is an inherent aspect of operations across various sectors, which is why the effectiveness of each agreement’s lifecycle impacts the organization's overall productivity. With airSlate SignNow, executing your Penn Mutual Forms is as straightforward and swift as possible. You’ll discover on this platform the latest version of almost any form. Even better, you can sign it right away without the need to install external applications on your computer or print any physical copies.

How to obtain and endorse your Penn Mutual Forms

- Explore our collection by category or use the search function to find the document you require.

- Check the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Penn Mutual Forms.

- Select the signing method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if necessary.

With airSlate SignNow, you have everything you require to manage your paperwork effectively. You can locate, fill out, modify, and even share your Penn Mutual Forms in one tab without any complications. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I have invested in a life insurance policy but want to make a partial withdrawal. Is it possible?

This is the mistake committed by millions in India every year. Since they don’t buy life insurance policy for covering life risk but as an “Investment” and then get trapped for many years.Traditional plans - In case of policy term upto 10 years, minimum 2 years premium must be paid in order to get “surrender value.” In case of policies beyond 10 years, minimum 3 years premium must be paid in order to get “surrender value.” (not partial withdrawal). Usually insurance company deducts first year’s premium from all premiums paid till date and apply surrender factor to remaining amount to arrive at Surrender Value. Hence, one looses on investment if surrendered before 10 -11 years. This is case with typical LIC plans.I think some companies have introduced some flexible products recently to allow partial withdrawal. You need to check with those companies.ULIP’s - After introduction of 2010 guidelines, revamped ULIPs allow partial withdrawal of funds after completion of 5 years of policy term.

-

I have Metlife Life insurance. I have requested a partial cash withdrawal online from my plan when can I expect the check to come in the mail?

This is a question that is better answered by MetLife than people on Quora.I cannot speak for MetLife, but most life insurers are very quick at providing loans against the cash value of a policy (I assume that is what you meant in your question). I would be surprised if it took longer than a week for you to receive it. Let me repeat that you should be asking MetLife about this, not us.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

What rules of thumb are there for figuring out how much life insurance to buy?

If you are not married, and have no dependents, then you don't need life insurance.If you are married and your spouse also works, one year's salary is enough insurance for them to cover funeral expenses, mourn, and move to a smaller home and sell the current house if needed.If you have dependents, and/or your spouse doesn't work, the situation becomes very dependent on your personal finances overall. Assuming you are a one-income household, with two pre-school aged children, you may want to consider a total life insurance value equal to enough money to cover:-Cost of paying off your mortgage immediately-Cost of fixed annuity to pay for annual expenses for your spouse, less housing cost-Children's educational expensesThat's the most common rule of thumb, but you should consider whether it is an outdated notion that your spouse will never be able to work or provide for themselves if you die.Also, whether you believe that parents should pay for a child's college education, or even whether a child needs to go to college (or a state school vs. private school) can impact that part of the equation.As you age, you will likely set aside 529 plans for your kids, pay down your mortgage, etc. In that case, you should adjust the total value of your insurance downward to save yourself on monthly premium costs. The very wealthy self-insure for the most part - you want to move in that direction as your personal wealth increases.Finally, don't mix investments with insurance. Insurance is for protection only. Therefore, "buy term and invest the rest" is the best advice. Whole insurance makes it difficult to remember how much you are spending on the insurance part, and how much you're investing.

-

Why can’t we reduce the amount of forms we have to fill out in our life?

Why can’t we reduce the amount of forms we have to fill out in our life?Very rarely does anybody have to fill out forms without a purpose, mostly because once you fill it out, somebody has to process and data entry the thing, and nobody likes doing that for pointless forms.So.. what thing that requires a form do you want to get rid of? Because you don’t just get rid of the form, you get rid of whatever that form is designed to do.You want a driver’s license or license plates? There’s going to be a form, because they can’t give you those without collecting the needed information.Do you thing getting rid of driver’s licenses or license plates is a good idea?When I take my car to a mechanic, there’s always a form to fill out, that lists among other things, the work authorized to be done, the estimated cost, and an upper cost limit they can’t exceed without further authorization (in case problems are found during the work - the additional work may cost more than the value of the car if it’s older. It also limits the ability of shady mechanics to run up the price tag with “Oh, we also had to fix this” claims.I’m personally happy to have my copy of a form that says exactly what my mechanic was supposed to do - it comes in handy if I have to sue them, The fact I have my copy in my backpack seems to keep them honest. Funny, that…Would you think getting rid of that form would be a good idea?When I moved into this apartment building a few years ago, one of the forms I had to sign was a statement by the leasing company that (a) the building was built before 1970 and (b) they were unable to guarantee that there was no lead-based paint. But that disclosure was legally required, because even today, there are *still* cases of 2 year olds finding flaking paint chips, eating them, and ending up severely messed up because it was lead-based paint, and lead is bad for growing baby brains.And although I’m old enough to be retired and wise enough to not eat paint chips, the family upstairs with the small kids is probably at least glad to have the heads-up, and call the maintenance crew at the first sign of flaking paint…Do you think it would be a good idea to let landlords claim “Oh, we told the tenants about known dangers that might be present”? Or make them keep paperwork that proved the tenants signed a form stating they were indeed told?

Create this form in 5 minutes!

How to create an eSignature for the partial withdrawal form life insurance penn mutual life

How to create an eSignature for your Partial Withdrawal Form Life Insurance Penn Mutual Life online

How to make an electronic signature for your Partial Withdrawal Form Life Insurance Penn Mutual Life in Chrome

How to generate an electronic signature for putting it on the Partial Withdrawal Form Life Insurance Penn Mutual Life in Gmail

How to generate an electronic signature for the Partial Withdrawal Form Life Insurance Penn Mutual Life from your mobile device

How to create an eSignature for the Partial Withdrawal Form Life Insurance Penn Mutual Life on iOS

How to generate an eSignature for the Partial Withdrawal Form Life Insurance Penn Mutual Life on Android

People also ask

-

What are Penn Mutual forms, and why are they important?

Penn Mutual forms are essential documents used for various transactions and agreements with Penn Mutual, including insurance applications and policy changes. These forms ensure compliance and help streamline the administrative process for both the policyholders and the company.

-

How does airSlate SignNow support the completion of Penn Mutual forms?

airSlate SignNow provides an intuitive platform that allows users to easily complete and eSign Penn Mutual forms electronically. By eliminating paper documents, SignNow enhances efficiency and reduces turnaround times, making it simpler to manage important paperwork.

-

What features does airSlate SignNow offer for eSigning Penn Mutual forms?

AirSlate SignNow offers features such as customizable templates, document tracking, and cloud storage, which are perfect for managing Penn Mutual forms. These tools not only enhance user experience but also help in maintaining a clear record of signed documents for future reference.

-

Are the pricing plans for airSlate SignNow suitable for small businesses handling Penn Mutual forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes, including small businesses managing Penn Mutual forms. The cost-effective solutions make it accessible for organizations looking to optimize their document workflow without breaking the bank.

-

Can I integrate airSlate SignNow with existing systems to manage Penn Mutual forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications and platforms, allowing users to incorporate it into their existing systems for handling Penn Mutual forms. This integration enhances productivity and makes it easier to manage documents within your current workflow.

-

Is airSlate SignNow secure for handling sensitive Penn Mutual forms?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance standards, ensuring that Penn Mutual forms and other sensitive documents are protected. Users can confidently manage their documents, knowing that their data is secure.

-

What are the benefits of using airSlate SignNow for Penn Mutual forms?

Using airSlate SignNow for Penn Mutual forms streamlines the signing process by reducing paperwork and increasing collaboration. It simplifies document management and speeds up the approval process, allowing businesses to focus more on their core activities.

Get more for Penn Mutual Forms

Find out other Penn Mutual Forms

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement