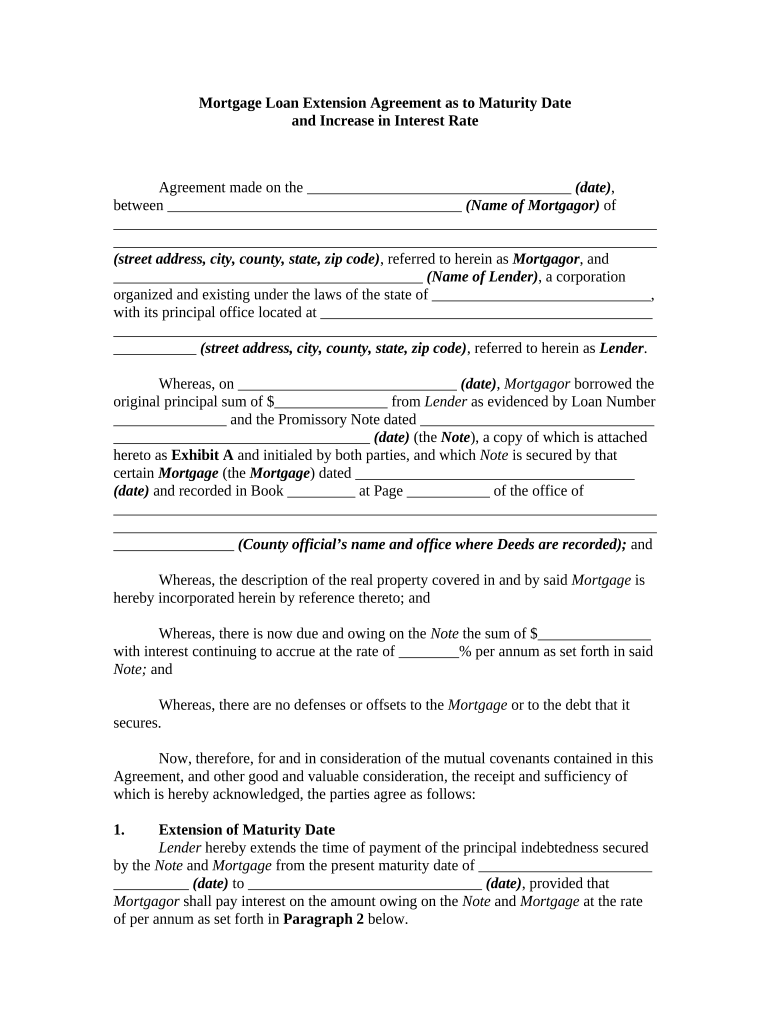

Mortgage Loan Extension Form

What is the mortgage loan extension?

A mortgage loan extension is a formal agreement between a borrower and a lender that allows the borrower to extend the term of their mortgage loan. This process can provide additional time for the borrower to repay the outstanding balance, which may be beneficial in situations where financial difficulties arise. The extension can help avoid foreclosure and provide the borrower with a more manageable repayment schedule.

Typically, the extension involves a review of the borrower’s financial situation and may require documentation to ensure that the borrower can meet the new terms. It is important to understand the implications of extending a mortgage, including any potential changes in interest rates or monthly payments.

How to obtain the mortgage loan extension

To obtain a mortgage loan extension, borrowers should start by contacting their lender to discuss their options. It is advisable to gather relevant financial documents, such as income statements, tax returns, and current mortgage details, to facilitate the discussion.

Once the lender has assessed the borrower's situation, they may present options for extending the loan. This could involve modifying the existing loan terms or creating a new agreement. Borrowers should carefully review any proposed changes and ensure they understand the terms before proceeding.

Steps to complete the mortgage loan extension

Completing a mortgage loan extension involves several key steps:

- Contact your lender to express your interest in extending your mortgage.

- Gather necessary financial documentation, including proof of income and current loan information.

- Submit a formal request for an extension, along with the required documents.

- Review the lender's proposal for the new terms of the loan extension.

- Sign the mortgage loan extension agreement once all terms are agreed upon.

Following these steps can help ensure a smooth process for extending your mortgage loan.

Legal use of the mortgage loan extension

The legal use of a mortgage loan extension is governed by state and federal regulations. It is essential that both parties adhere to the terms outlined in the extension agreement to ensure its enforceability. This includes proper documentation and signatures, which can be facilitated through electronic signing platforms.

Compliance with laws such as the Electronic Signatures in Global and National Commerce Act (ESIGN) is crucial to validate the agreement. Borrowers should also be aware of their rights and obligations under the extension to avoid any legal complications in the future.

Key elements of the mortgage loan extension

Key elements of a mortgage loan extension typically include:

- Loan term: The new duration for the mortgage repayment.

- Interest rate: Any changes to the interest rate that may apply during the extension.

- Monthly payments: Adjustments to the monthly payment amount based on the new terms.

- Fees: Any associated fees for processing the extension.

- Documentation: Required paperwork that must be completed and signed by both parties.

Understanding these elements can help borrowers make informed decisions regarding their mortgage loan extension.

Examples of using the mortgage loan extension

There are various scenarios in which a mortgage loan extension may be beneficial:

- A borrower experiencing temporary financial hardship may seek an extension to avoid default.

- Homeowners planning to sell their property may extend their mortgage to align with the sale timeline.

- Borrowers who wish to refinance may use an extension to maintain their current loan while exploring options.

These examples illustrate how a mortgage loan extension can provide flexibility and support during challenging financial times.

Quick guide on how to complete mortgage loan extension

Complete Mortgage Loan Extension effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Mortgage Loan Extension on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Mortgage Loan Extension with ease

- Obtain Mortgage Loan Extension and click on Get Form to begin.

- Make use of the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced paperwork, tedious document searching, or mistakes that require reprinting documents. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Mortgage Loan Extension to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage loan extension?

A mortgage loan extension allows you to prolong your mortgage agreement, giving you extra time to repay your loan. It can be a beneficial option when you're facing financial difficulties or need more flexibility in payment terms. Understanding mortgage loan extensions can help you make informed decisions about your financial future.

-

How can airSlate SignNow assist with mortgage loan extensions?

airSlate SignNow streamlines the document signing process for mortgage loan extensions, making it easy to eSign necessary paperwork. Our platform allows you to manage your mortgage documents securely and efficiently, ensuring you never miss important deadlines. Using airSlate SignNow for mortgage loan extensions can save you time and reduce stress.

-

Is there a cost associated with using airSlate SignNow for mortgage loan extensions?

Yes, while airSlate SignNow offers competitive pricing, the cost may vary based on your specific needs and usage. We provide various subscription plans that cater to different users, ensuring you find a cost-effective solution for processing your mortgage loan extension documents. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for mortgage loan extensions?

airSlate SignNow offers a range of features tailored for mortgage loan extensions, including customizable templates, document tracking, and team collaboration tools. Our platform is designed to enhance the efficiency of the signing process. With advanced security and compliance measures, you can trust airSlate SignNow to manage your mortgage loan extension securely.

-

What are the benefits of using airSlate SignNow for mortgage-related documents?

Using airSlate SignNow for mortgage-related documents, including loan extensions, provides speed, convenience, and enhanced security. You'll enjoy the ease of electronic signatures, which can expedite the approval process signNowly. Ultimately, adopting airSlate SignNow can lead to a more streamlined and efficient mortgage loan extension experience.

-

Can I integrate airSlate SignNow with other mortgage management tools?

Absolutely! airSlate SignNow integrates seamlessly with various mortgage management tools and CRMs. This integration simplifies the process by allowing you to manage all aspects of mortgage loan extensions in one place, enhancing productivity and collaboration across your teams. Check our integrations page to see compatible platforms.

-

How secure is using airSlate SignNow for mortgage loan extension documents?

Security is a top priority for airSlate SignNow. We employ bank-level encryption and compliance measures to protect your mortgage loan extension documents. With our robust security protocols, you can have peace of mind knowing that your sensitive information is safeguarded throughout the eSigning process.

Get more for Mortgage Loan Extension

Find out other Mortgage Loan Extension

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now