Foreclosure Form

What is the Foreclosure

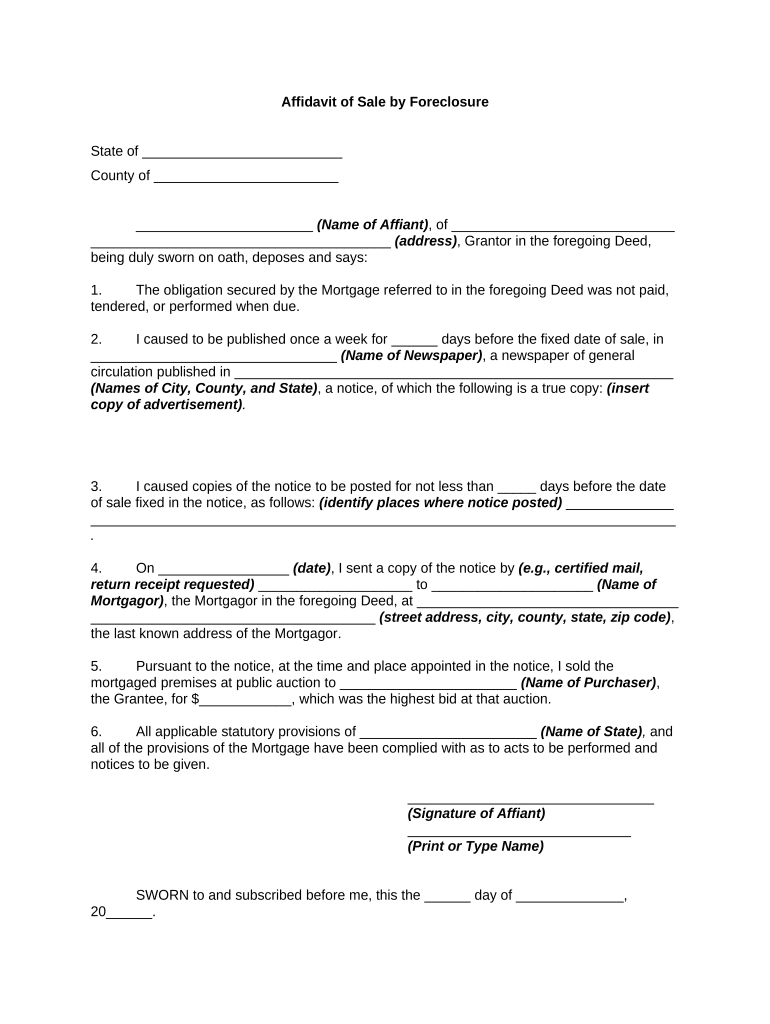

A foreclosure is a legal process through which a lender takes possession of a property when the borrower fails to make mortgage payments. This process typically involves the sale of the property to recover the outstanding debt. In the United States, foreclosure laws and procedures can vary significantly by state, making it essential for homeowners to understand their rights and obligations during this challenging time.

Steps to Complete the Foreclosure

Completing a foreclosure file involves several critical steps to ensure compliance with legal requirements. The process generally includes:

- Gathering necessary documentation, including loan agreements and payment records.

- Notifying the borrower of the impending foreclosure, often through a notice of default.

- Filing the foreclosure application with the appropriate court or agency.

- Conducting a public auction or sale of the property, if required by state law.

- Finalizing the transfer of ownership to the new buyer or back to the lender.

Legal Use of the Foreclosure

To ensure that a foreclosure document is legally valid, specific criteria must be met. The document must include accurate information about the property, the borrower, and the lender. Additionally, it must comply with state laws regarding notice requirements and timelines. Using a reliable electronic signature solution can enhance the legal standing of the foreclosure file by providing a digital certificate and maintaining compliance with relevant regulations, such as the ESIGN Act and UETA.

Required Documents

When preparing a foreclosure file, several documents are essential for a smooth process. These typically include:

- The original mortgage agreement or deed of trust.

- Payment history and records of missed payments.

- Notice of default or intent to foreclose.

- Foreclosure application or petition.

- Any additional state-specific forms required for the foreclosure process.

Eligibility Criteria

Eligibility for foreclosure can depend on various factors, including the type of loan, the borrower’s payment history, and state-specific regulations. Generally, a borrower may be eligible for foreclosure if they have defaulted on their mortgage payments for a specified period, typically three to six months. Understanding these criteria can help homeowners navigate their options and seek assistance if needed.

Examples of Using the Foreclosure

Foreclosure files can be utilized in various scenarios, such as:

- A lender initiating foreclosure due to a homeowner's prolonged inability to make payments.

- A homeowner seeking to understand their rights and options during the foreclosure process.

- Legal professionals preparing documentation for court proceedings related to foreclosure.

State-Specific Rules for the Foreclosure

Each state in the U.S. has its own set of rules and regulations governing the foreclosure process. These may dictate the timeline for notifications, the method of foreclosure (judicial vs. non-judicial), and the rights of borrowers during the process. It is crucial for both lenders and borrowers to familiarize themselves with their state's specific laws to ensure compliance and protect their interests throughout the foreclosure process.

Quick guide on how to complete foreclosure 497329927

Effortlessly Prepare Foreclosure on Any Gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without any hold-ups. Handle Foreclosure on any device using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign Foreclosure with Ease

- Find Foreclosure and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you'd like to share your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or mislaid documents, time-consuming form locating, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Foreclosure and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a foreclosure file and how can airSlate SignNow help?

A foreclosure file is a collection of legal documents related to the foreclosure process. airSlate SignNow provides an efficient way to manage these documents by allowing you to eSign and send them securely, saving you time and reducing paperwork.

-

How does pricing for airSlate SignNow work for managing foreclosure files?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our pricing is straightforward, with no hidden fees, making it cost-effective even when managing multiple foreclosure files.

-

What features does airSlate SignNow provide for handling foreclosure files?

With airSlate SignNow, you can easily create, send, and eSign your foreclosure files. Our advanced features include templates for quick document preparation, audit trails for tracking signatures, and integration with storage services for easy document access.

-

Can I integrate airSlate SignNow with other tools to manage foreclosure files?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow for managing foreclosure files. This integration allows you to synchronize your documents and data effortlessly across platforms.

-

What are the benefits of using airSlate SignNow for foreclosure files?

Using airSlate SignNow for foreclosure files streamlines the entire document management process. This not only accelerates transaction times but also ensures compliance, reduces errors, and enhances overall productivity.

-

How secure is airSlate SignNow for my foreclosure files?

Security is paramount at airSlate SignNow. All foreclosure files are encrypted and stored securely, and our platform complies with the highest industry standards to protect sensitive information throughout the signing process.

-

Are there any mobile capabilities for managing foreclosure files with airSlate SignNow?

Absolutely! airSlate SignNow has mobile applications that allow you to manage and sign foreclosure files on the go. This flexibility ensures you can handle important documents anytime, anywhere, without hassle.

Get more for Foreclosure

- Girl guide health form

- Board of governors handbook rutgers university form

- Instructions for form aia02 substitute statement in li united

- Ey tax covid 19 response tracker readkongcom form

- Temporary on premises sign application form

- Application for licensure new jersey division of consumer form

- Ots 2 go screening form hamilton health sciences

- Faculty of nursing student academic appeals committee form

Find out other Foreclosure

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation