Sale Residence Form

What is the Sale Residence

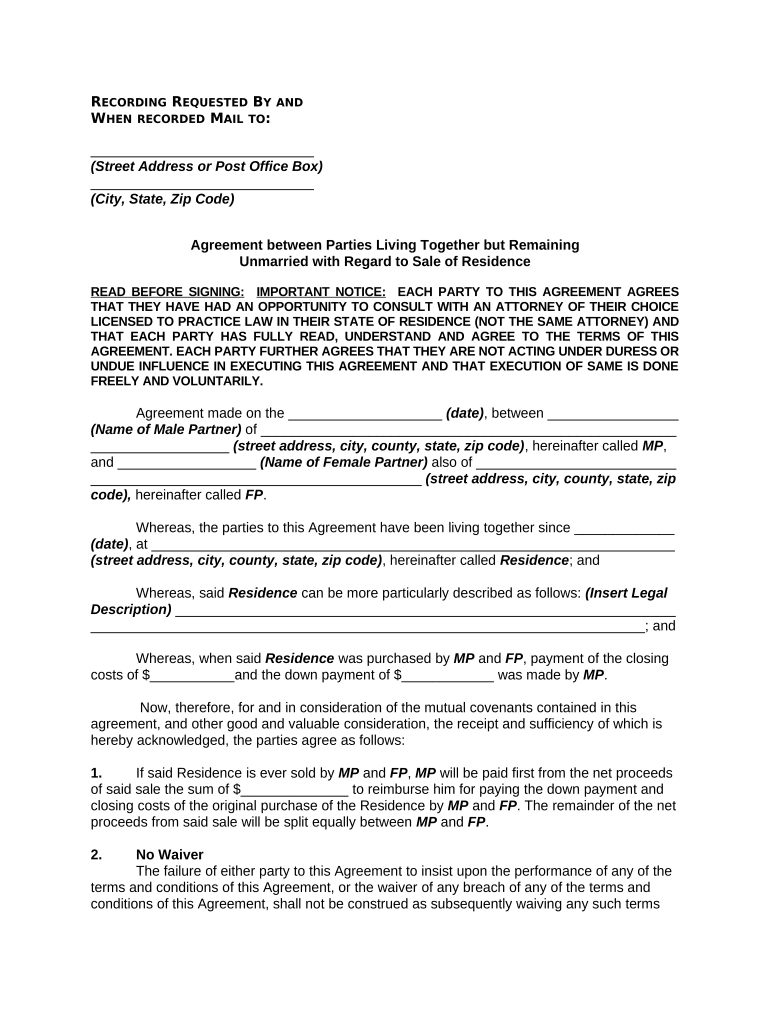

The sale residence form is a legal document used in real estate transactions to formalize the sale of a residential property. This form outlines the terms of the sale, including the purchase price, property description, and the responsibilities of both the buyer and seller. It serves as a binding agreement that ensures both parties are aware of their obligations and rights during the transaction process.

Steps to Complete the Sale Residence

Completing the sale residence form involves several key steps to ensure accuracy and legal compliance. First, gather all necessary information about the property, including its legal description and current market value. Next, both the buyer and seller should review and agree on the terms of the sale, such as the purchase price and any contingencies. After filling out the form, both parties must sign it, ensuring that signatures are legally binding. Finally, it is advisable to have the document notarized to enhance its validity and protect against future disputes.

Legal Use of the Sale Residence

The legal use of the sale residence form is crucial for ensuring that the transaction is recognized by law. To be legally binding, the form must comply with state laws regarding real estate transactions. This includes adhering to regulations related to disclosures, property conditions, and any specific requirements set forth by local authorities. By using a reliable digital solution like signNow, parties can ensure that their eSignatures meet legal standards, such as those outlined in the ESIGN Act and UETA.

Key Elements of the Sale Residence

Several key elements must be included in the sale residence form to ensure its effectiveness. These elements typically include:

- Property Description: A detailed description of the property being sold, including its address and legal boundaries.

- Purchase Price: The agreed-upon price for the sale of the property.

- Contingencies: Any conditions that must be met for the sale to proceed, such as financing or inspection requirements.

- Signatures: The signatures of both the buyer and seller, which indicate their agreement to the terms outlined in the form.

How to Obtain the Sale Residence

Obtaining the sale residence form can be done through various channels. Typically, real estate agents provide these forms as part of their services. Additionally, many state and local government websites offer downloadable versions of the form. It is essential to use the most current version to ensure compliance with local regulations. For those who prefer a digital approach, platforms like signNow offer templates that can be easily customized and completed online.

Form Submission Methods

After completing the sale residence form, it can be submitted through several methods. The most common methods include:

- Online Submission: Utilizing electronic signature platforms to submit the form digitally, ensuring quick processing.

- Mail: Sending a printed copy of the completed form to the appropriate local government office or agency.

- In-Person: Delivering the form directly to the relevant office, which may be required for notarization or additional verification.

Quick guide on how to complete sale residence

Effortlessly complete Sale Residence on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without any delays. Manage Sale Residence on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to modify and eSign Sale Residence with ease

- Find Sale Residence and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Sale Residence and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for managing a sale residence using airSlate SignNow?

Managing a sale residence with airSlate SignNow is straightforward. Users can easily upload documents related to the sale, send them for eSignature, and monitor their status in real-time. The platform’s intuitive interface ensures that all necessary steps in the sale residence process are covered efficiently.

-

How does airSlate SignNow ensure the security of sale residence agreements?

Security is a priority at airSlate SignNow, especially when dealing with sensitive documents like sale residence agreements. The platform utilizes advanced encryption and secure data storage to protect all signed documents, ensuring that your agreements are safe and compliant with industry standards.

-

What are the pricing options for using airSlate SignNow for sale residence documents?

airSlate SignNow offers flexible pricing plans tailored to fit different needs, including those for sale residence transactions. You can choose a plan that best suits your business size and usage frequency, which ensures you only pay for the features you need to manage your sale residence efficiently.

-

Can airSlate SignNow integrate with other tools for managing sale residence workflows?

Yes, airSlate SignNow seamlessly integrates with a variety of popular applications, making it easier to manage sale residence workflows. This includes integrations with CRM systems, payment platforms, and cloud storage solutions, allowing for a streamlined process from document creation to signing and storage.

-

What are the benefits of using airSlate SignNow for sale residence transactions?

Using airSlate SignNow for sale residence transactions offers numerous benefits, including accelerated contract signings, reduced paper waste, and enhanced collaboration among parties involved. The platform simplifies the process by providing easy access to documents and timely notifications, thereby improving overall efficiency in managing sale residence agreements.

-

Is it easy to collaborate with clients on a sale residence document with airSlate SignNow?

Absolutely! airSlate SignNow features collaborative tools that allow you to invite clients to review and eSign sale residence documents easily. Users can add comments, make amendments, and track changes, ensuring clear communication and faster resolution of tasks related to the sale residence process.

-

What types of documents can I create for a sale residence with airSlate SignNow?

With airSlate SignNow, you can create a wide variety of documents for sale residence transactions, including contracts, agreements, and disclosure forms. The platform offers customizable templates that help users craft the exact documents required for their specific sale residence needs quickly and efficiently.

Get more for Sale Residence

Find out other Sale Residence

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile