Contract Independent Contractor Form

What is the contract with self employed?

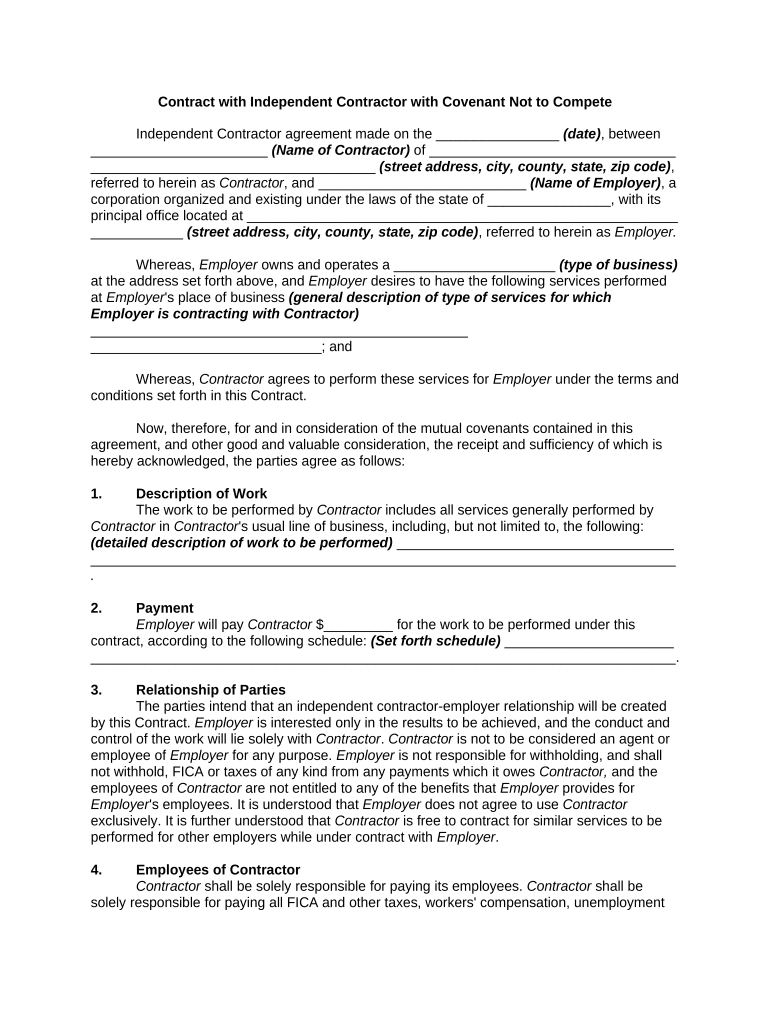

A contract with self employed individuals, often referred to as an independent contractor agreement, is a legally binding document that outlines the terms of engagement between a business and a self-employed worker. This type of contract specifies the nature of the work, payment terms, deadlines, and responsibilities of both parties. It is crucial for protecting the rights of both the contractor and the hiring entity, ensuring clarity and mutual understanding.

Key elements of the contract with self employed

When drafting a contract with self employed individuals, certain key elements must be included to ensure its effectiveness and legality. These elements typically encompass:

- Scope of Work: A detailed description of the tasks and services to be performed.

- Payment Terms: Clear stipulations regarding compensation, including rates, payment schedules, and any additional expenses.

- Duration: The timeframe for the contract, including start and end dates, or conditions for termination.

- Confidentiality Clauses: Provisions to protect sensitive information shared during the contract period.

- Dispute Resolution: Procedures for resolving conflicts that may arise during the contract execution.

Steps to complete the contract with self employed

Completing a contract with self employed individuals involves several important steps to ensure all parties are aligned and protected. Here are the essential steps:

- Define the Scope: Clearly outline the work to be performed.

- Draft the Contract: Use a template or create a document that includes all necessary elements.

- Review and Revise: Both parties should review the contract and suggest any changes.

- Sign the Document: Utilize a reliable eSignature platform to sign the contract electronically.

- Distribute Copies: Ensure both parties receive a signed copy for their records.

Legal use of the contract with self employed

The legal use of a contract with self employed individuals is governed by federal and state laws. It is essential that the contract complies with the IRS guidelines regarding independent contractors to avoid misclassification. This includes ensuring that the contractor operates independently and is not subject to the same control as an employee. Proper documentation and adherence to legal standards help prevent disputes and potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the classification of independent contractors. Understanding these guidelines is crucial for businesses to ensure compliance. Key points include:

- Independent contractors must have control over how they complete their work.

- They are responsible for their own taxes, including self-employment tax.

- Businesses must issue a Form 1099-NEC for payments made to contractors exceeding $600 in a calendar year.

Examples of using the contract with self employed

Contracts with self employed individuals can be utilized in various scenarios, including:

- A graphic designer hired for a specific project.

- A freelance writer contracted to produce articles for a website.

- A consultant engaged to provide expert advice for a business strategy.

Each example illustrates the importance of a clear contract to define expectations and protect both parties involved.

Quick guide on how to complete contract independent contractor 497330540

Effortlessly prepare Contract Independent Contractor on any device

The management of online documents has gained traction among businesses and individuals alike. It presents an excellent eco-friendly option compared to traditional printed and signed papers, enabling you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and eSign your documents without any hindrances. Manage Contract Independent Contractor on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Contract Independent Contractor with ease

- Locate Contract Independent Contractor and select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign Contract Independent Contractor and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a contract with self employed individuals?

A contract with self employed individuals outlines the terms and conditions of the working relationship. It serves to protect both parties by specifying deliverables, payment schedules, and responsibilities. This type of contract is crucial for ensuring transparency and compliance in freelance or independent work.

-

How can airSlate SignNow help with contracts for self employed workers?

airSlate SignNow allows you to create, send, and eSign contracts with self employed workers quickly and efficiently. The platform offers templates and customizable features to meet specific needs, ensuring that agreements are professional and legally binding. This streamlines the process, saves time, and reduces administrative burdens.

-

What features does airSlate SignNow offer for managing contracts with self employed individuals?

airSlate SignNow provides a range of features for managing contracts with self employed individuals, including document templates, secure eSigning, and real-time status tracking. You can also store documents safely in the cloud and collaborate with others through an intuitive interface. These features enhance efficiency and organization in contract management.

-

Is airSlate SignNow a cost-effective solution for freelancers managing contracts?

Yes, airSlate SignNow is a cost-effective solution for freelancers managing contracts with self employed individuals. The platform offers flexible pricing plans designed to accommodate different business sizes and budgets. With its powerful tools and features, you can save money on paper and administrative costs while improving contract workflows.

-

Can I integrate airSlate SignNow with other software that I use for contract management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing its functionality for managing contracts with self employed individuals. Popular software like CRM systems and cloud storage services can be linked to your account, allowing for streamlined processes and improved workflow efficiency.

-

What are the benefits of eSigning a contract with self employed individuals through airSlate SignNow?

eSigning a contract with self employed individuals through airSlate SignNow offers several benefits, including faster turnaround times and reduced paperwork. The electronic signature process is secure, legally binding, and easy to use, which contributes to faster project initiation. Additionally, all signed documents can be stored digitally, ensuring they are accessible when needed.

-

How secure are contracts with self employed individuals when using airSlate SignNow?

Contracts with self employed individuals created and signed using airSlate SignNow are highly secure. The platform uses advanced encryption technology to protect your data and signatures, ensuring that sensitive information remains confidential. Also, compliance with legal regulations further enhances security and trust in the process.

Get more for Contract Independent Contractor

Find out other Contract Independent Contractor

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online