Waiver Nonprofit Form

What is the Waiver Nonprofit Form

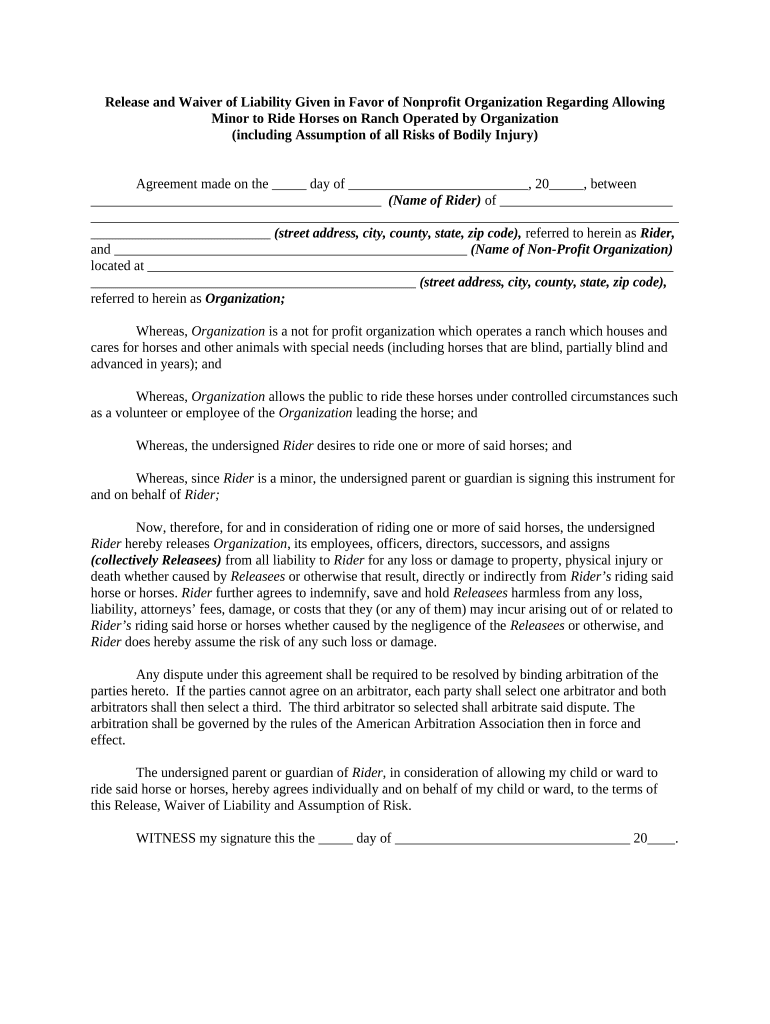

The waiver nonprofit form is a legal document used by nonprofit organizations to release liability for certain activities or events. This form is essential for protecting the organization from claims arising from injuries or damages that may occur during participation in its programs or events. By having participants sign this waiver, nonprofits can ensure that individuals acknowledge the risks involved and agree not to hold the organization responsible for any potential harm.

How to use the Waiver Nonprofit Form

Using the waiver nonprofit form involves several steps to ensure its effectiveness and legal validity. First, the organization must clearly outline the activities covered by the waiver. Next, participants should be provided with the form before engaging in any activities. It is crucial that individuals read the document thoroughly and understand its terms before signing. Once signed, the form should be securely stored by the organization to maintain a record of consent.

Steps to complete the Waiver Nonprofit Form

Completing the waiver nonprofit form requires careful attention to detail. Here are the essential steps:

- Download the waiver nonprofit form from a reliable source.

- Fill in the organization's name and contact information at the top of the form.

- Clearly describe the activity or event for which the waiver is being signed.

- Include a section for participants to provide their personal information, including name and contact details.

- Ensure there is a space for participants to acknowledge understanding of the risks involved.

- Provide a signature line and date for participants to sign and date the form.

Legal use of the Waiver Nonprofit Form

The legal use of the waiver nonprofit form is critical for its enforceability. To be legally binding, the form must meet specific criteria, such as being clear and concise, outlining the risks involved, and being signed voluntarily by participants. It is also important to comply with state laws regarding liability waivers, as these can vary significantly. Consulting with a legal professional can help ensure that the form adheres to applicable regulations.

Key elements of the Waiver Nonprofit Form

Several key elements must be included in the waiver nonprofit form to enhance its effectiveness:

- Clear identification of the nonprofit organization: This includes the name, address, and contact information.

- Description of the activity: A detailed explanation of the event or activity for which the waiver is being signed.

- Assumption of risk statement: A clause that states participants acknowledge the risks involved.

- Release of liability: A section where participants agree not to hold the organization liable for injuries or damages.

- Signature and date: A space for participants to sign and date the form, indicating their agreement.

Examples of using the Waiver Nonprofit Form

Nonprofit organizations can use the waiver nonprofit form in various scenarios, including:

- Sports events, where participants acknowledge the risks of injury.

- Workshops or classes, ensuring that attendees understand any potential hazards.

- Fundraising events, where participants may be involved in physical activities.

Quick guide on how to complete waiver nonprofit form

Complete Waiver Nonprofit Form effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Waiver Nonprofit Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The most efficient way to modify and electronically sign Waiver Nonprofit Form with ease

- Locate Waiver Nonprofit Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant parts of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Waiver Nonprofit Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a waiver nonprofit form?

A waiver nonprofit form is a legal document used by nonprofit organizations to protect themselves from liability during events or activities. This form helps to ensure that participants acknowledge the risks involved and agree not to hold the organization responsible for any injuries or damages. Utilizing a waiver nonprofit form can provide peace of mind to nonprofits operating various programs and activities.

-

How can airSlate SignNow help me with a waiver nonprofit form?

airSlate SignNow simplifies the process of creating, sending, and signing waiver nonprofit forms. With our easy-to-use platform, you can quickly customize templates and collect signatures electronically, saving time and resources. This streamlines your workflows and ensures that all necessary documents are managed efficiently.

-

What features should I look for in a waiver nonprofit form solution?

When searching for a waiver nonprofit form solution, look for features like customizable templates, secure electronic signatures, and cloud storage. Additionally, ensure the platform offers integrations with your existing software and has user-friendly navigation. These features will enhance your efficiency in handling waiver documents.

-

Is airSlate SignNow a cost-effective option for waiver nonprofit forms?

Yes, airSlate SignNow is a cost-effective solution for managing waiver nonprofit forms. With competitive pricing plans, even smaller nonprofits can benefit from our services without straining their budgets. Our platform helps you save money by reducing printing and mailing costs while improving document turnaround times.

-

Can I integrate airSlate SignNow with other tools for managing waiver nonprofit forms?

Absolutely! airSlate SignNow offers integrations with various popular tools to streamline your workflow. Whether you use CRM systems or project management tools, seamlessly connecting them allows you to manage your waiver nonprofit forms more efficiently, ensuring a smooth process from start to finish.

-

What are the benefits of using airSlate SignNow for waiver nonprofit forms?

Using airSlate SignNow for your waiver nonprofit forms offers numerous benefits, including improved efficiency, enhanced security, and quicker document turnaround. Our platform enables easy tracking of signatures and document status, ensuring that you always stay compliant. Additionally, you can access documents from anywhere, making it convenient for remote teams.

-

Can I customize a waiver nonprofit form template on airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize waiver nonprofit form templates to meet your specific organizational needs. You can add your branding, modify sections, and include any additional information required. This flexibility ensures that your waiver forms reflect your nonprofit's identity and comply with legal requirements.

Get more for Waiver Nonprofit Form

Find out other Waiver Nonprofit Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors