Form Home Sale

What is the Form Home Sale

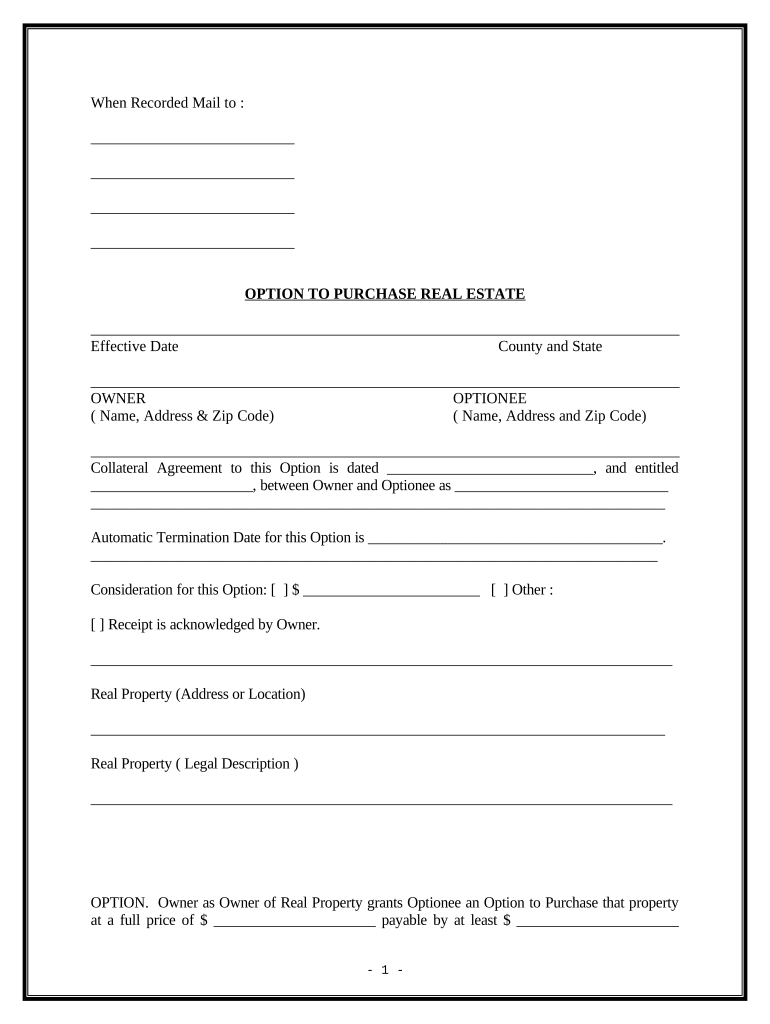

The form home sale is a legal document used in real estate transactions, specifically for the sale of residential properties. This form outlines the terms and conditions of the sale, including the purchase price, property details, and the responsibilities of both the buyer and seller. It serves as a binding agreement once signed by both parties, ensuring that all parties are aware of their obligations and rights in the transaction.

How to use the Form Home Sale

Using the form home sale involves several steps to ensure the document is completed accurately and legally. First, both the buyer and seller should gather all necessary information, including property details, sale price, and any contingencies. Next, the form should be filled out carefully, ensuring that all sections are completed. Once the form is filled, both parties need to sign it, ideally using a secure electronic signature platform to ensure compliance with legal standards. This process helps to streamline the transaction and provides a clear record of the agreement.

Steps to complete the Form Home Sale

Completing the form home sale requires attention to detail. Here are the essential steps:

- Gather all relevant information about the property, including its legal description and any existing liens.

- Fill out the form, ensuring that all fields are completed, including buyer and seller information, sale price, and any special terms.

- Review the form for accuracy, making sure that all information is correct and up-to-date.

- Both parties should sign the form, ideally using an electronic signature for added security and compliance.

- Keep a copy of the signed form for personal records and future reference.

Legal use of the Form Home Sale

The form home sale must comply with various legal requirements to be considered valid. In the United States, electronic signatures are legally binding under the ESIGN Act and UETA, provided certain criteria are met. This includes ensuring that both parties consent to use electronic signatures and that the form is stored securely. Additionally, the form should clearly outline the terms of the sale to avoid any disputes later on. Understanding these legal aspects can help both buyers and sellers navigate the transaction more confidently.

Key elements of the Form Home Sale

Several key elements must be included in the form home sale to ensure it is comprehensive and legally binding:

- Parties Involved: Clearly identify the buyer and seller, including full names and contact information.

- Property Description: Provide a detailed description of the property being sold, including its address and any unique features.

- Sale Price: State the agreed-upon price for the property, including any deposits or financing arrangements.

- Contingencies: Outline any conditions that must be met for the sale to proceed, such as inspections or financing approvals.

- Signatures: Ensure that both parties sign the document, confirming their agreement to the terms outlined.

Examples of using the Form Home Sale

The form home sale can be utilized in various scenarios within real estate transactions. For instance, a couple selling their first home might use this form to outline the sale to a new family. Alternatively, an investor purchasing a property to rent out can also utilize the form to formalize the transaction. Each example highlights the versatility of the form home sale in different real estate contexts, ensuring that all parties involved have a clear understanding of their rights and responsibilities.

Quick guide on how to complete form home sale

Effortlessly Create Form Home Sale on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it in the cloud. airSlate SignNow equips you with every resource necessary to create, modify, and eSign your documents rapidly without delay. Handle Form Home Sale on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Form Home Sale with Ease

- Locate Form Home Sale and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for that function.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced files, tiresome form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form Home Sale to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for completing a form home sale using airSlate SignNow?

To complete a form home sale with airSlate SignNow, simply upload your document, add signature fields, and invite the necessary parties to sign. Our intuitive interface makes it easy to navigate the process, ensuring your form home sale is executed smoothly and efficiently.

-

Are there any fees associated with using airSlate SignNow for my form home sale?

While airSlate SignNow offers a free trial, there may be fees associated with premium features or additional document storage. However, our pricing plans are designed to be affordable and provide excellent value for businesses handling form home sales.

-

What features does airSlate SignNow offer for form home sale transactions?

airSlate SignNow provides various features for form home sale transactions, including eSignature functionality, document templates, and automated workflows. These features help streamline the signing process, making it quicker and more efficient.

-

Can I integrate airSlate SignNow with other tools for my form home sale?

Yes, airSlate SignNow offers integrations with many popular tools and platforms, such as Google Drive, Dropbox, and CRM systems. These integrations enhance your workflow and simplify the process of managing documents related to your form home sale.

-

How secure is my data when using airSlate SignNow for form home sale documents?

Security is a top priority for airSlate SignNow. We utilize industry-standard encryption and comply with rigorous security protocols to ensure that your data, including any form home sale information, is kept safe and confidential.

-

Is airSlate SignNow user-friendly for completing a form home sale?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete a form home sale without prior technical knowledge. Our user-friendly interface guides you through each step, ensuring a hassle-free signing process.

-

What benefits can I expect from using airSlate SignNow for my form home sale?

Using airSlate SignNow for your form home sale can result in faster transactions, reduced paperwork, and improved communication with all parties involved. By digitizing the process, you can enhance efficiency and focus on closing the sale.

Get more for Form Home Sale

Find out other Form Home Sale

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure