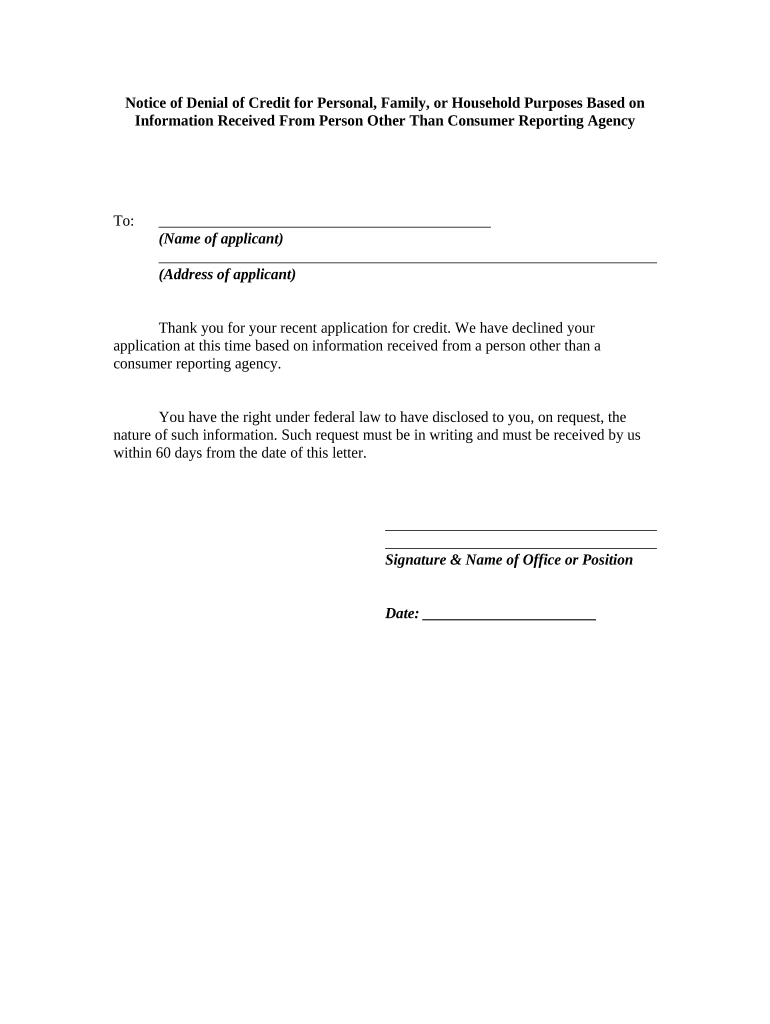

Denial Credit Form Statement

What is the family information form?

The family information form is a document designed to collect essential details about family members for various purposes, such as legal, educational, or health-related needs. This form typically includes sections for personal information, relationships, and contact details of each family member. It serves as a foundational document that helps organizations and institutions understand the family structure and the specific needs of its members.

Key elements of the family information form

When filling out a family information form, several key elements are essential to ensure completeness and accuracy. These include:

- Personal Information: Names, dates of birth, and social security numbers of family members.

- Contact Details: Addresses, phone numbers, and email addresses for each family member.

- Relationship Information: Descriptions of how each member is related (e.g., parent, sibling, guardian).

- Health Information: Any relevant medical history or needs that may affect family members.

- Emergency Contacts: Names and contact information for individuals to reach in case of emergencies.

Steps to complete the family information form

Completing the family information form involves several straightforward steps to ensure that all necessary information is accurately captured. Follow these steps:

- Gather all relevant personal information for each family member.

- Fill in the form systematically, ensuring that each section is completed fully.

- Review the information for accuracy and completeness before submission.

- Sign and date the form as required, ensuring that all parties involved are informed.

- Submit the form through the designated method, whether online or in person.

Legal use of the family information form

The family information form can have legal implications, especially when used in contexts such as custody arrangements, health care decisions, or educational enrollments. It is important to ensure that the information provided is accurate and truthful, as discrepancies can lead to legal challenges or complications. Additionally, organizations must handle the information in compliance with privacy laws, safeguarding the data from unauthorized access.

Who issues the family information form?

The family information form can be issued by various organizations, depending on its intended use. Common issuers include:

- Schools: For enrollment and emergency contact purposes.

- Healthcare Providers: To gather necessary health information for treatment.

- Legal Institutions: For custody or legal matters involving family dynamics.

- Government Agencies: For assistance programs or benefits related to family welfare.

Required documents for the family information form

When completing the family information form, certain supporting documents may be required to verify the information provided. These may include:

- Birth certificates for each family member.

- Proof of residency, such as utility bills or lease agreements.

- Identification documents, like driver's licenses or passports.

- Medical records if health information is requested.

Quick guide on how to complete denial credit form statement

Easily Prepare Denial Credit Form Statement on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct template and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Denial Credit Form Statement on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Denial Credit Form Statement Effortlessly

- Find Denial Credit Form Statement and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Denial Credit Form Statement and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a family information form?

A family information form is a document used to gather essential details about family members. It helps organizations collect and manage relevant family information efficiently, especially in contexts like healthcare or educational settings. airSlate SignNow makes it easy to create and manage these forms digitally.

-

How can airSlate SignNow improve my family information form process?

airSlate SignNow streamlines the process of creating, sending, and signing family information forms. With an intuitive interface, users can customize these forms to fit their needs, ensuring that all necessary data is collected seamlessly. This efficiency allows organizations to focus more on their core activities rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for family information forms?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. Each plan includes features tailored for managing documents, including family information forms. Potential customers can choose a plan that best fits their budget and needs.

-

Can I integrate airSlate SignNow with other applications for managing family information forms?

Absolutely! airSlate SignNow provides integration options with popular applications like Salesforce, Google Drive, and Zapier. By integrating these tools, you can streamline the workflow associated with family information forms and enhance your overall operational efficiency.

-

What features does airSlate SignNow offer for family information forms?

airSlate SignNow offers several features geared towards enhancing the handling of family information forms. These include customizable templates, electronic signing, secure document storage, and real-time tracking of your forms. These features ensure that your family information forms are managed efficiently and securely.

-

How secure is the data collected through family information forms in airSlate SignNow?

Data security is a top priority for airSlate SignNow. All family information forms and sensitive data are protected with encryption protocols and secure cloud storage. This ensures that your information is kept safe and compliant with various regulations.

-

Can I access my family information forms from mobile devices?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing users to access and manage family information forms from any mobile device. This flexibility makes it easy to collect and process information on-the-go, improving workflow and productivity.

Get more for Denial Credit Form Statement

- Classroom behavior evaluation form

- University emergency action plan form

- Emily durst awarddocx ryerson form

- Human population growth computer lab activity answer key form

- Inter generational faith formation registration form

- Unam online application form

- Ferpa release form stephen phillips memorial scholarship fund

- Planned absence request south burlington high school sbsd sbhs schoolfusion form

Find out other Denial Credit Form Statement

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe