Indiana Property Tax Benefits Form 51781 2006

What is the Indiana Property Tax Benefits Form 51781

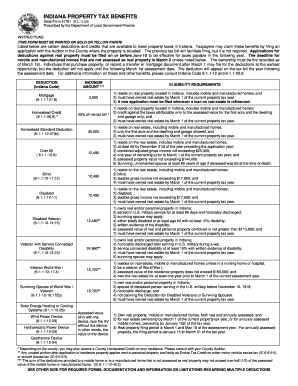

The Indiana Property Tax Benefits Form 51781 is a crucial document for property owners seeking tax benefits in the state of Indiana. This form allows eligible taxpayers to apply for various property tax deductions and exemptions, which can significantly reduce their overall tax liability. The form is specifically designed to facilitate the application process for benefits such as the homestead deduction, which is available to homeowners who occupy their property as their primary residence. Understanding the purpose and requirements of this form is essential for any property owner looking to maximize their tax benefits.

How to use the Indiana Property Tax Benefits Form 51781

Using the Indiana Property Tax Benefits Form 51781 involves several straightforward steps. First, ensure that you meet the eligibility criteria for the tax benefits you wish to claim. Next, download the form from an official source or obtain a physical copy from your local county assessor's office. Carefully fill out the form, providing all required information, including your property details and personal information. Once completed, submit the form to your county assessor's office by the specified deadline to ensure consideration for the tax benefits.

Steps to complete the Indiana Property Tax Benefits Form 51781

Completing the Indiana Property Tax Benefits Form 51781 requires attention to detail. Follow these steps:

- Gather necessary documents, such as proof of residency and property ownership.

- Download or obtain a copy of Form 51781.

- Fill in your personal information, including name, address, and property details.

- Indicate the specific tax benefits you are applying for, such as the homestead deduction.

- Review the form for accuracy and completeness.

- Submit the form to your local county assessor's office by the deadline.

Legal use of the Indiana Property Tax Benefits Form 51781

The Indiana Property Tax Benefits Form 51781 is legally binding once submitted to the appropriate authority. To ensure its validity, it must be completed accurately and submitted within the designated time frame. The form serves as a formal request for tax benefits and must comply with all state regulations governing property tax deductions. Failure to provide accurate information or to meet submission deadlines may result in the denial of benefits.

Eligibility Criteria

To qualify for the benefits associated with the Indiana Property Tax Benefits Form 51781, applicants must meet specific eligibility criteria. Generally, applicants must be property owners who occupy their property as their primary residence. Additional requirements may include income limits, age restrictions, or disability status, depending on the type of benefits being claimed. It is essential to review the eligibility guidelines carefully to ensure compliance and maximize potential tax savings.

Form Submission Methods

The Indiana Property Tax Benefits Form 51781 can be submitted through various methods to accommodate different preferences. Property owners may choose to submit the form in person at their local county assessor's office, ensuring immediate confirmation of receipt. Alternatively, the form can often be mailed to the appropriate office, although this method may require additional time for processing. Some counties may also offer online submission options, allowing for a more convenient and efficient process.

Quick guide on how to complete indiana property tax benefits form 51781

Prepare Indiana Property Tax Benefits Form 51781 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Manage Indiana Property Tax Benefits Form 51781 on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and eSign Indiana Property Tax Benefits Form 51781 seamlessly

- Obtain Indiana Property Tax Benefits Form 51781 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Indiana Property Tax Benefits Form 51781 while ensuring excellent communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana property tax benefits form 51781

Create this form in 5 minutes!

How to create an eSignature for the indiana property tax benefits form 51781

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana State Form 51781 and how can it be used with airSlate SignNow?

The Indiana State Form 51781 is a crucial document required for various administrative procedures. With airSlate SignNow, you can easily complete, sign, and submit this form electronically, ensuring fast and secure processing.

-

Is airSlate SignNow compliant with the Indiana State Form 51781 requirements?

Yes, airSlate SignNow is fully compliant with the regulations around the Indiana State Form 51781. Our platform provides an electronic signature solution that meets the legal standards for submitting this form.

-

How much does it cost to use airSlate SignNow for the Indiana State Form 51781?

airSlate SignNow offers competitive pricing plans, making it a cost-effective solution to manage the Indiana State Form 51781. You can choose from various subscription tiers that fit different business needs and budgets.

-

What features does airSlate SignNow provide for handling the Indiana State Form 51781?

airSlate SignNow offers a variety of features such as template creation, automated workflows, and real-time tracking for the Indiana State Form 51781. These tools streamline the signing process and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for managing the Indiana State Form 51781?

Absolutely! airSlate SignNow supports integrations with popular applications, enabling you to manage the Indiana State Form 51781 alongside your existing tools. This enhances productivity and helps maintain a cohesive workflow.

-

How secure is the process of signing the Indiana State Form 51781 with airSlate SignNow?

Security is a priority at airSlate SignNow. The platform employs advanced encryption protocols to ensure that the Indiana State Form 51781 is signed and stored securely, protecting sensitive information.

-

Is it easy to access past submissions of the Indiana State Form 51781 in airSlate SignNow?

Yes, airSlate SignNow provides a user-friendly dashboard where you can easily access past submissions of the Indiana State Form 51781. This feature allows for quick retrieval and reference whenever needed.

Get more for Indiana Property Tax Benefits Form 51781

Find out other Indiana Property Tax Benefits Form 51781

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement