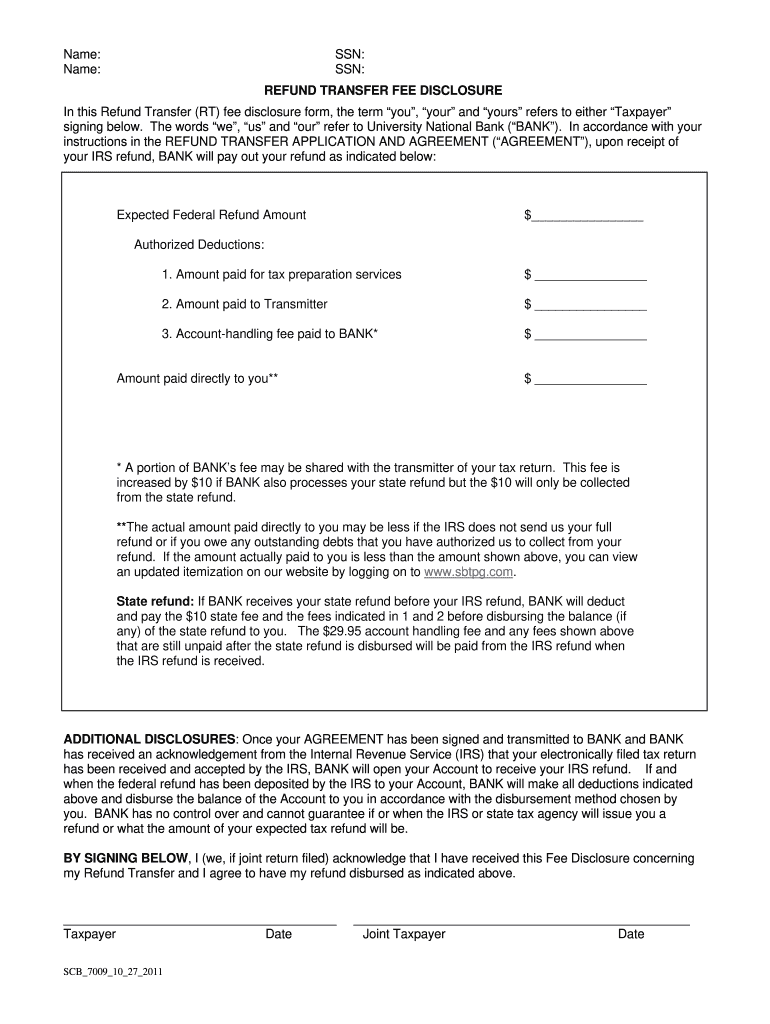

Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX 2011-2026

Understanding the Green Man Gaming Refund Process

The Green Man Gaming refund process allows customers to request a refund for their purchases under specific conditions. Generally, refunds are applicable if the request is made within a certain timeframe after the purchase. It is essential to review the terms and conditions associated with your purchase to determine eligibility for a refund. Customers should be aware that not all purchases may qualify for a refund, particularly if the product has been activated or downloaded.

Steps to Request a Refund from Green Man Gaming

To initiate a refund request, follow these steps:

- Log into your Green Man Gaming account.

- Navigate to your order history to find the purchase you wish to refund.

- Select the order and look for the refund option.

- Complete any required fields in the refund request form.

- Submit your request and await confirmation via email.

Keep in mind that processing times for refunds may vary, and it is advisable to check your email for updates regarding your request.

Key Elements of the Green Man Gaming Refund Policy

The refund policy of Green Man Gaming includes several key elements that customers should understand:

- Refund eligibility is typically limited to a specific period after purchase.

- Digital game purchases may have different refund terms compared to physical products.

- Activated or downloaded games may not be eligible for a refund.

- Customers must provide proof of purchase when requesting a refund.

Familiarizing yourself with these elements can help streamline the refund process and set realistic expectations.

Legal Considerations for Refund Requests

When requesting a refund from Green Man Gaming, it is important to consider the legal aspects involved. Refund policies are often governed by consumer protection laws that vary by state. These laws may dictate the timeframe for refunds and the conditions under which they can be granted. Understanding your rights as a consumer can empower you to navigate the refund process more effectively.

Examples of Refund Scenarios

There are various scenarios in which a customer might seek a refund from Green Man Gaming:

- A customer purchases a game but realizes it is not compatible with their system.

- A game is purchased but the customer decides they no longer wish to play it before activating it.

- A technical issue prevents the game from functioning as advertised.

Each of these scenarios may have different outcomes based on the refund policy and the specific circumstances surrounding the purchase.

Required Documentation for Refund Requests

To successfully process a refund request, customers may need to provide certain documentation, including:

- A copy of the order confirmation email.

- Details of the transaction, such as the order number.

- Any correspondence related to the purchase or refund request.

Having this information readily available can expedite the refund process and help ensure a smoother experience.

Quick guide on how to complete name ssn refund transfer fee disclosure gmg tax

The simplest method to obtain and authorize Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX

Across the entirety of your organization, ineffective workflows surrounding document authorization can consume a signNow amount of labor hours. Executing documents such as Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX is a fundamental aspect of operations in any organization, which is why the effectiveness of every agreement's lifecycle is crucial to the overall productivity of the company. With airSlate SignNow, finalizing your Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX has never been more straightforward or rapid. This platform provides you access to the latest version of virtually any form. Even better, you have the ability to authorize it instantly without the requirement to install external applications on your device or to print physical copies.

Steps to obtain and authorize your Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX

- Browse our collection by category or use the search bar to find the form you need.

- Check the form preview by hitting Learn more to confirm its accuracy.

- Click Get form to begin editing immediately.

- Fill out your form and add any necessary information using the toolbar.

- Once completed, select the Sign tool to authorize your Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Press Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you possess everything required to handle your documents efficiently. You can locate, complete, modify, and even dispatch your Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX all within one tab without any inconvenience. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Why should I transfer a car title to my name from the lien holder after the vehicle is paid off? It seems like a hassle having to go to DPS and pay a fee on top of the form needed to be filled out.

Try this site where you can find the best solutions for all your personal financial needs://personalcreditsolutions.info/index.html?src=compare//RELATEDOk I am for the poor getting Health Care….And I am also for insurance reform?for crying out loud there are kids poor with illness..for them to not be insured is just insane… 1.What I am not for however is this fine for not having insurance if you can afford http://it.It is there choice and they should be made to pay for there health care should it go South…If they lose there house,car etc than that is there fault because they made a choice.AND please don’t come on here and say there is not a fine for it because there is..I just read it again… 2.What I would also like to know is why the Democrats voted out the amendment to the bill that stated that if you have insurance you will not have to replace it with something else?Is that not something Obama has already promised would be in the bill… Thanks for all the Answers ahead of time…”“I just passed my driving test and got a license, do I need to pay for insurance if I’m driving my mom’s car?”I just passed my driving test and got a license, do I need to pay for insurance if I’m driving my mom’s car? She has allstate insurance. I won’t be driving often. in California btw”Average medical cost of baby first year?We have a $600 deductable with an 80/20 co-pay for our health insurance. Supposing the baby gets sick one time in the first year & goes to regular checkups, what would the medical expenses be? How much is birth at a hospital with an epidural & 2 day stay? Of course, this is all assuming we have a healthy baby.”1990 Mazda Rx7 Insurance?Im 18, i live in wisconsin and im looking to buy a 1990 Mazda rx7 gtu.. i have no bad records or nothing b student… and i was wondering how much a year would a 1990 mazda rx7 gtu cost? or even monthly.. before i can buy it need to know if can support 2 cars on my insurance a year. Any help would be great.. i’v been looking every where..”Geico car insurance down payment?Is anyone here doing geico auto insurance monthly payments? I just got my policy and had to put a downpayment. the down payment is part of my policy total right? it’s not like an extra fee? I’am pretty sure it’s part of my total.Health Insurance (Prescription insurance denied) Why?Bad title for this question I know. I have never really had to go to the doctor for anything, ANYTHING. Recently I went to go see one because my energy level has been horrible, and I am always fatigued. After seeing the doctor, and getting lab work done, I had spent almost a $1000 dollars. But still, I’m okay with that, if its like one visit every six months or so, so what. Anyways, they found my levels to be really really low. So they put me on a medication called . Let me tell you, I can only get 15 days worth of this medication at a time, but every time I go to Walgreens to get a refill, I spend hundreds. Tonight when I picked it up it cost me $268.41. I called everywhere to see about health insurance, even though I only need help with prescriptions. I dont know what to do. I dont need all out full fledge health insurance. But apparently if I tried to get it anyway, I would be denied due to a pre-existing condition ((WTF))!! Apparently the only people who can qualify for health insurance are those who dont need it to begin with. And those who need it are denied because of a pre-existing condition. They are no programs that help with prescriptions that I know of, that dont require tons and tons of paperwork, audits, background investigations, and appointment after appointment. I am really upset and am lost with regard to getting the medication my doctor says I need, reduced in price. I cant afford almost $600 a month. But if even if I try to get health care, i will be denied. Could someone please help me out : ) Thanks for checking out my question I dont have health insurance because I never needed it. Plus I have always been responsible with my money”Difference between policy holder and insured?In Royal Sun Alliance my husband has two letters, one mentioned policy holder and the other insured. Whats the difference between them?”Does anyone know a good affordable health insurace that offers maternity coverage? if so please help?Does anyone know a good affordable health insurace that offers maternity coverage? if so please help?What is the toll free phone number for Travelers Insurance?I am looking for a toll free phone number with Travelers Insurance that is dedicated to new customer quotes not existing customer service.Cheapest car insurance?2001 ford mustang, 2005 chevy cobalt, 2003 chevy impala, 2000 chevy blazer, and a 2002 chevy camaro. Put them in order from most expensive to least expensive based on insurance and gas. I am an almost 16 year old guy, if that helps! thanks!”

Create this form in 5 minutes!

How to create an eSignature for the name ssn refund transfer fee disclosure gmg tax

How to make an eSignature for your Name Ssn Refund Transfer Fee Disclosure Gmg Tax online

How to generate an electronic signature for your Name Ssn Refund Transfer Fee Disclosure Gmg Tax in Chrome

How to make an electronic signature for putting it on the Name Ssn Refund Transfer Fee Disclosure Gmg Tax in Gmail

How to make an electronic signature for the Name Ssn Refund Transfer Fee Disclosure Gmg Tax right from your smartphone

How to create an electronic signature for the Name Ssn Refund Transfer Fee Disclosure Gmg Tax on iOS

How to generate an electronic signature for the Name Ssn Refund Transfer Fee Disclosure Gmg Tax on Android

People also ask

-

What is the process for obtaining a green man gaming refund?

To obtain a green man gaming refund, you need to submit a request through their customer support portal. Ensure that your request complies with their refund policy, including any time limits for requesting refunds on purchases. Once your request is submitted, expect a response within a few business days.

-

What are the eligibility criteria for a green man gaming refund?

Eligibility for a green man gaming refund depends on the specific product and the purchase date. Generally, if the product hasn't been downloaded or activated and is within the stipulated refund timeframe, you should be eligible. Review their refund policy for detailed conditions that must be met.

-

How long does it take to receive a green man gaming refund?

The time it takes to receive a green man gaming refund can vary, typically ranging from a few days to up to two weeks, depending on your payment method. After your refund request is processed, you will receive an email confirmation with the timeline for your specific situation. Check with your bank or payment provider for additional processing times.

-

Can I get a green man gaming refund for a game I have already played?

Generally, you cannot obtain a green man gaming refund for a game that has been played or activated. Refund policies are usually strict about digital goods once they’ve been utilized. Always verify their terms regarding refunds after gameplay to avoid disappointment.

-

Are there any fees associated with the green man gaming refund process?

Most of the time, there are no fees associated with obtaining a green man gaming refund directly. However, processing times may differ based on your payment method, and some banks or credit card companies might charge their own fees. It's advisable to consult with your payment provider for their policy on refunds.

-

How can I contact customer support for a green man gaming refund?

You can contact customer support for a green man gaming refund through their official website’s support section. They usually offer a contact form, live chat, or email support options. Ensure to provide all relevant purchase details to expedite your refund request.

-

Is the green man gaming refund policy the same for all types of games?

No, the green man gaming refund policy may differ based on the type of game or product purchased. Each game might have its own set of conditions, especially for exclusives or early access titles. Be sure to read the specific refund policy related to the game you purchased.

Get more for Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX

- Massachusetts prenuptial premarital agreement with financial statements massachusetts form

- Prenuptial agreement massachusetts form

- Amendment to prenuptial or premarital agreement massachusetts form

- Financial statements only in connection with prenuptial premarital agreement massachusetts form

- Revocation of premarital or prenuptial agreement massachusetts form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children massachusetts form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497309542 form

- Ma incorporation form

Find out other Name SSN REFUND TRANSFER FEE DISCLOSURE GMG TAX

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast