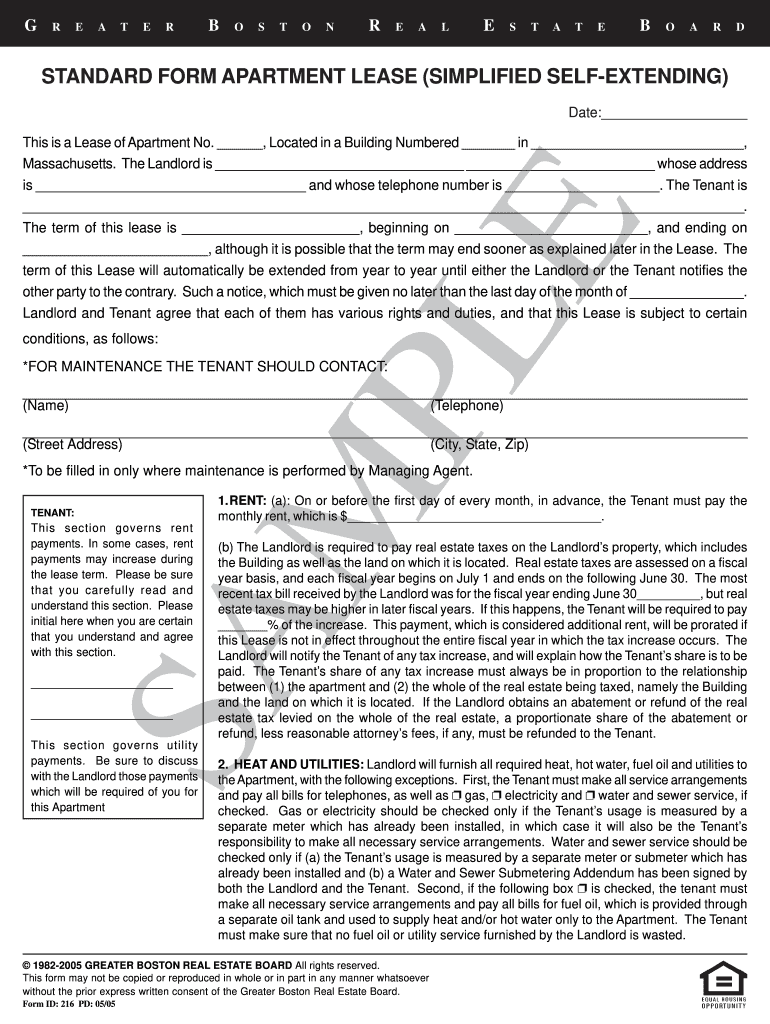

Self Extending Lease Form

What is the Self Extending Lease

A self extending lease is a rental agreement that automatically renews for a specified period unless either party provides notice to terminate. This type of lease provides convenience for tenants who wish to remain in their apartments without the need for frequent negotiations or paperwork. It typically outlines the terms of the extension, including duration, rental amount, and any changes to the original lease conditions. Understanding the specifics of a self extending lease can help tenants and landlords manage their rental agreements effectively.

How to use the Self Extending Lease

Using a self extending lease involves several key steps. First, both the landlord and tenant should review the original lease agreement to ensure they understand the terms of the extension. Next, if either party wishes to terminate the lease, they must provide written notice within the timeframe specified in the lease. If no notice is given, the lease will automatically renew. It is essential to document any communication regarding the lease extension to maintain clarity and avoid disputes.

Steps to complete the Self Extending Lease

Completing a self extending lease involves the following steps:

- Review the original lease agreement for renewal terms.

- Determine if any changes are needed for the extension period.

- Communicate with the landlord or tenant about intentions to renew or terminate.

- Document any agreements or changes in writing.

- Sign and date the extension agreement, if applicable.

Following these steps ensures that both parties are aware of their rights and obligations under the renewed lease.

Legal use of the Self Extending Lease

The legal use of a self extending lease is governed by state laws and the terms outlined in the original lease agreement. It is important that both landlords and tenants comply with local regulations regarding notice periods and renewal terms. In most states, a self extending lease is valid as long as it meets the legal requirements and both parties agree to the terms. Additionally, using a digital platform for signing and managing lease agreements can enhance legal compliance and streamline the process.

Key elements of the Self Extending Lease

Key elements of a self extending lease include:

- Duration: Specifies the length of the extension period.

- Rental Amount: Indicates any changes to the rent for the new term.

- Notice Requirements: Outlines how much notice is needed to terminate the lease.

- Conditions: Details any changes to the original lease terms.

Understanding these elements helps both landlords and tenants navigate their rental agreements effectively.

State-specific rules for the Self Extending Lease

State-specific rules for self extending leases can vary significantly. Some states may have specific regulations regarding notice periods, while others may dictate the maximum duration for lease extensions. It is crucial for both landlords and tenants to familiarize themselves with their state's laws to ensure compliance. Consulting with a legal professional or a real estate expert can provide valuable insights into these regulations.

Quick guide on how to complete standard form apartment lease simplified self extending

Set up Self Extending Lease effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your paperwork promptly and without delays. Handle Self Extending Lease on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Self Extending Lease seamlessly

- Locate Self Extending Lease and click on Get Form to initiate the process.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your preference. Alter and electronically sign Self Extending Lease and ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the standard form apartment lease simplified self extending

How to generate an electronic signature for the Standard Form Apartment Lease Simplified Self Extending online

How to generate an electronic signature for the Standard Form Apartment Lease Simplified Self Extending in Chrome

How to generate an electronic signature for signing the Standard Form Apartment Lease Simplified Self Extending in Gmail

How to create an electronic signature for the Standard Form Apartment Lease Simplified Self Extending from your smart phone

How to create an electronic signature for the Standard Form Apartment Lease Simplified Self Extending on iOS devices

How to generate an eSignature for the Standard Form Apartment Lease Simplified Self Extending on Android OS

People also ask

-

What is a standard form apartment lease simplified fixed term PDF?

A standard form apartment lease simplified fixed term PDF is a legal document outlining the terms and conditions of renting an apartment for a specified period. This PDF format ensures that the lease is easily accessible, printable, and shareable, making it convenient for both landlords and tenants.

-

How can airSlate SignNow help with the standard form apartment lease simplified fixed term PDF?

airSlate SignNow provides a user-friendly platform to create, customize, and eSign your standard form apartment lease simplified fixed term PDF. You can streamline the entire process of lease management, ensuring that all parties can sign easily and securely from any device.

-

Is there a cost associated with using airSlate SignNow for creating my lease PDF?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, which include features for creating and managing standard form apartment lease simplified fixed term PDFs. We provide a cost-effective solution for businesses and individuals looking to manage their documents efficiently.

-

Can I integrate airSlate SignNow with other applications for my lease agreements?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your tools for managing standard form apartment lease simplified fixed term PDFs. This helps enhance your workflow and ensures that all necessary data is easily accessible and organized.

-

What features does airSlate SignNow offer for managing apartments leases?

airSlate SignNow includes features such as custom templates, eSigning capabilities, secure storage, and document tracking for your standard form apartment lease simplified fixed term PDFs. These features streamline the leasing process and enhance communication between landlords and tenants.

-

Can I edit my standard form apartment lease simplified fixed term PDF after it has been created?

Yes, you can easily edit your standard form apartment lease simplified fixed term PDF in airSlate SignNow. Our platform allows you to make necessary revisions and updates to ensure that the document accurately reflects the terms agreed upon by both parties before finalizing the lease.

-

Is my information secure when using airSlate SignNow for my lease PDFs?

Absolutely! airSlate SignNow prioritizes the security of your information and ensures that all standard form apartment lease simplified fixed term PDFs are protected through advanced encryption technologies. You can trust that your documents and personal data are safe and secure within our platform.

Get more for Self Extending Lease

- Quitclaim deed from corporation to corporation massachusetts form

- Warranty deed from corporation to corporation massachusetts form

- Quitclaim deed from corporation to two individuals massachusetts form

- Warranty deed from corporation to two individuals massachusetts form

- Warranty deed from individual to a trust massachusetts form

- Warranty deed from husband and wife to a trust massachusetts form

- Ma selling form

- Massachusetts note 497309568 form

Find out other Self Extending Lease

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document