Dissolving Business Form

What is the dissolving business?

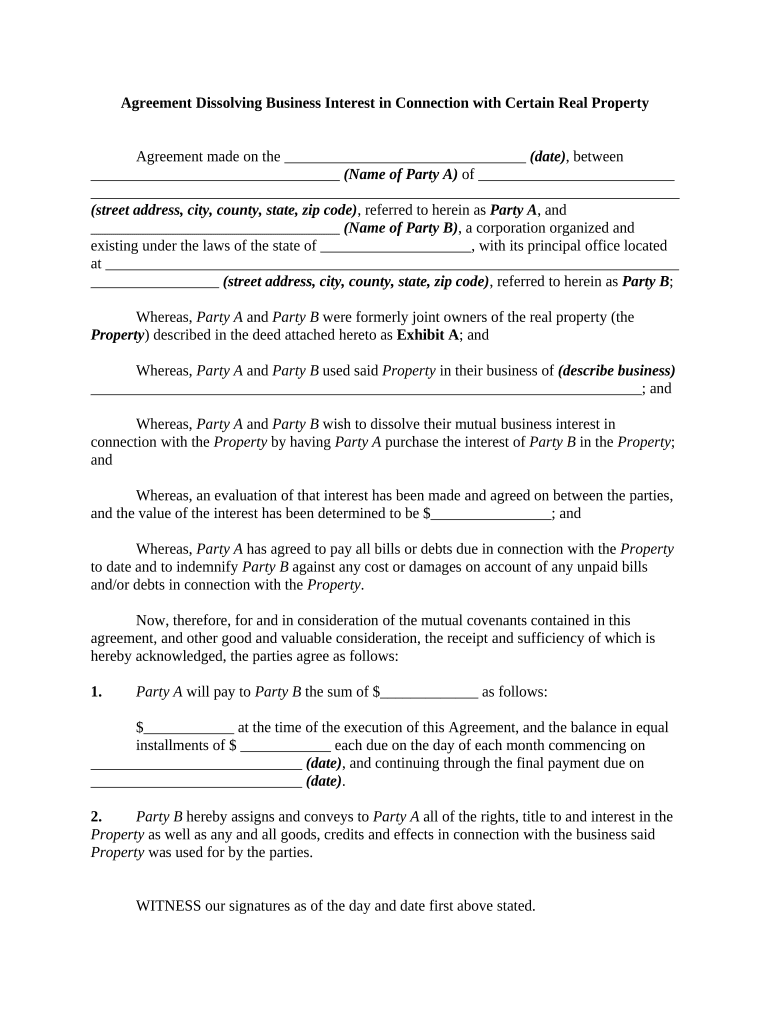

The dissolving business refers to the legal process through which a business entity ceases its operations and is formally dissolved. This process involves settling debts, distributing remaining assets, and filing necessary documents with state authorities. The dissolution can occur voluntarily, initiated by the owners, or involuntarily, often due to legal issues or failure to comply with state regulations. Understanding the implications of dissolving a business is crucial for owners to ensure compliance with legal requirements and to protect their interests.

Steps to complete the dissolving business

Completing the dissolving business involves several key steps to ensure a smooth transition. First, the owners should hold a meeting to discuss and agree on the decision to dissolve. Next, they must settle any outstanding debts and obligations. Following this, the owners should prepare and file the dissolution documents with the appropriate state agency. This typically includes a certificate of dissolution and may require additional forms depending on the business structure. Finally, it is essential to notify stakeholders, including employees, customers, and suppliers, about the dissolution.

Legal use of the dissolving business

The legal use of the dissolving business is governed by state laws, which dictate the procedures and requirements for dissolution. It is important for business owners to follow these legal guidelines to avoid potential penalties or complications. Proper documentation must be filed, and all financial obligations must be settled to ensure that the dissolution is recognized legally. Failure to adhere to these regulations can lead to personal liability for the owners and potential legal disputes.

Required documents

When dissolving a business, several documents are typically required to formalize the process. These may include:

- Certificate of dissolution or articles of dissolution

- Final tax returns and any necessary tax clearance certificates

- Records of meetings or resolutions from owners agreeing to dissolve

- Notices to creditors and stakeholders

Gathering and submitting these documents accurately is essential for a legally recognized dissolution.

State-specific rules for the dissolving business

Each state in the United States has its own rules and regulations regarding the dissolution of businesses. These rules can vary significantly, affecting the required documentation, filing fees, and timelines. Business owners should consult their state's Secretary of State website or a legal professional to understand the specific requirements applicable in their jurisdiction. Adhering to state-specific rules ensures compliance and helps prevent delays or complications during the dissolution process.

Examples of using the dissolving business

Examples of when a business might choose to dissolve include:

- A partnership that has reached the end of its term and is not renewing.

- A corporation that has incurred significant losses and cannot continue operations.

- A sole proprietorship that the owner decides to close due to personal reasons or retirement.

These scenarios illustrate the various situations in which business owners may need to initiate the dissolving process.

Quick guide on how to complete dissolving business

Effortlessly Complete Dissolving Business on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without complications. Manage Dissolving Business across any platform with the airSlate SignNow apps for Android or iOS, simplifying any document-related task today.

The Easiest Way to Modify and eSign Dissolving Business Effortlessly

- Find Dissolving Business and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Dissolving Business and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is agreement dissolving and how does it work?

Agreement dissolving is the process of formally terminating a contract or arrangement between parties. With airSlate SignNow, users can easily create, send, and eSign documents that facilitate this process, ensuring all parties acknowledge the dissolution in a secure manner.

-

What features does airSlate SignNow offer for agreement dissolving?

airSlate SignNow offers a range of features to support agreement dissolving, including customizable templates, electronic signatures, and document tracking. These tools simplify the dissolution process, ensuring that all required documents are completed and signed efficiently.

-

Is airSlate SignNow cost-effective for businesses managing agreement dissolving?

Yes, airSlate SignNow is a cost-effective solution for businesses managing agreement dissolving. It offers various pricing plans to fit different business needs, ensuring that users can handle document management without breaking the bank.

-

Can airSlate SignNow integrate with other applications for agreement dissolving?

Absolutely! airSlate SignNow integrates with numerous applications such as Google Drive, Dropbox, and Salesforce to streamline the agreement dissolving process. This connectivity allows businesses to manage documents more effectively across their existing software ecosystem.

-

What are the benefits of using airSlate SignNow for agreement dissolving?

Using airSlate SignNow for agreement dissolving provides businesses with a fast, secure, and efficient method to terminate contracts. This platform reduces paperwork, increases productivity, and ensures compliance, making it easier for teams to focus on core activities.

-

How secure is airSlate SignNow for agreement dissolving transactions?

airSlate SignNow employs advanced security measures, including encryption and secure access protocols, to ensure the safety of documents during agreement dissolving. Your sensitive information is well-protected, giving you peace of mind as you manage your legal documents.

-

How long does it take to finalize an agreement dissolving using airSlate SignNow?

Finalizing an agreement dissolving with airSlate SignNow can be done in minutes, depending on the number of signers involved. The platform’s intuitive interface and rapid eSigning capabilities signNowly shorten the time it takes to complete this process.

Get more for Dissolving Business

Find out other Dissolving Business

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation