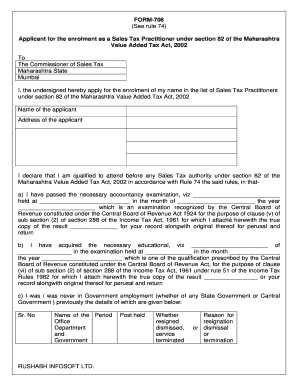

FORM 706 See Rule 74 Applicant for the Enrolment as a Sales Tax

What is the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

The FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax is a critical document used by businesses in the United States to apply for sales tax enrollment. This form serves as an official request to the relevant tax authority, ensuring that the applicant is recognized as a legitimate entity authorized to collect sales tax. The completion of this form is essential for compliance with state regulations and to avoid potential penalties associated with unregistered sales tax collection.

How to use the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

Using the FORM 706 See Rule 74 involves several steps to ensure accurate submission. First, gather all necessary business information, including the legal name, address, and tax identification number. Next, complete the form by providing detailed information about the nature of your business and expected sales. Once completed, you can submit the form electronically or via mail, depending on your state’s requirements. Utilizing digital tools can streamline this process, making it easier to manage and track submissions.

Steps to complete the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

Completing the FORM 706 See Rule 74 requires careful attention to detail. Follow these steps for successful completion:

- Gather required information: Collect your business details, including the legal structure and ownership information.

- Fill out the form: Accurately enter all required fields, ensuring that the information matches your official records.

- Review for accuracy: Double-check all entries for errors or omissions that could delay processing.

- Submit the form: Choose your submission method—online or by mail—based on your state’s guidelines.

Key elements of the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

Several key elements must be included in the FORM 706 See Rule 74 for it to be valid. These include:

- Business Information: Legal name, address, and contact details.

- Tax Identification Number: Essential for tax processing and identification.

- Nature of Business: Description of the goods or services sold.

- Estimated Sales: Projected sales figures for accurate tax assessment.

Legal use of the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

The legal use of the FORM 706 See Rule 74 is crucial for businesses to operate within the law. Submitting this form properly ensures compliance with state sales tax regulations. Failure to enroll can lead to significant penalties, including fines and back taxes. It is essential to maintain accurate records and adhere to filing deadlines to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 706 See Rule 74 vary by state, but generally, businesses should submit their applications before they begin sales. It is advisable to check with your state’s tax authority for specific deadlines. Keeping track of these dates is vital to ensure compliance and avoid late fees.

Quick guide on how to complete form 706 see rule 74 applicant for the enrolment as a sales tax

Complete FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to find the necessary form and safely keep it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents swiftly without interruptions. Manage FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax without hassle

- Find FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax and click Obtain Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Finished button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 706 see rule 74 applicant for the enrolment as a sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax?

FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax is a specific document required for applicants seeking to enroll for sales tax purposes. It outlines key information that businesses must provide to comply with tax regulations. Understanding this form is crucial for ensuring that your business meets legal sales tax obligations.

-

How can airSlate SignNow simplify the eSigning of FORM 706 See Rule 74?

AirSlate SignNow provides a user-friendly platform that allows you to electronically sign the FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax quickly and securely. With just a few clicks, you can send, sign, and store this important document, streamlining your tax enrollment process. The platform also offers features like templates and reminders to enhance efficiency.

-

What features does airSlate SignNow offer to manage FORM 706 See Rule 74 effectively?

AirSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage to manage FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax documents effectively. These features save time and reduce errors, allowing you to focus on your business instead of paperwork. Additionally, tracking and auditing options enhance compliance and transparency.

-

Is there a cost involved in using airSlate SignNow for FORM 706 See Rule 74?

AirSlate SignNow offers flexible pricing plans designed to suit various business needs, starting with a no-cost trial. The pricing is competitive, ensuring that you receive a cost-effective solution for managing important documents, including FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax. You can choose a plan that best fits your usage and budget.

-

Can airSlate SignNow integrate with other tools for handling FORM 706 See Rule 74?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for handling FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax. Whether you're using CRM systems, cloud storage, or project management tools, seamless integration ensures that your documents are easily accessible and manageable within your business ecosystem.

-

What are the benefits of using airSlate SignNow for FORM 706 See Rule 74?

Using airSlate SignNow for FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax provides signNow benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signature process speeds up the enrollment while providing legal compliance and verification. Overall, this leads to a smoother operational workflow for managing sales tax documentation.

-

How secure is airSlate SignNow when managing FORM 706 See Rule 74?

AirSlate SignNow prioritizes security, employing advanced encryption techniques to protect all documents, including FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax. User authentication and access controls ensure that only authorized personnel can handle sensitive information. This robust security framework helps businesses maintain compliance and protect their data.

Get more for FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

- Blank prescription form template australiapdf download books blank prescription form template australia pdf imaginedragon esy

- How to renew your drivers license online form

- Aubagio start form

- Tesoro filler form

- Baby checklist excel form

- Morrow ashland richland knox consortium form

- Rose bcfymca orgfilesgalleriesymca medical clearance form rose bcfymca org

- Engineer service contract template form

Find out other FORM 706 See Rule 74 Applicant For The Enrolment As A Sales Tax

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy