Retirement Cash Flow Form

What is the Retirement Cash Flow

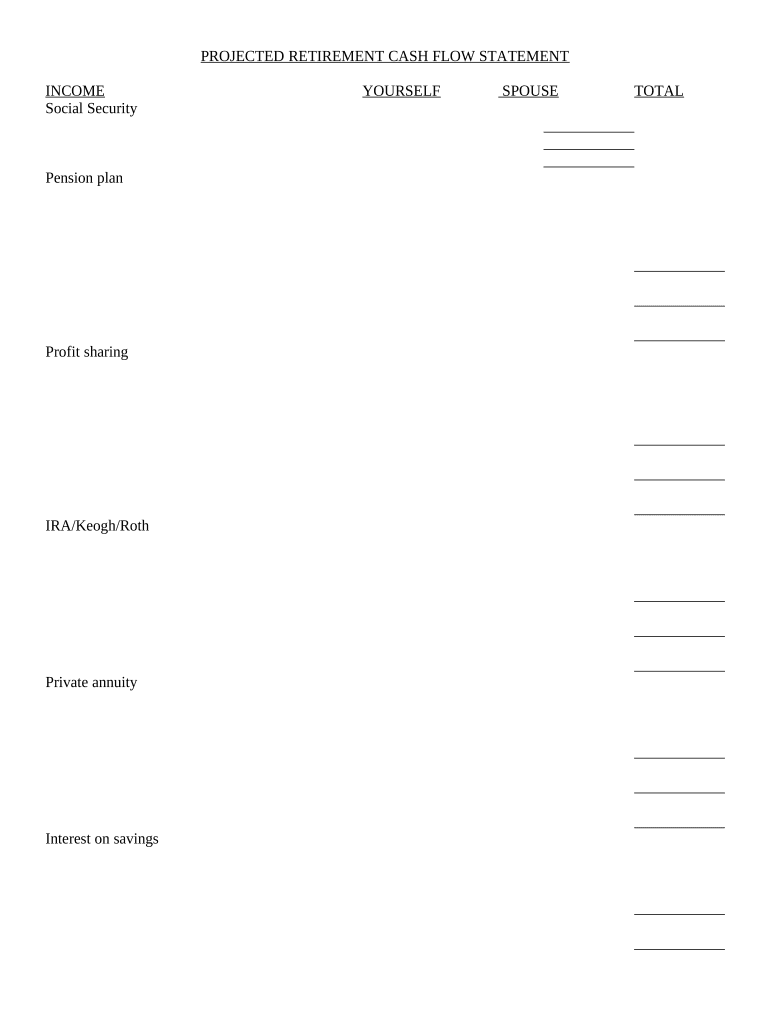

The Retirement Cash Flow form is a crucial document that helps individuals assess their income and expenses during retirement. This form typically outlines various sources of income, such as Social Security benefits, pensions, and retirement account withdrawals. It also includes anticipated expenses, allowing retirees to estimate their cash flow needs effectively. Understanding this flow is essential for financial planning, ensuring that individuals can maintain their desired lifestyle without running out of funds.

How to use the Retirement Cash Flow

Using the Retirement Cash Flow form involves several steps that facilitate effective financial planning. First, gather all relevant financial information, including income sources and expected expenses. Next, fill out the form by entering your income details, such as monthly Social Security payments and any pension distributions. After that, list your projected monthly expenses, including housing costs, healthcare, and leisure activities. Finally, review the completed form to ensure accuracy and make any necessary adjustments to align with your retirement goals.

Steps to complete the Retirement Cash Flow

Completing the Retirement Cash Flow form requires a systematic approach:

- Gather Financial Documents: Collect statements from retirement accounts, bank accounts, and any other income sources.

- List Income Sources: Document all expected income, including Social Security, pensions, and investment income.

- Estimate Expenses: Create a comprehensive list of monthly expenses, factoring in both fixed and variable costs.

- Fill Out the Form: Input all gathered information into the Retirement Cash Flow form accurately.

- Review and Adjust: Examine the completed form for any discrepancies and adjust figures as needed to reflect realistic expectations.

Legal use of the Retirement Cash Flow

The Retirement Cash Flow form is legally recognized when completed accurately and honestly. It serves as an important tool for financial planning and can be used to support applications for loans or other financial products. To ensure its legal standing, users must adhere to relevant regulations surrounding financial disclosures and maintain accurate records of the information provided. Additionally, utilizing a secure platform for electronic signatures can enhance the form's legal validity.

Key elements of the Retirement Cash Flow

Several key elements are essential to the Retirement Cash Flow form:

- Income Sources: This includes Social Security, pensions, and any other retirement income.

- Monthly Expenses: A detailed breakdown of all expected expenses during retirement.

- Net Cash Flow: The difference between total income and total expenses, indicating whether funds will be sufficient.

- Assumptions: Any assumptions made regarding inflation, investment returns, and changes in expenses should be documented.

Examples of using the Retirement Cash Flow

Examples of utilizing the Retirement Cash Flow form can illustrate its practical applications. For instance, a retiree may use the form to determine if their Social Security benefits, combined with a pension, will cover their monthly living expenses. Another example could involve a couple planning for healthcare costs, where they estimate future medical expenses against their retirement income. These scenarios highlight how the form aids in making informed financial decisions and adjustments to retirement plans.

Quick guide on how to complete retirement cash flow

Complete Retirement Cash Flow effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional paper documents, as you can easily find the needed form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without hindrances. Manage Retirement Cash Flow on any device using the airSlate SignNow apps for Android or iOS and simplify any document-driven task today.

The easiest way to alter and electronically sign Retirement Cash Flow with ease

- Find Retirement Cash Flow and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to share your form, be it via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow manages all your document needs in just a few clicks from any device of your choice. Modify and eSign Retirement Cash Flow and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Retirement Cash Flow and why is it important?

Retirement Cash Flow refers to the income available to you after you retire. It is crucial for ensuring that you have enough funds to cover your living expenses and maintain your desired lifestyle during retirement. Understanding and managing your Retirement Cash Flow can help you achieve financial stability and peace of mind.

-

How does airSlate SignNow help manage documents related to Retirement Cash Flow?

airSlate SignNow simplifies the process of managing documents related to your Retirement Cash Flow by allowing you to easily send, sign, and store important paperwork electronically. This means you can handle financial documents such as retirement plans or tax forms securely and efficiently, ensuring you keep track of all necessary records.

-

Are there any special pricing options for retirement planning features?

Yes, airSlate SignNow offers competitive pricing options that can be tailored to your specific needs related to Retirement Cash Flow management. Our plans are designed to be cost-effective, ensuring you can access essential features without breaking the bank. Check our website for the latest promotional offers and tailored packages.

-

What features does airSlate SignNow offer that are beneficial for retirement planning?

airSlate SignNow provides features such as easy document sharing, secure e-signatures, and reliable storage solutions, all of which are beneficial for managing your Retirement Cash Flow. These tools allow you to streamline your financial transactions and keep all necessary documents organized, making it easier to plan for your retirement.

-

How can airSlate SignNow integrate with other retirement planning tools?

airSlate SignNow offers seamless integrations with various retirement planning tools and financial software, enhancing your capabilities in managing your Retirement Cash Flow. By integrating with your existing systems, you can automate workflows, streamline document management, and ensure that all your retirement-related documents are up-to-date.

-

Is airSlate SignNow secure for handling sensitive retirement documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive Retirement Cash Flow documents. With features like encryption, secure storage, and compliant e-signatures, you can trust that your personal and financial information is safeguarded throughout the document management process.

-

Can I access airSlate SignNow on mobile devices for retirement planning on-the-go?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage your Retirement Cash Flow documents anytime, anywhere. This flexibility enables you to review, sign, and send important financial documents on the go, making retirement planning more convenient.

Get more for Retirement Cash Flow

- Nc poa form

- 19419 texas administrative code texas secretary of state form

- Non disclosure agreement nda template sample form

- State flood hazard disclosures survey national association form

- Motion for waiver of 90 day waiting period in the form

- Pa affidavit service form

- State of south carolina in the family court county of form

- Tennessee power of attorney revocation form

Find out other Retirement Cash Flow

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word