Denial Credit Form

What is the Denial Credit Form

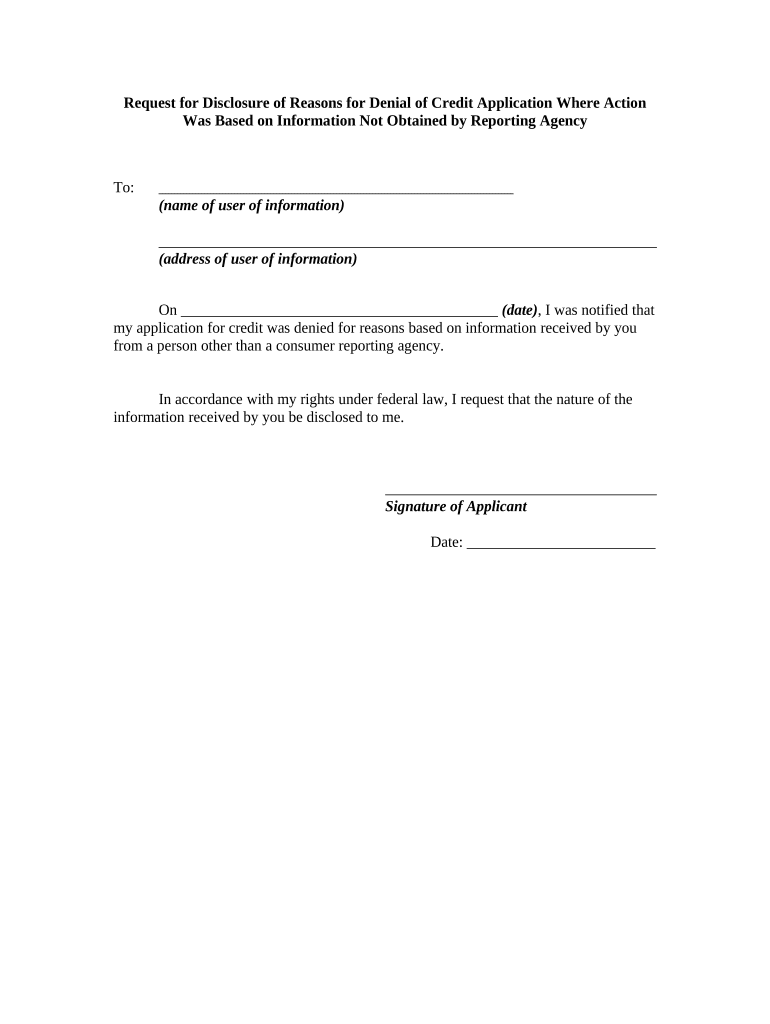

The Denial Credit Form is a crucial document used by individuals and businesses to formally request a review of a credit denial. This form serves as a means for applicants to understand the reasons behind the denial and to clarify any discrepancies in their credit application. It is essential for maintaining transparency in the credit evaluation process, allowing applicants to address issues such as insufficient credit history or a minimum score not met for the product requested.

How to use the Denial Credit Form

Using the Denial Credit Form involves a straightforward process. First, ensure that you have all relevant information regarding your credit application, including the specific reasons for denial. Next, fill out the form with accurate details, clearly stating your request for disclosure. This may include asking for specific documentation or clarification on the denial reasons. Once completed, submit the form as instructed, either online or via mail, depending on the institution's requirements.

Steps to complete the Denial Credit Form

Completing the Denial Credit Form requires careful attention to detail. Follow these steps:

- Gather all necessary information, including your credit report and denial notice.

- Fill out the form with your personal details, including your name, address, and contact information.

- Clearly indicate the reasons for your request, referencing specific denial codes if applicable.

- Provide any additional documentation that supports your case, such as proof of income or corrected credit information.

- Review the form for accuracy and completeness before submission.

Legal use of the Denial Credit Form

The Denial Credit Form is legally recognized and can be used to ensure compliance with various consumer protection laws. It is important to understand that submitting this form does not guarantee approval but allows applicants to formally contest the denial. Compliance with regulations such as the Fair Credit Reporting Act (FCRA) ensures that consumers have the right to dispute inaccuracies in their credit reports, making the Denial Credit Form a vital tool in protecting consumer rights.

Key elements of the Denial Credit Form

Several key elements must be included in the Denial Credit Form to ensure its effectiveness:

- Personal Information: Include your full name, address, and contact details.

- Credit Application Details: Reference the specific credit application in question.

- Denial Reasons: Clearly outline the reasons for denial as stated by the credit issuer.

- Request for Disclosure: Explicitly request the information or documentation you seek.

- Signature: Sign and date the form to validate your request.

Required Documents

When submitting the Denial Credit Form, certain documents may be required to support your request. These may include:

- A copy of the denial notice from the credit issuer.

- Your most recent credit report.

- Proof of income or employment, if applicable.

- Any additional documentation that may clarify your creditworthiness.

Quick guide on how to complete denial credit form

Effortlessly Create Denial Credit Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option compared to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Denial Credit Form on any device with airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

The easiest way to edit and electronically sign Denial Credit Form effortlessly

- Find Denial Credit Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure private information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Denial Credit Form to ensure efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit application form and how can it benefit my business?

A credit application form is a document that allows potential clients to apply for credit. By using an efficient and customizable credit application form, your business can streamline the approval process, reducing time and enhancing customer satisfaction.

-

How does airSlate SignNow simplify the credit application form process?

airSlate SignNow simplifies the credit application form process by offering an intuitive interface for sending, signing, and managing documents. You can create and customize your credit application forms, ensuring a seamless experience for your clients and improving overall efficiency.

-

Can I integrate airSlate SignNow with other business tools for managing credit applications?

Yes, airSlate SignNow supports integrations with various business tools, enabling you to easily sync data from your credit application forms with your existing systems. This helps in automating workflows and enhancing productivity while managing credit applications.

-

What is the pricing structure for using airSlate SignNow for credit application forms?

airSlate SignNow offers flexible pricing plans to fit different business needs. You can select a plan that allows you to use credit application forms without breaking the bank, ensuring you get a cost-effective solution for your document management.

-

Are there any security features in airSlate SignNow for handling credit application forms?

Absolutely! airSlate SignNow prioritizes security for your credit application forms with industry-leading encryption and compliance measures. You can trust that sensitive data submitted in credit applications is protected, giving your clients peace of mind.

-

Can I customize my credit application form with airSlate SignNow?

Yes, with airSlate SignNow, you can easily customize your credit application forms to suit your business needs and branding. This flexibility allows you to include specific fields and instructions to gather the exact information you require from applicants.

-

Is it easy to track the status of credit application forms sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features for credit application forms, enabling you to monitor when forms are sent, viewed, and signed. This transparency helps you stay on top of your credit application process and improves communication with clients.

Get more for Denial Credit Form

- Booster clubs ptas and form

- Counter petition for protection from abuse order et seq kansasjudicialcouncil form

- Wind mitigation reports form

- Solid tumor test requisition upmc molecular amp genomic pathology form

- Job shadow report form

- Ulm iv form

- H1200 form

- Alamance community college transcripts form

Find out other Denial Credit Form

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free