Gift over with Form

What is the Gift Over With

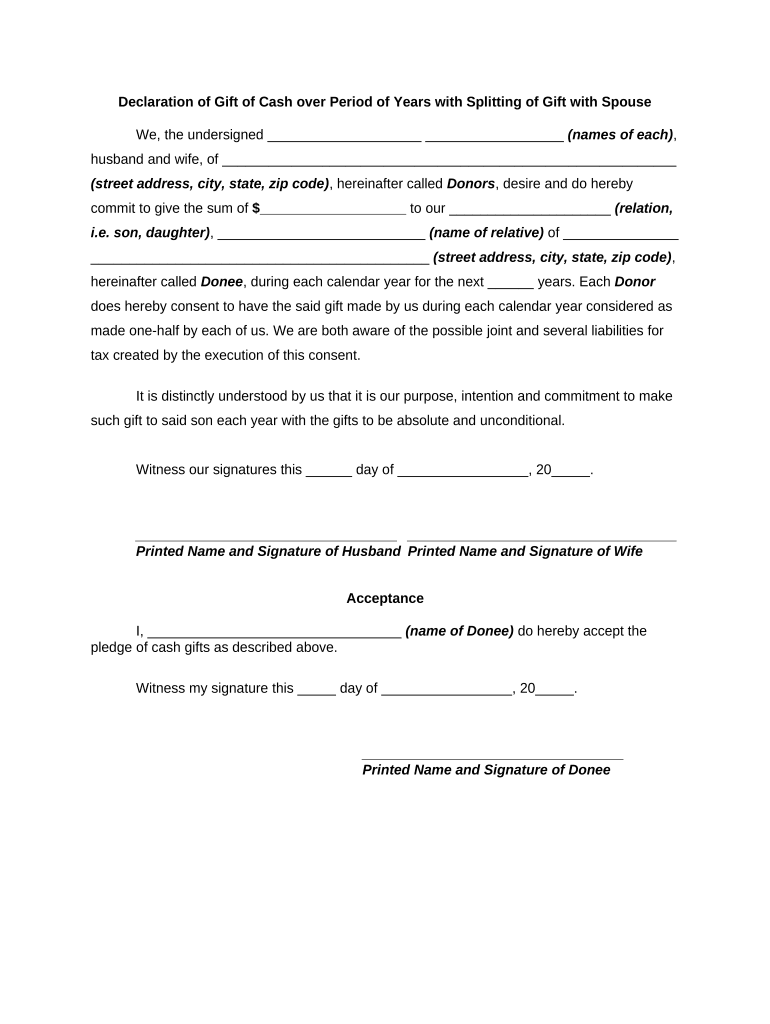

The gift over with form is a legal document used to transfer ownership of an asset, typically from one individual to another, without any exchange of money. This form is often utilized in estate planning, allowing individuals to gift property or financial assets to family members or friends while retaining certain rights. It is essential to understand the implications of this transfer, as it may affect tax liabilities and ownership rights. The form ensures that the transfer is documented and recognized legally, providing clarity for both the giver and the recipient.

How to Use the Gift Over With

Using the gift over with form involves several straightforward steps. First, gather all necessary information about the asset being transferred, including its description and current value. Next, both parties should review the form to ensure all details are accurate. Once completed, the form must be signed by the giver, and in some cases, a witness or notary may be required to validate the signatures. Finally, it is advisable to keep copies of the signed document for personal records and to provide a copy to the recipient for their records.

Legal Use of the Gift Over With

The legal use of the gift over with form is governed by specific regulations that vary by state. Generally, the form must meet certain criteria to be considered valid, such as clear identification of the parties involved and the asset being gifted. Additionally, compliance with state laws regarding gift tax exemptions is crucial. It is important to consult with a legal professional to ensure that the form is filled out correctly and adheres to all applicable laws, particularly when dealing with significant assets or complex family situations.

Steps to Complete the Gift Over With

Completing the gift over with form involves a systematic approach to ensure accuracy and legality. Follow these steps:

- Identify the asset being gifted and its fair market value.

- Gather personal information for both the giver and the recipient.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign the form in the presence of a witness or notary, if required.

- Distribute copies of the signed form to all parties involved.

Key Elements of the Gift Over With

Key elements of the gift over with form include the names and addresses of the giver and recipient, a detailed description of the asset, and the date of the transfer. Additionally, it should specify any conditions attached to the gift, such as retaining certain rights or responsibilities. Providing a clear declaration of intent to gift is also essential, as it establishes the giver's wishes and helps prevent disputes in the future.

Examples of Using the Gift Over With

There are various scenarios where the gift over with form can be beneficial. For instance, a parent may use the form to transfer ownership of a family home to their child as part of estate planning. Another example is gifting stocks or bonds to a relative, allowing them to benefit from the asset without the giver retaining any ownership. Each situation requires careful consideration of tax implications and legal requirements to ensure a smooth transfer.

Quick guide on how to complete gift over with

Effortlessly Complete Gift Over With on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents promptly without delays. Manage Gift Over With on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Gift Over With with ease

- Locate Gift Over With and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Gift Over With and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help me gift over with documents?

airSlate SignNow is an eSignature platform that allows you to gift over with documents securely and efficiently. By using this solution, you can eliminate the hassle of printing, signing, and scanning physical documents. Instead, you can easily send, sign, and manage your documents digitally.

-

What are the key features of airSlate SignNow?

With airSlate SignNow, you can gift over with documents using a variety of features such as customizable templates, automated workflows, and real-time tracking. These tools streamline the signing process, allowing for quicker turnaround times and enhanced productivity.

-

How does airSlate SignNow ensure the security of my documents?

Security is a priority at airSlate SignNow. When you gift over with documents, they are protected by encryption and comply with industry standards such as GDPR and HIPAA. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial so you can get a feel for the service before committing. During this trial, you can explore how to gift over with documents and utilize the platform's full range of features, making it easier to assess its value for your business.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers various pricing plans tailored for different business needs, allowing you to choose the one that fits best. Each plan includes features that enable you to gift over with documents effectively, aiming for an optimal balance between affordability and functionality.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Salesforce, and more. This enables you to gift over with documents directly from your existing workflows, enhancing efficiency without disrupting your routine.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly reduce the time and costs associated with paper-based processes. By enabling you to gift over with documents electronically, it increases efficiency, enhances security, and provides a better experience for both you and your clients.

Get more for Gift Over With

- Statutory declaration of acknowledgement of parentage form

- Divorce form 36b fill online printable fillable blank

- Colorado salesuse tax rates colorado department of form

- Transport and main roads corporate forms f2208 bus travel

- Syringe driver checklist form

- Form unregistered vehicle permit

- A67 dot forms

- Form 451 exemption application nebraska revenue

Find out other Gift Over With

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document