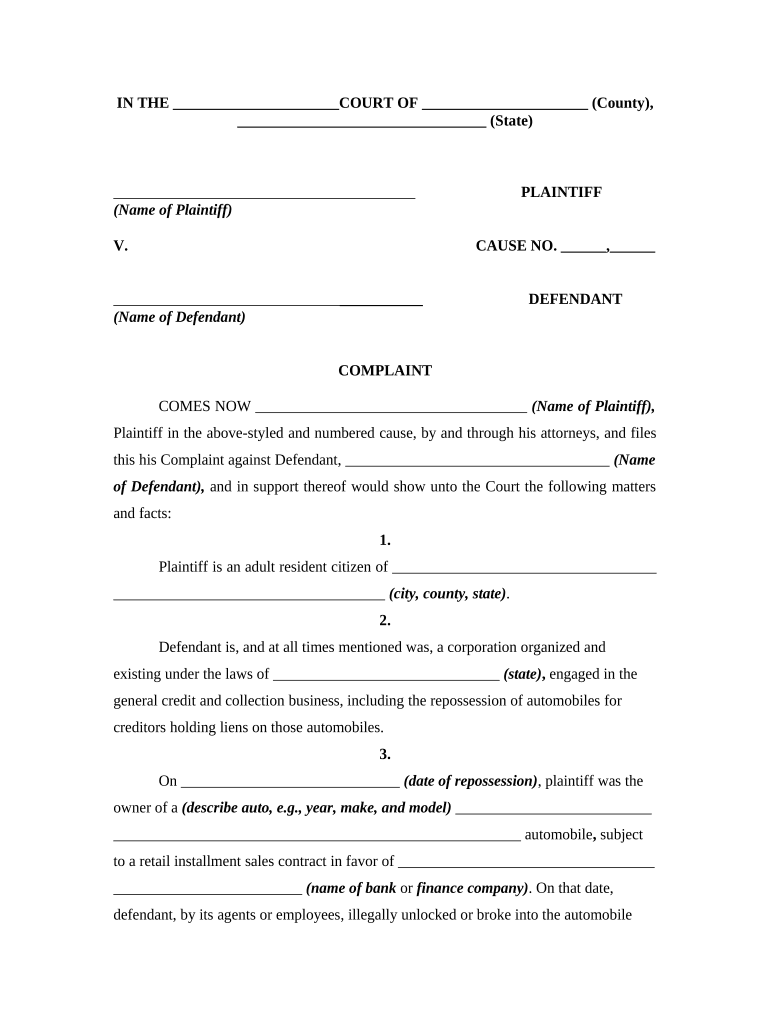

Repossession Form

What is wrongful repossession?

Wrongful repossession occurs when a lender or creditor takes possession of a vehicle or property without following the legal process or without a valid reason. This can happen due to errors in documentation, failure to provide proper notice, or repossession conducted without a court order when required. Understanding the definition and implications of wrongful repossession is crucial for individuals who may face this situation, as it can lead to significant financial and emotional distress.

Key elements of wrongful repossession

Several key elements can define wrongful repossession, including:

- Failure to notify: Creditors must provide proper notice before repossessing a vehicle. Lack of notification can render the repossession illegal.

- Improper procedure: If a repossession is conducted without following state laws or contractual agreements, it may be deemed wrongful.

- Payment disputes: If a borrower is current on payments or has made arrangements with the lender, repossession may be unjustified.

- Excessive force: Using intimidation or violence during repossession can lead to claims of wrongful repossession.

Steps to complete a wrongful repossession complaint

Filing a complaint regarding wrongful repossession involves several important steps:

- Gather documentation: Collect all relevant documents, including loan agreements, payment records, and any correspondence with the lender.

- Identify violations: Clearly outline how the repossession violated your rights or the terms of the agreement.

- Consult legal counsel: Seek advice from an attorney specializing in consumer rights or repossession law to evaluate your case.

- File a complaint: Submit your complaint to the appropriate regulatory agency or court, ensuring all required forms are completed accurately.

Legal use of repossession forms

Using repossession forms legally requires adherence to specific regulations. These forms must be filled out accurately and submitted according to state laws. Ensuring compliance with the Uniform Commercial Code (UCC) and other relevant statutes is essential. Additionally, electronic signatures can be utilized, provided they meet legal standards, ensuring the documents are recognized in court if necessary.

Eligibility criteria for wrongful repossession claims

To pursue a wrongful repossession claim, certain eligibility criteria must be met:

- Proof of ownership: You must demonstrate that you legally own the vehicle or property that was repossessed.

- Documentation of payments: Evidence showing that payments were made on time or that disputes were raised with the lender is necessary.

- Timeliness: Claims must be filed within a specific timeframe, often dictated by state laws regarding repossession.

Examples of wrongful repossession

Examples of wrongful repossession can help clarify what constitutes this situation:

- A borrower is current on their payments but the lender repossesses the vehicle without notice.

- A creditor uses excessive force or intimidation to take possession of a vehicle.

- A vehicle is repossessed without a court order when one is required by state law.

Quick guide on how to complete repossession 497330026

Set Up Repossession effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Repossession on any device with airSlate SignNow's Android or iOS apps and enhance any document-related operation today.

How to modify and eSign Repossession with ease

- Find Repossession and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes merely seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Repossession and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is wrongful repossession?

Wrongful repossession occurs when a lender repossesses a vehicle or property without following the proper legal procedures. This can lead to financial and emotional stress for the affected individuals. Understanding wrongful repossession is essential for anyone facing this situation, as it may allow them to dispute the repossession legally.

-

How can airSlate SignNow assist in wrongful repossession cases?

airSlate SignNow provides businesses and legal professionals with tools to create, send, and eSign important documents related to wrongful repossession cases. By streamlining document management, it ensures timely responses to repossession notices. This can be crucial in building an effective case against wrongful repossession.

-

What features does airSlate SignNow offer that are relevant to wrongful repossession?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage for documents. These features help create legally binding documents that can support claims in wrongful repossession situations. Simplifying the documentation process is essential for addressing wrongful repossession claims effectively.

-

Is airSlate SignNow cost-effective for handling wrongful repossession cases?

Yes, airSlate SignNow offers a range of pricing plans suited for businesses of all sizes, making it a cost-effective solution for handling wrongful repossession cases. With affordable options, you can access powerful features without breaking the bank. Investing in such a solution can save time and resources when managing legal documents.

-

What benefits does airSlate SignNow provide for those dealing with wrongful repossession?

Using airSlate SignNow signNowly improves efficiency by automating the document signing process, which is crucial in wrongful repossession cases. The platform enhances communication and collaboration among involved parties, ensuring that every document is signed promptly. This can be a game-changer in resolving wrongful repossession disputes swiftly.

-

Can airSlate SignNow integrate with other tools for wrongful repossession management?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage wrongful repossession cases more effectively. Whether you're using CRM software or document management systems, these integrations enhance your workflow and ensure that all related documents are accessible in one place.

-

How secure is airSlate SignNow in handling wrongful repossession documents?

airSlate SignNow takes document security seriously, employing advanced encryption and compliance measures to protect your information. This is particularly important in wrongful repossession cases, where sensitive data needs to be safeguarded. You can confidently send and store documents knowing they are secure.

Get more for Repossession

- Teacher recommendation form for cheerleaders bishop kelly

- Omb no 1845 0074 expiration date 09302015 form

- Tsu forms

- Informed consent form counseling and wellness center

- Myer and lois franklin scholarship form

- Vocal jury form doc

- Request to graduate notice of intent manhattanville college form

- Tardy slip pdf form

Find out other Repossession

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free