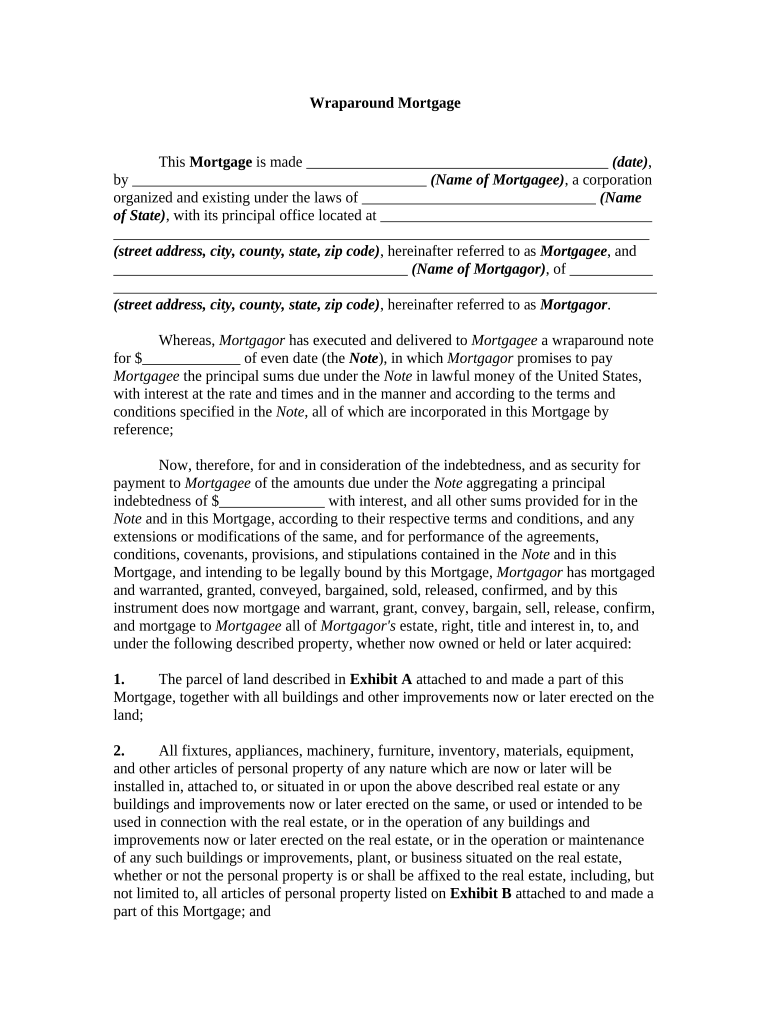

Wraparound Mortgage Form

What is the Wraparound Mortgage

A wraparound mortgage is a type of financing that allows a buyer to purchase a property while the seller retains the original mortgage. This arrangement involves the seller creating a new mortgage that "wraps around" the existing loan, allowing the buyer to make payments to the seller, who then continues to pay the original lender. This method can be beneficial in situations where traditional financing is difficult to obtain, as it offers flexibility and can simplify the transaction process.

How to use the Wraparound Mortgage

Using a wraparound mortgage involves several key steps. First, both the buyer and seller must agree on the terms, including the interest rate and payment schedule. It is essential to ensure that the existing mortgage allows for this type of arrangement, as some lenders may have restrictions. Once agreed upon, a legal document outlining the terms must be drafted. This document should clearly state the obligations of both parties and include any necessary disclosures. Finally, both parties should sign the agreement, ideally in the presence of a notary to enhance its legal standing.

Steps to complete the Wraparound Mortgage

Completing a wraparound mortgage involves a series of organized steps:

- Negotiate the terms between the buyer and seller.

- Confirm that the existing mortgage allows for a wraparound arrangement.

- Draft a legal agreement detailing the terms of the wraparound mortgage.

- Include necessary disclosures and ensure compliance with local laws.

- Sign the agreement in the presence of a notary public.

- Make initial payments as outlined in the agreement.

Legal use of the Wraparound Mortgage

The legal use of a wraparound mortgage requires adherence to specific regulations. Both parties must ensure that the agreement complies with state and federal laws governing real estate transactions. It is also important to verify that the original mortgage does not contain a due-on-sale clause, which could trigger the loan's full repayment upon transfer of ownership. Consulting with a real estate attorney can provide clarity on the legal implications and help ensure that all documentation is correctly prepared and executed.

Key elements of the Wraparound Mortgage

Several key elements define a wraparound mortgage:

- Principal Amount: The total amount financed through the wraparound mortgage.

- Interest Rate: The rate at which interest is charged on the wraparound loan, which may differ from the original mortgage.

- Payment Schedule: The timeline for payments, including due dates and amounts.

- Duration: The length of the wraparound mortgage, which can vary based on the agreement.

- Legal Documentation: A formal agreement that outlines all terms and conditions.

Examples of using the Wraparound Mortgage

Wraparound mortgages can be particularly useful in various scenarios. For instance, a buyer with poor credit may find it challenging to secure traditional financing. In such cases, a seller willing to finance the purchase through a wraparound mortgage can facilitate the sale. Another example includes situations where a property has significant equity, allowing the seller to offer favorable terms to attract buyers. This financing method can also be advantageous in a competitive real estate market, where buyers may need to act quickly.

Quick guide on how to complete wraparound mortgage

Effortlessly Prepare Wraparound Mortgage on Any Device

Online document oversight has grown increasingly favored among businesses and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the necessary tools to compose, modify, and electronically sign your documents promptly without holdups. Manage Wraparound Mortgage on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related task today.

How to Modify and Electronically Sign Wraparound Mortgage With Ease

- Obtain Wraparound Mortgage and select Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Wraparound Mortgage while ensuring seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wraparound Mortgage?

A Wraparound Mortgage is a type of financing that allows the buyer to assume the existing mortgage while wrapping it in a new loan. This can be beneficial for both buyers and sellers, as it often simplifies the transaction process. It enables buyers to make payments on both loans together, usually resulting in lower interest rates and increased flexibility.

-

How does a Wraparound Mortgage benefit buyers?

Buyers benefit from a Wraparound Mortgage by potentially accessing better interest rates and terms than they would through traditional financing. This structure can make purchasing a property more affordable, especially in a competitive market. Additionally, it allows for more straightforward negotiations between buyers and sellers.

-

What are the risks associated with a Wraparound Mortgage?

While a Wraparound Mortgage can offer advantages, there are risks to consider. If the seller defaults on the original mortgage, the buyer could lose their investment. Therefore, it's essential for buyers to conduct thorough due diligence and consult with financial professionals before proceeding with this type of financing.

-

Can a Wraparound Mortgage be used with other loan types?

Yes, a Wraparound Mortgage can be combined with various loan types, allowing for versatility in financing options. Many lenders allow this structure alongside conventional loans or even seller financing. It is advisable to check with financial experts to see how it integrates with different lending scenarios.

-

What features should I look for in a Wraparound Mortgage?

When seeking a Wraparound Mortgage, look for features like flexible payment options, competitive interest rates, and straightforward terms. It's also important to find a knowledgeable lender who understands this financing method and can provide guidance throughout the process. Evaluating all features will help you make a wise financial decision.

-

How can I determine if a Wraparound Mortgage is right for me?

To determine if a Wraparound Mortgage is right for you, assess your financial situation, credit history, and long-term goals. Consulting with a real estate agent or mortgage expert can provide insights into whether this option aligns with your needs. This personalized analysis is crucial for making informed decisions about property investment.

-

What should sellers know about Wraparound Mortgages?

Sellers considering a Wraparound Mortgage should understand how it can expedite the sale process and potentially yield a higher price. It’s important to clearly outline the terms in the purchase agreement to avoid misunderstandings later. Additionally, sellers must assess their existing mortgage's conditions before proceeding with a Wraparound Mortgage.

Get more for Wraparound Mortgage

Find out other Wraparound Mortgage

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF