Credit Application Form for Motorcycle Loan

What is the Credit Application Form for Motorcycle Loan

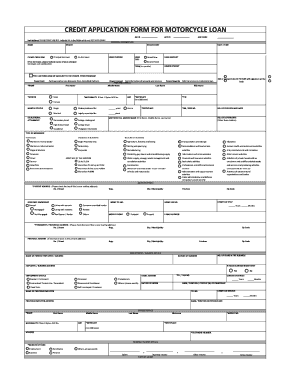

The credit application form for a motorcycle loan is a crucial document used by lenders to evaluate a borrower's financial situation and creditworthiness. This form typically requires personal information such as the applicant's name, address, Social Security number, and employment details. Additionally, it may ask for information about the motorcycle being financed, including its make, model, and purchase price. The information provided helps lenders determine the terms of the loan, including interest rates and repayment schedules.

Steps to Complete the Credit Application Form for Motorcycle Loan

Completing the credit application form for a motorcycle loan involves several key steps to ensure accuracy and completeness. First, gather all necessary documents, such as proof of income, identification, and any existing loan information. Next, fill out the application form with precise details, ensuring that all sections are addressed. It's important to review the form thoroughly for any errors or omissions before submission. Finally, submit the completed form either online or in person, depending on the lender's requirements.

Legal Use of the Credit Application Form for Motorcycle Loan

The legal use of the credit application form for a motorcycle loan is governed by various regulations that protect both the lender and the borrower. This includes compliance with the Equal Credit Opportunity Act (ECOA), which prohibits discrimination in lending practices. Additionally, lenders must adhere to the Fair Credit Reporting Act (FCRA), ensuring that the information obtained from credit reports is accurate and used appropriately. Understanding these legal frameworks is essential for both parties during the loan application process.

Eligibility Criteria for the Credit Application Form for Motorcycle Loan

Eligibility criteria for the credit application form for a motorcycle loan typically include factors such as age, income, credit score, and employment status. Most lenders require applicants to be at least eighteen years old and have a stable source of income to demonstrate their ability to repay the loan. A good credit score can significantly enhance the chances of approval and may lead to more favorable loan terms. It's advisable for applicants to check their credit reports beforehand to identify any issues that may affect their eligibility.

How to Obtain the Credit Application Form for Motorcycle Loan

The credit application form for a motorcycle loan can be obtained through various channels. Most lenders provide the form on their official websites, allowing applicants to download and print it. Additionally, applicants can visit local dealerships or financial institutions to request a physical copy. Some lenders also offer the option to complete the application online, streamlining the process and allowing for quicker submission.

Form Submission Methods for the Credit Application Form for Motorcycle Loan

Submitting the credit application form for a motorcycle loan can be done through several methods, depending on the lender's policies. Common submission methods include online applications, which are often the fastest and most convenient option. Alternatively, applicants may choose to submit the form via mail or in person at a local branch or dealership. It is essential to follow the lender's specific instructions for submission to ensure timely processing of the application.

Quick guide on how to complete credit application form for motorcycle loan

Complete Credit Application Form For Motorcycle Loan effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the features you require to create, modify, and electronically sign your documents quickly without any delays. Handle Credit Application Form For Motorcycle Loan on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Credit Application Form For Motorcycle Loan without effort

- Obtain Credit Application Form For Motorcycle Loan and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of missing or lost files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choosing. Alter and electronically sign Credit Application Form For Motorcycle Loan to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application form for motorcycle loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a motortrade motorcycle loan?

A motortrade motorcycle loan is a financing option specifically designed for purchasing motorcycles. With competitive rates and flexible terms, this type of loan helps you acquire your dream bike while managing your budget effectively. It is ideal for both private buyers and those in the motorcycle trade.

-

What are the benefits of a motortrade motorcycle loan?

The benefits of a motortrade motorcycle loan include lower interest rates compared to personal loans, tailored repayment terms, and the ability to finance new or used motorcycles. This loan type also enables you to retain cash for other needs while ensuring you can purchase the motorcycle you desire with ease.

-

How do I apply for a motortrade motorcycle loan?

Applying for a motortrade motorcycle loan is straightforward. Simply complete an online application through your chosen lender, providing necessary financial information and details about the motorcycle. The approval process is usually quick, enabling you to get on the road faster.

-

What documents do I need for a motortrade motorcycle loan?

To secure a motortrade motorcycle loan, you typically need to provide identification, proof of income, and details about the motorcycle you intend to purchase. Some lenders may also request your credit report to assess your eligibility, ensuring a smooth application process.

-

Are there specific eligibility criteria for a motortrade motorcycle loan?

Eligibility criteria for a motortrade motorcycle loan commonly include being of legal age, having a steady income, and a positive credit history. Some lenders may also consider the motorcycle's age and value, making it crucial to understand your chosen lender's specific requirements.

-

Can I refinance my existing motortrade motorcycle loan?

Yes, refinancing an existing motortrade motorcycle loan is often possible. This option allows you to take advantage of better interest rates or change the terms of your loan for improved payment flexibility. It’s advisable to compare potential savings before proceeding with refinancing.

-

What features should I look for in a motortrade motorcycle loan?

When evaluating a motortrade motorcycle loan, consider features like competitive interest rates, flexible repayment terms, and the lender's reputation. Additionally, look for options that include quick approvals and excellent customer service, ensuring a hassle-free experience throughout the loan period.

Get more for Credit Application Form For Motorcycle Loan

- Offer in compromise e form rs login

- Form 4506 t request for transcript of tax return official

- How to report hazards unsafe conditions or practices with ps form 1767

- Alberta personal tax credits return form

- Form fl clkct 141 fill online printable

- Be 008 pdf form

- This form must be typewritten or computer generated 644853167

- Board of bar examiners university of wisconsin law school form

Find out other Credit Application Form For Motorcycle Loan

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation