Adjustable Rate Rider Variable Rate Note Form

What is the adjustable rate rider variable rate note?

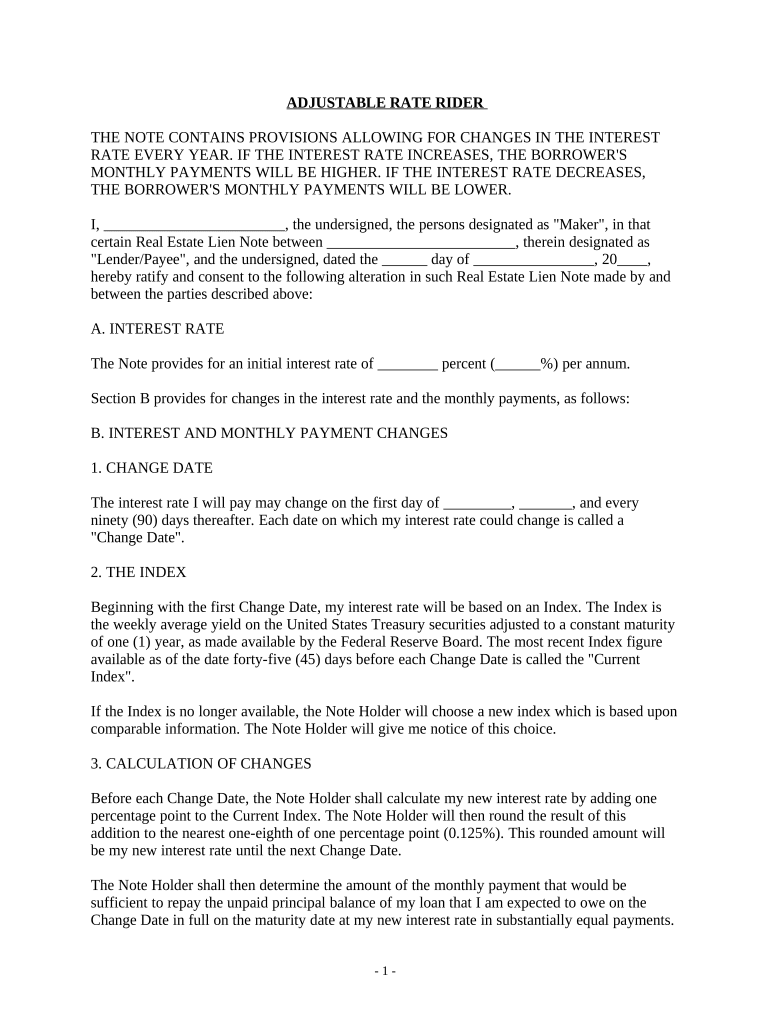

The adjustable rate rider variable rate note is a financial document that outlines the terms of a loan with an interest rate that can change over time. This form is typically used in real estate transactions, particularly for mortgages. It allows borrowers to understand how their interest payments may fluctuate based on market conditions. The adjustable rate rider is attached to the primary mortgage note and specifies the conditions under which the interest rate will adjust, including the frequency of adjustments and the index used to determine rate changes.

How to use the adjustable rate rider variable rate note

Using the adjustable rate rider variable rate note involves several steps. First, ensure you have the correct version of the form, as it may vary by lender or state. Next, fill out the required information, including borrower details, loan amount, and property information. It is crucial to review the terms outlined in the rider, such as the adjustment intervals and maximum rate caps. Once completed, the document must be signed by all parties involved, ensuring that all signatures are legally compliant. Finally, submit the signed form to your lender as part of the mortgage application process.

Steps to complete the adjustable rate rider variable rate note

Completing the adjustable rate rider variable rate note requires careful attention to detail. Follow these steps:

- Obtain the form from your lender or financial institution.

- Provide accurate borrower information, including names and contact details.

- Specify the loan amount and property address.

- Review the terms related to interest rate adjustments, including the index and frequency of changes.

- Sign and date the document, ensuring all parties involved do the same.

- Submit the completed form to your lender for processing.

Legal use of the adjustable rate rider variable rate note

The legal use of the adjustable rate rider variable rate note is governed by federal and state laws. To be considered valid, the form must meet specific requirements, such as proper signatures and compliance with eSignature laws. In the U.S., the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) provide the legal framework for electronic signatures. Ensuring that the adjustable rate rider is completed accurately and submitted in accordance with these laws is essential for its enforceability.

Key elements of the adjustable rate rider variable rate note

Several key elements are essential to the adjustable rate rider variable rate note. These include:

- Interest Rate Index: The benchmark used to determine how the interest rate will adjust.

- Adjustment Period: The frequency at which the interest rate can change, typically annually or semi-annually.

- Margin: The fixed percentage added to the index to calculate the new interest rate.

- Rate Caps: Limits on how much the interest rate can increase during each adjustment period and over the life of the loan.

- Borrower Obligations: Any responsibilities the borrower must adhere to regarding payment and notification of changes.

Examples of using the adjustable rate rider variable rate note

Examples of using the adjustable rate rider variable rate note often involve residential mortgage scenarios. For instance, a borrower may choose an adjustable-rate mortgage (ARM) with an initial fixed period followed by adjustments based on market rates. Another example could be a homeowner refinancing their mortgage and opting for an adjustable rate rider to take advantage of lower initial interest rates. Understanding these examples can help borrowers make informed decisions about their financing options.

Quick guide on how to complete adjustable rate rider variable rate note

Complete Adjustable Rate Rider Variable Rate Note effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Adjustable Rate Rider Variable Rate Note on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Adjustable Rate Rider Variable Rate Note effortlessly

- Obtain Adjustable Rate Rider Variable Rate Note and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Adjustable Rate Rider Variable Rate Note to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an adjustable rate rider?

An adjustable rate rider is a document that modifies an existing loan agreement, allowing the interest rate to fluctuate over time based on market conditions. It is an essential component for homeowners who want flexibility in their mortgage payments. Understanding how an adjustable rate rider works can help you make informed financial decisions.

-

How does an adjustable rate rider affect my monthly payments?

An adjustable rate rider can lead to varying monthly payments as the interest rate adjusts. Initially, your payments may be lower than those of a fixed-rate mortgage, but they can increase over time based on market rates. It's important to evaluate your financial situation and potential rate fluctuations before signing the adjustable rate rider.

-

What are the benefits of using an adjustable rate rider?

The primary benefit of an adjustable rate rider is the potential for lower initial interest rates compared to fixed-rate mortgages. This can lead to signNow savings in the early years of your loan. Additionally, if market rates decrease, your interest rate may also be lower, providing further financial advantages.

-

Are there any fees associated with an adjustable rate rider?

Yes, there may be fees associated with an adjustable rate rider, such as appraisal or origination fees. It's crucial to review all associated costs before agreeing to the rider to ensure it aligns with your budget. Understanding these fees can help you make a cost-effective decision.

-

Which lenders offer adjustable rate riders?

Many lenders offer adjustable rate riders as part of their mortgage products, including banks, credit unions, and online mortgage companies. It's advisable to compare various lenders to find the best terms and interest rates for your adjustable rate rider. Thorough research can help you secure a favorable deal.

-

Can I convert my adjustable rate rider to a fixed-rate mortgage?

Yes, many lenders allow borrowers to convert an adjustable rate rider to a fixed-rate mortgage at certain points in the loan term. This option provides flexibility for homeowners who want stability after experiencing initial rate adjustments. Be sure to inquire about specific terms for conversion with your lender.

-

How do I know if an adjustable rate rider is right for me?

Determining if an adjustable rate rider is right for you depends on your financial goals, risk tolerance, and the current interest rate environment. If you anticipate remaining in your home for a short period and want lower initial payments, it may be a great option. Consulting with a mortgage advisor can help clarify whether this rider suits your needs.

Get more for Adjustable Rate Rider Variable Rate Note

- Student employment appointment form suny oneonta

- Surplus equipment disposal form university of massachusetts umass

- Full text of ampquotpanama canal treaty disposition of united form

- Name last first mi student id csudh form

- Release petition form

- Personal reference form weber state university weber

- The wesleyan studies project methodist history dvd form

- Fillable online health ny comment form new york state

Find out other Adjustable Rate Rider Variable Rate Note

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed