How Extreme Sports Can Affect Your Life Insurance Policy 2013-2026

What is the impact of extreme sports on your life insurance policy?

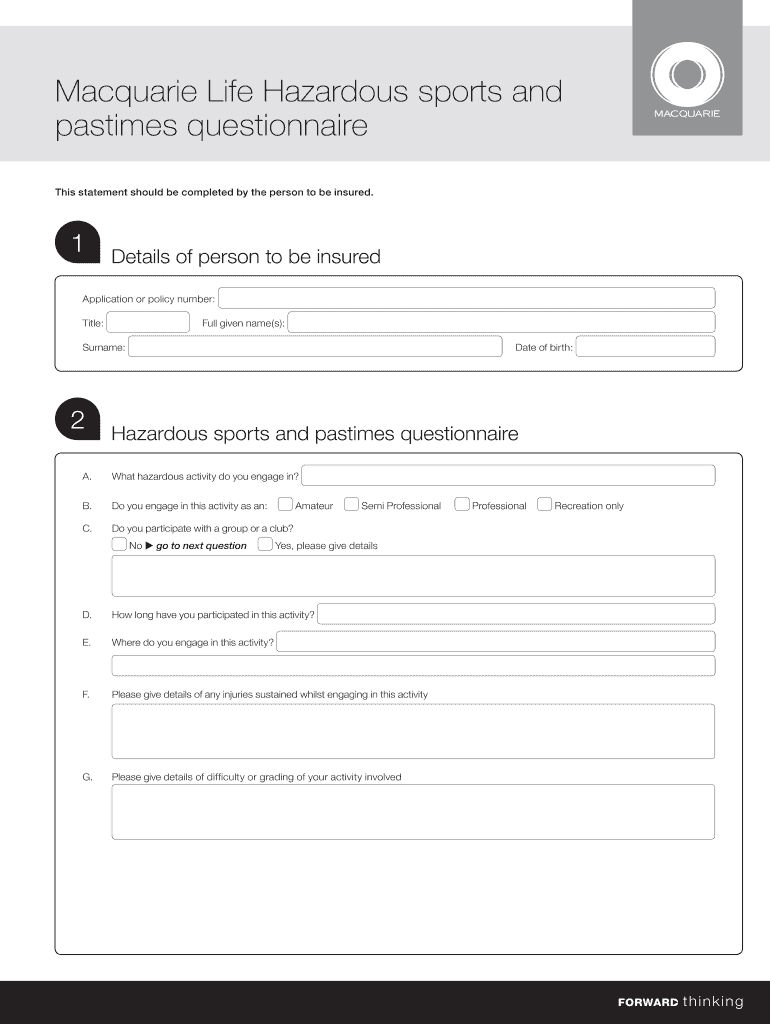

Engaging in extreme sports can significantly affect your life insurance policy. Insurers often view these activities as high-risk, which may lead to higher premiums or even exclusions in coverage. When applying for life insurance, it is essential to disclose any involvement in extreme sports, such as skydiving, rock climbing, or motocross. Failure to do so may result in denied claims in the event of an accident. Understanding how these activities influence your policy is crucial for ensuring adequate coverage.

Steps to complete the life insurance extreme sports disclosure

Completing the disclosure for life insurance related to extreme sports involves several important steps:

- Research your insurer: Different companies have varying policies regarding extreme sports. Review their guidelines to understand how they assess risk.

- Gather necessary information: Be prepared to provide details about the specific extreme sports you participate in, including frequency and level of experience.

- Complete the application: Fill out the life insurance application accurately, ensuring all extreme sports activities are disclosed.

- Review policy options: After submission, discuss with your insurer any potential adjustments to your policy based on your activities.

Legal considerations for life insurance and extreme sports

When dealing with life insurance and extreme sports, legal considerations play a vital role. Policies may include specific clauses that outline exclusions related to high-risk activities. Understanding these legal stipulations can help avoid complications during the claims process. It is advisable to consult with a legal expert or insurance advisor to clarify any terms that may impact your coverage. This ensures that you are fully informed about your rights and obligations under the policy.

Examples of extreme sports and their insurance implications

Different extreme sports can have varying implications for life insurance policies. For instance:

- Skydiving: Often considered high-risk, it may lead to higher premiums or specific exclusions.

- Rock climbing: Depending on the type (indoor vs. outdoor), insurers may view this activity differently.

- Motor racing: Typically associated with significant risk, it can result in substantial premium increases.

Being aware of these examples can help individuals make informed decisions when seeking life insurance coverage.

Eligibility criteria for life insurance with extreme sports involvement

Eligibility for life insurance when participating in extreme sports is influenced by several factors:

- Type of sport: Some activities may be deemed too risky for coverage.

- Experience level: Insurers may consider your experience and safety measures taken while participating in these sports.

- Health status: A thorough health assessment may be required to determine overall risk.

Understanding these criteria is essential for anyone involved in extreme sports looking to secure life insurance.

Quick guide on how to complete how extreme sports can affect your life insurance policy

Accomplish How Extreme Sports Can Affect Your Life Insurance Policy effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage How Extreme Sports Can Affect Your Life Insurance Policy on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign How Extreme Sports Can Affect Your Life Insurance Policy with ease

- Obtain How Extreme Sports Can Affect Your Life Insurance Policy and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and electronically sign How Extreme Sports Can Affect Your Life Insurance Policy and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how extreme sports can affect your life insurance policy

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is life insurance for extreme sports?

Life insurance for extreme sports is a specialized policy tailored for individuals engaging in high-risk activities. It provides coverage for accidents that may occur during these sports, ensuring peace of mind while you enjoy your adventurous lifestyle. Understanding your specific risks is essential in finding the right life insurance extreme sports policy.

-

How does life insurance for extreme sports differ from standard life insurance?

Life insurance for extreme sports typically involves higher premiums due to the increased risks associated with these activities. Standard life insurance may not cover accidents or fatalities related to extreme sports, making it crucial to seek a specialized policy. Life insurance extreme sports ensures you are adequately protected during your high-octane pursuits.

-

What factors affect the pricing of life insurance for extreme sports?

The pricing of life insurance extreme sports policies is influenced by several factors, including the type of sports you participate in, your overall health, and your age. High-risk activities may lead to higher premiums, but providing detailed information when applying can help secure better rates. It's important to compare quotes from multiple providers to find the best option.

-

Are there any specific benefits of having life insurance for extreme sports?

Having life insurance extreme sports coverage offers several benefits, including financial security for your loved ones in the event of an accident. Additionally, these policies can include features like accident coverage, disability income, and even coverage for travel-related mishaps. This comprehensive protection allows you to pursue your passions with confidence.

-

Can I integrate my life insurance for extreme sports with other financial planning tools?

Yes, you can often integrate life insurance extreme sports with other financial planning tools to create a holistic approach to your finances. Many insurers offer options to bundle policies or provide discounts for simultaneous coverage. Consulting with a financial advisor can help you understand the best strategies for integration.

-

Do I need a medical examination to obtain life insurance for extreme sports?

Many life insurance extreme sports policies might require a medical examination, especially if you're involved in high-risk activities. A medical check evaluates your overall health and helps insurers determine your premium. However, some companies offer no-exam policies, so it's worthwhile to explore various options.

-

How can I find the best life insurance policy for my extreme sports activities?

To find the best life insurance extreme sports policy, start by researching specialized insurers that cater to high-risk activities. Compare coverage options, premiums, and terms to identify what best suits your needs. Additionally, consult with an insurance broker who understands the nuances of extreme sports coverage.

Get more for How Extreme Sports Can Affect Your Life Insurance Policy

- Letter landlord notice rent form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase montana form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant montana form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services montana form

- Temporary lease agreement to prospective buyer of residence prior to closing montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497316208 form

- Letter from landlord to tenant returning security deposit less deductions montana form

Find out other How Extreme Sports Can Affect Your Life Insurance Policy

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy