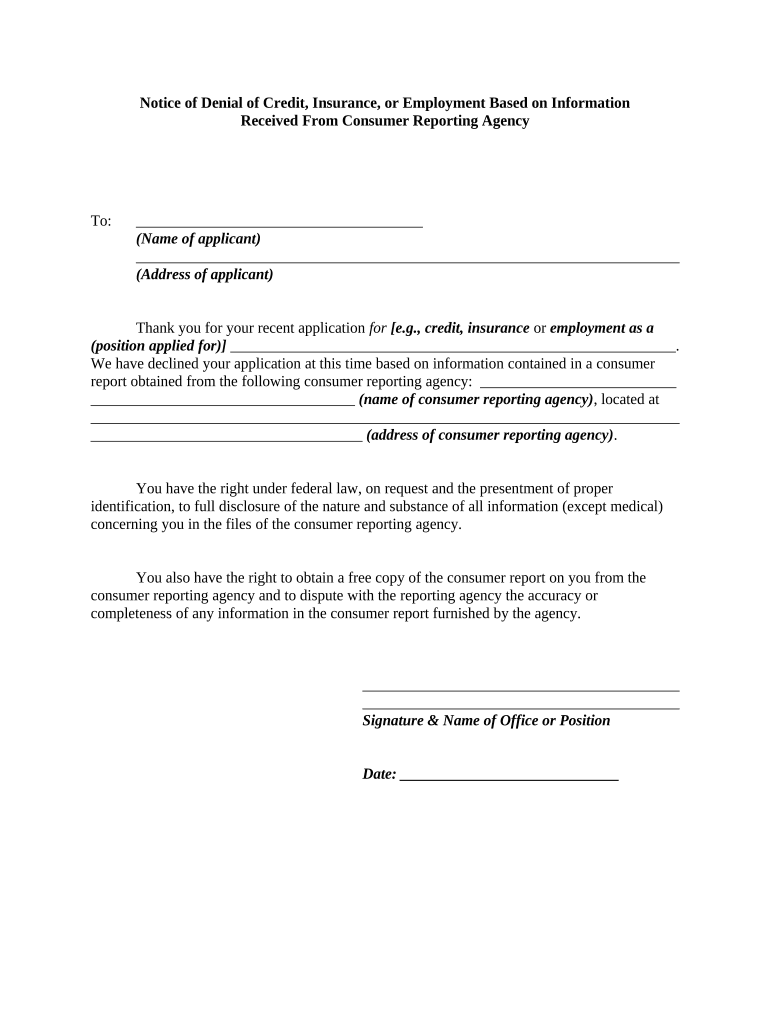

Denial Insurance Form

What is the denial insurance?

Denial insurance is a type of coverage designed to protect individuals and businesses from financial losses resulting from denied insurance claims. It serves as a safety net, ensuring that policyholders can recover some of their losses if their claims are rejected by their insurance providers. This form of insurance is particularly relevant in industries where claims are frequently disputed, such as health care, auto insurance, and property insurance.

How to use the denial insurance

Using denial insurance involves understanding the specific terms and conditions outlined in the policy. Policyholders should maintain thorough documentation of all claims submitted, including correspondence with the insurance company. If a claim is denied, the policyholder can initiate the process of filing for denial insurance by providing the necessary documentation to their insurer. This typically includes the original claim, the denial notice, and any supporting evidence to substantiate the claim.

Key elements of the denial insurance

Several key elements define the effectiveness of denial insurance:

- Coverage Limits: The maximum amount that can be claimed under the policy.

- Exclusions: Specific situations or conditions that are not covered by the insurance.

- Claim Process: The steps required to file a claim, including documentation needed and timelines.

- Premiums: The cost of the insurance policy, which can vary based on coverage limits and risk factors.

Steps to complete the denial insurance

Completing the denial insurance process involves several steps:

- Review your insurance policy to understand the coverage and exclusions.

- Gather all relevant documentation related to the denied claim.

- Contact your insurance provider to initiate the denial insurance claim process.

- Submit the required documents and any additional information requested by the insurer.

- Follow up with your insurer to ensure that your claim is being processed.

Legal use of the denial insurance

The legal use of denial insurance is governed by state and federal regulations. It is essential for policyholders to understand their rights and obligations under the policy. Compliance with all legal requirements ensures that claims are processed smoothly and that the coverage remains valid. Additionally, policyholders should be aware of any specific state laws that may impact their denial insurance, as these can vary significantly across jurisdictions.

Eligibility criteria

Eligibility for denial insurance typically depends on several factors, including:

- Type of Insurance: The specific type of insurance for which denial coverage is being sought.

- Claim History: A history of claims may influence eligibility and premium rates.

- Business Type: Different industries may have unique eligibility requirements based on risk assessments.

Quick guide on how to complete denial insurance

Prepare Denial Insurance smoothly on any device

Managing documents online has gained traction among businesses and individuals. It serves as a great eco-friendly substitute for conventional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without holdups. Manage Denial Insurance on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Denial Insurance with ease

- Obtain Denial Insurance and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Denial Insurance to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is denial insurance and how does it work?

Denial insurance is a financial safeguard that protects businesses from losses due to claim denials by insurance providers. It helps cover costs associated with appeals and resubmissions, ensuring that your organization can maintain cash flow despite unexpected denials. This type of insurance can be beneficial for medical practices and businesses that rely heavily on timely reimbursements.

-

How can airSlate SignNow assist with denial insurance documentation?

airSlate SignNow streamlines the process of sending and signing documents related to denial insurance. With its intuitive platform, businesses can easily create, send, and track essential documents, ensuring compliance and quick response times to denial issues. This enhances efficiency and reduces the administrative burden associated with denial insurance claims.

-

What are the benefits of having denial insurance for my business?

Having denial insurance provides peace of mind by protecting your revenue stream against unexpected claim rejections. It also allows your business to allocate resources more effectively, knowing that some of the potential financial risk is mitigated. Ultimately, this can lead to improved operational stability and growth opportunities.

-

Are there specific features of airSlate SignNow that support denial insurance processes?

Yes, airSlate SignNow offers features such as customizable templates, automated reminders, and tracking tools specifically designed to handle denial insurance documentation efficiently. These features help ensure that all necessary documents are completed accurately and submitted on time, minimizing the risk of additional denials. The platform's integration capabilities further enhance its utility in managing insurance claims.

-

What pricing plans does airSlate SignNow offer for businesses dealing with denial insurance?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses managing denial insurance claims. These plans range from basic to advanced options, allowing you to choose a solution that fits your budget without compromising on essential features. Each plan provides unlimited eSigning capabilities, which is critical for managing denial insurance documentation efficiently.

-

Can airSlate SignNow integrate with other systems for denial insurance management?

Absolutely! airSlate SignNow integrates seamlessly with various healthcare management systems and CRM tools, enhancing the workflow for businesses handling denial insurance. This integration allows for better data synchronization and reduces the chances of errors that can lead to denial issues. By connecting your systems, you can create a cohesive approach to managing insurance claims.

-

How does eSigning with airSlate SignNow improve denial insurance claims?

eSigning with airSlate SignNow accelerates the submission process for denial insurance claims by allowing documents to be signed electronically in real-time. This not only speeds up operations but also provides a clear audit trail that can support your case in the event of a disputed denial. With airSlate SignNow, you can ensure that your claims are filed promptly and accurately.

Get more for Denial Insurance

- Out of network vision services claim form claim form instructions

- Po box 5185 form

- Escheten091901 1019 page 1 of 12 form

- Esa50 form

- 824 10th avenue po box 129 form

- Wire transfer request approval letter form

- 401k nationwide retirement solutions form

- Corporate income tax highlightsarizona department of revenue azdor form

Find out other Denial Insurance

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment