Sale Partnership Form

What is the Sale Partnership

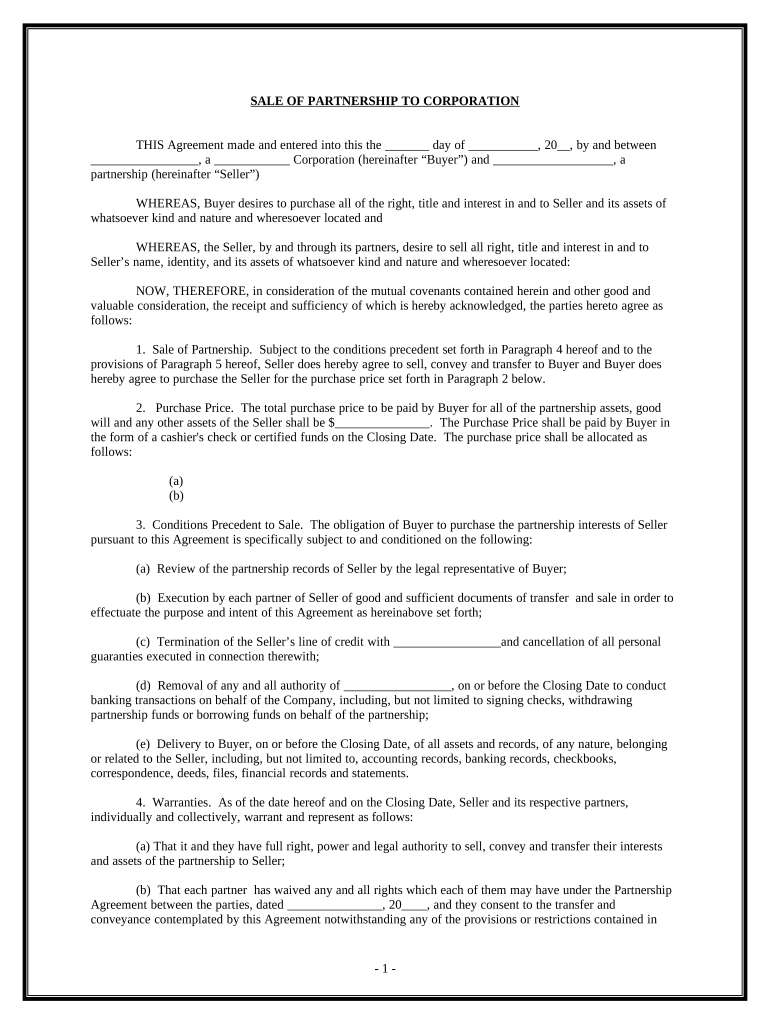

The sale partnership is a legal agreement between two or more parties to conduct business together, sharing profits, losses, and responsibilities. This partnership structure allows individuals or entities to pool resources and expertise, enhancing their ability to operate effectively in the marketplace. Each partner typically contributes capital, skills, or services, and in return, they receive a share of the profits based on the terms outlined in the partnership agreement.

How to use the Sale Partnership

Utilizing a sale partnership involves several key steps. First, partners must clearly define their roles, contributions, and profit-sharing arrangements in a partnership agreement. This document serves as the foundation for the partnership, outlining how decisions are made and how disputes will be resolved. Once established, partners can leverage their combined resources to pursue business opportunities, market products or services, and manage operations collaboratively.

Steps to complete the Sale Partnership

Completing a sale partnership requires careful planning and execution. Here are the essential steps:

- Identify potential partners who share similar business goals and values.

- Draft a partnership agreement that outlines each partner's contributions, responsibilities, and profit-sharing ratios.

- Register the partnership with the appropriate state authorities, if required.

- Open a joint business bank account to manage finances transparently.

- Develop a business plan that outlines the partnership's objectives, strategies, and operational plans.

Legal use of the Sale Partnership

The legal use of a sale partnership is governed by state laws, which may vary significantly. It is crucial for partners to ensure that their partnership agreement complies with local regulations. This includes adhering to laws regarding business registration, tax obligations, and liability. Additionally, partners should consider consulting with a legal professional to ensure that their agreement protects their interests and complies with all legal requirements.

Key elements of the Sale Partnership

Several key elements are essential for a successful sale partnership:

- Partnership Agreement: A written document that details the terms of the partnership.

- Capital Contributions: The financial or in-kind contributions made by each partner.

- Profit Sharing: The method by which profits and losses are distributed among partners.

- Decision-Making Process: Guidelines for how decisions will be made within the partnership.

- Dispute Resolution: Procedures for resolving conflicts among partners.

Examples of using the Sale Partnership

Sale partnerships can take various forms, depending on the industry and objectives of the partners involved. For instance, two local restaurants might form a partnership to share marketing costs and cross-promote their services. Similarly, a technology startup may partner with a marketing firm to enhance its reach and visibility in the market. Each example illustrates how partnerships can create synergies that benefit all parties involved.

Quick guide on how to complete sale partnership 497330583

Manage Sale Partnership effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, revise, and eSign your documents swiftly without delays. Handle Sale Partnership on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign Sale Partnership with ease

- Locate Sale Partnership and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Sale Partnership and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sale partnership with airSlate SignNow?

A sale partnership with airSlate SignNow allows businesses to collaborate and leverage our eSignature solution for enhanced growth. This partnership provides access to our vast tools, enabling partners to offer streamlined document signing services to their customers. By joining our sale partnership program, businesses can improve their service portfolio and increase revenue.

-

How much does it cost to join the airSlate SignNow sale partnership?

Joining the airSlate SignNow sale partnership doesn't have an upfront cost. Instead, partners can earn commissions based on the sales generated through their referrals. This model allows for a flexible earning potential while offering signNow benefits to their clients.

-

What features are included in the airSlate SignNow sale partnership?

The airSlate SignNow sale partnership includes access to a robust set of features like eSigning, document templates, and workflow automation. Partners benefit from a user-friendly platform that simplifies the document signing process for their clients. Additionally, partners receive training and support to maximize their success.

-

What are the benefits of becoming an airSlate SignNow sale partner?

Becoming an airSlate SignNow sale partner comes with numerous benefits, including lucrative commission structures and marketing resources. Partners gain exclusive access to our product updates and customer support, ensuring they can provide the best service to their clients. It's an excellent opportunity for businesses looking to expand their offerings in the digital signature space.

-

Can I integrate airSlate SignNow with my existing systems as a sale partner?

Absolutely! As a sale partner, you can seamlessly integrate airSlate SignNow with various CRM systems, document management solutions, and more. This integration ensures that your clients can efficiently manage their documents while utilizing existing tools, enhancing overall workflow productivity.

-

How does the commission structure work for the sale partnership?

The commission structure for the sale partnership is designed to reward partners for their sales efforts. Partners earn a percentage of the revenue generated from clients they refer to airSlate SignNow. This performance-based model incentivizes partners to actively promote our eSignature solution.

-

Is there training available for new sale partners?

Yes, airSlate SignNow provides comprehensive training for all new sale partners. This training covers the features, benefits, and selling points of our platform, ensuring partners are well-equipped to support their customers. Ongoing support is also available to help partners stay updated with product developments.

Get more for Sale Partnership

- Incident report exposure to blood or form

- Ucare appeal form

- Volunteer medical release form wellstar

- Contact usmolecular otolaryngology and renal research form

- Patient health questionnaire radiation oncology ucla form

- Musculoskeletal questionnaire application supplement individual disability icc16 17985pdf gr 81178 87436 form

- Anesthesia post operative assessment form

- Information for clients texas aampampm veterinary medical

Find out other Sale Partnership

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer